Region:Middle East

Author(s):Shubham

Product Code:KRAB4482

Pages:85

Published On:October 2025

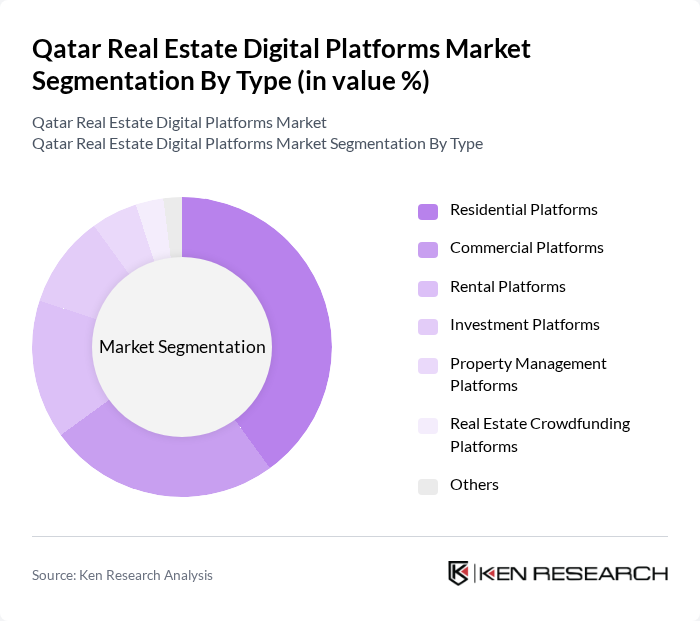

By Type:The market is segmented into various types, including Residential Platforms, Commercial Platforms, Rental Platforms, Investment Platforms, Property Management Platforms, Real Estate Crowdfunding Platforms, and Others. Each of these segments caters to different consumer needs and preferences, with residential platforms being particularly popular due to the high demand for housing solutions.

By End-User:The end-user segmentation includes Individual Buyers, Real Estate Agents, Property Developers, and Investors. Each group utilizes digital platforms differently, with individual buyers seeking user-friendly interfaces and comprehensive listings, while real estate agents leverage these platforms for marketing and client engagement.

The Qatar Real Estate Digital Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Property Finder Qatar, Qatari Diar, Ezdan Real Estate, Al Asmakh Real Estate Development, The Pearl-Qatar, Qatar Real Estate Investment Company (QREIC), United Development Company (UDC), Barwa Real Estate Company, Al Jazeera Real Estate, Al Fardan Properties, Qatari Investors Group, Doha Land, Gulf International Services, Qatar First Bank, Aamal Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of Qatar's real estate digital platforms is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As urbanization accelerates and smart city initiatives gain momentum, digital platforms will increasingly integrate AI and big data analytics to enhance user experiences. Furthermore, the growing expatriate population will create additional demand for innovative solutions, fostering a dynamic environment for digital transactions. The focus on sustainability will also shape platform offerings, aligning with global trends toward eco-friendly real estate solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Platforms Commercial Platforms Rental Platforms Investment Platforms Property Management Platforms Real Estate Crowdfunding Platforms Others |

| By End-User | Individual Buyers Real Estate Agents Property Developers Investors |

| By Application | Property Listing Virtual Tours Transaction Management Market Analysis Tools |

| By Sales Channel | Online Platforms Mobile Applications Direct Sales |

| By Distribution Mode | Direct Distribution Third-Party Distribution |

| By Price Range | Budget Platforms Mid-Range Platforms Premium Platforms |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Property Buyers | 150 | First-time home buyers, Investors |

| Commercial Real Estate Users | 100 | Business Owners, Real Estate Agents |

| Property Management Firms | 80 | Property Managers, Operations Directors |

| Digital Platform Users | 120 | End-users, Real Estate Brokers |

| Real Estate Investors | 90 | Institutional Investors, High-net-worth Individuals |

The Qatar Real Estate Digital Platforms Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by technological adoption in real estate transactions and the increasing demand for efficient property management solutions.