Region:Africa

Author(s):Rebecca

Product Code:KRAB4053

Pages:92

Published On:October 2025

By Type:The market is segmented into Residential Platforms, Commercial Platforms, Rental Platforms, Real Estate Investment Platforms, Property Management Platforms, Real Estate Auction Platforms, and Others. Residential platforms dominate due to Nigeria’s acute housing shortage and urban migration, offering services such as online listings, virtual tours, and AI-powered valuation tools that appeal to first-time buyers and young professionals. Commercial and rental platforms are also significant, catering to the needs of businesses and the growing short-let market, while investment and property management platforms are gaining traction among institutional and diaspora investors seeking portfolio diversification and asset management solutions.

The Residential Platforms segment leads the market, driven by Nigeria’s housing deficit and the convenience of digital access for urban populations. Platforms are increasingly integrating AI for pricing, fraud detection, and customer service, making them essential for both local and diaspora buyers.

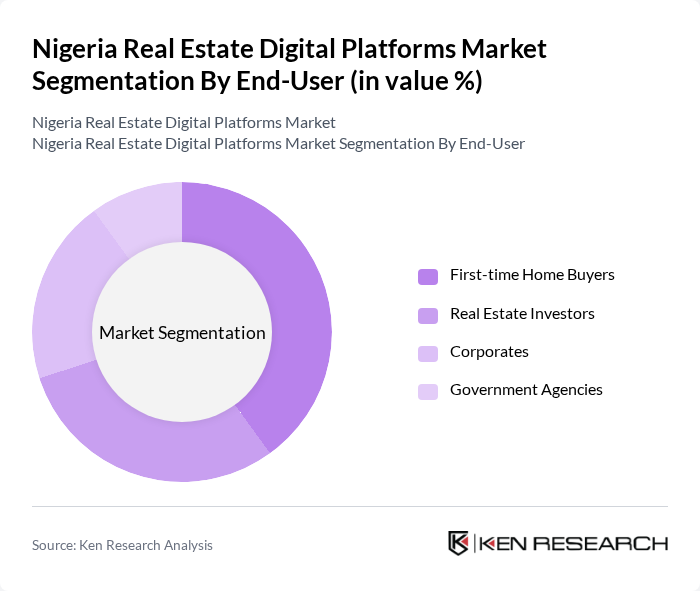

By End-User:The market is segmented into First-time Home Buyers, Real Estate Investors, Corporates, and Government Agencies. First-time home buyers represent the largest segment, driven by Nigeria’s youthful, tech-savvy population and the ease of comparing properties online. Real estate investors, including diaspora buyers, are a growing force, leveraging digital platforms for remote transactions and portfolio management. Corporates use these platforms for office and retail space, while government agencies increasingly adopt digital tools for transparency in public housing projects and land administration.

The First-time Home Buyers segment is the largest, reflecting demographic trends and the digitization of property search and purchase processes. Platforms are tailored to this group with intuitive interfaces, comprehensive listings, and support for remote transactions, which are especially appealing to young professionals and diaspora Nigerians.

The Nigeria Real Estate Digital Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as PropertyPro.ng, Jumia House, Nigeria Property Centre, ToLet.com.ng, RentSmallSmall, LandWey Investment Limited, Estate Intel, MyProperty.ng, 247RealEstate, PropertyMall, Real Estate Mall, Property Finder Nigeria, Bungalow.ng, NairaLand, PropertyGurus contribute to innovation, geographic expansion, and service delivery in this space.

The future of Nigeria's real estate digital platforms is poised for significant transformation, driven by technological innovations and changing consumer preferences. As urbanization accelerates, platforms that offer enhanced user experiences, such as virtual property tours and AI-driven property management, will gain traction. Additionally, the integration of digital payment solutions will facilitate smoother transactions, making real estate investments more accessible. The market is likely to see increased collaboration between tech companies and real estate developers, fostering a more dynamic ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Platforms Commercial Platforms Rental Platforms Real Estate Investment Platforms Property Management Platforms Real Estate Auction Platforms Others |

| By End-User | First-time Home Buyers Real Estate Investors Corporates Government Agencies |

| By Sales Channel | Online Marketplaces Direct Sales Mobile Applications Social Media Platforms |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas |

| By Property Type | Residential Properties Commercial Properties Industrial Properties Mixed-Use Properties |

| By Pricing Model | Subscription-Based Commission-Based Flat Fee |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Public-Private Partnerships |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Real Estate Platforms | 100 | Real Estate Agents, Home Buyers |

| Commercial Real Estate Platforms | 60 | Commercial Property Managers, Investors |

| Real Estate Technology Providers | 50 | Tech Developers, Product Managers |

| Real Estate Regulatory Bodies | 40 | Policy Makers, Regulatory Officers |

| End-User Experience with Platforms | 80 | Home Renters, Property Seekers |

The Nigeria Real Estate Digital Platforms Market is valued at approximately USD 2.6 trillion, with the residential segment accounting for USD 2.25 trillion. This growth is driven by urbanization, a housing deficit, and demand for affordable housing solutions.