Region:Europe

Author(s):Rebecca

Product Code:KRAB4099

Pages:87

Published On:October 2025

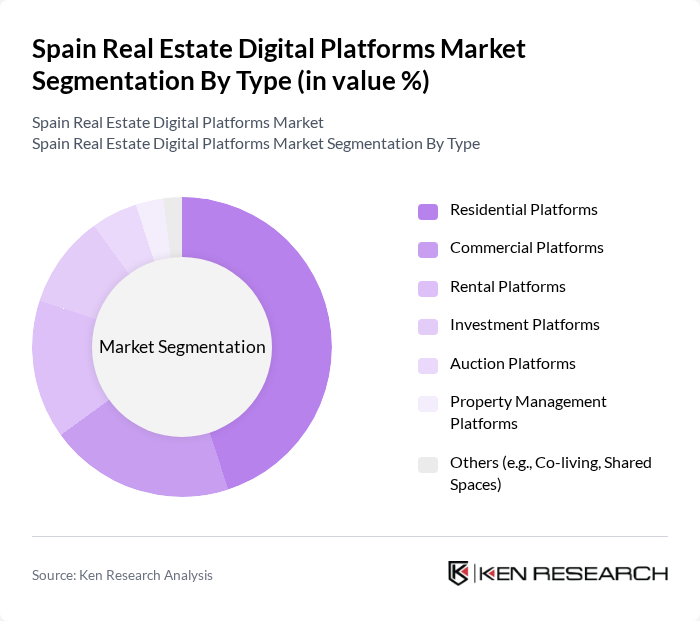

By Type:The market is segmented into various types of digital platforms that cater to different real estate needs. The primary subsegments include Residential Platforms, Commercial Platforms, Rental Platforms, Investment Platforms, Auction Platforms, Property Management Platforms, and Others (e.g., Co-living, Shared Spaces). Each of these subsegments serves distinct consumer demands, with Residential Platforms being the most prominent due to the high demand for housing solutions and the increasing use of digital channels for home searches and transactions .

By End-User:The end-user segmentation includes Individual Buyers, Real Estate Agents, Investors, and Property Developers. Individual Buyers dominate the market as they represent the largest group seeking residential properties. The increasing trend of first-time homebuyers, the growing interest in investment properties among individuals, and the accessibility of digital platforms for property searches and transactions further solidify this segment's leading position .

The Spain Real Estate Digital Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Idealista, Fotocasa, Habitaclia, Badi, Housell, Trovimap, Kyero, Nestoria, Uniplaces, Spotahome, Rentberry, Property Finder, Casavo, Homelike, Witei contribute to innovation, geographic expansion, and service delivery in this space.

The future of Spain's real estate digital platforms is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As urbanization continues, platforms will increasingly integrate AI and big data analytics to enhance user experience and streamline transactions. Additionally, the growing emphasis on sustainability will likely lead to the development of eco-friendly property listings, catering to environmentally conscious consumers. These trends will shape the competitive landscape, fostering innovation and collaboration within the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Platforms Commercial Platforms Rental Platforms Investment Platforms Auction Platforms Property Management Platforms Others (e.g., Co-living, Shared Spaces) |

| By End-User | Individual Buyers Real Estate Agents Investors Property Developers |

| By Sales Channel | Online Direct Sales Third-Party Listings Mobile Applications |

| By Geographic Focus | Urban Areas (e.g., Madrid, Barcelona) Suburban Areas Rural Areas |

| By Service Type | Listing Services Marketing Services Transaction Services |

| By Customer Segment | First-Time Buyers Luxury Buyers Commercial Buyers |

| By Policy Support | Subsidies for Digital Platforms Tax Incentives Regulatory Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Property Buyers | 150 | First-time Homebuyers, Investors |

| Commercial Real Estate Investors | 100 | Real Estate Fund Managers, Corporate Buyers |

| Real Estate Agents and Brokers | 120 | Licensed Real Estate Professionals, Agency Owners |

| Property Developers | 80 | Residential and Commercial Developers, Project Managers |

| Digital Platform Users | 120 | Active Users of Real Estate Platforms, Online Property Seekers |

The Spain Real Estate Digital Platforms Market is valued at approximately USD 1.7 billion, reflecting a significant shift towards digital technologies in real estate transactions, driven by consumer demand for convenience and efficiency.