Region:Europe

Author(s):Rebecca

Product Code:KRAB4066

Pages:89

Published On:October 2025

By Type:The market is segmented into various types of digital platforms that cater to different aspects of real estate transactions. The primary subsegments include Residential Portals, Commercial Portals, Rental Platforms, Investment Platforms, Auction Platforms, Property Management Platforms, and Others. Each of these subsegments serves distinct user needs, with Residential Portals being particularly popular due to the high demand for housing solutions.

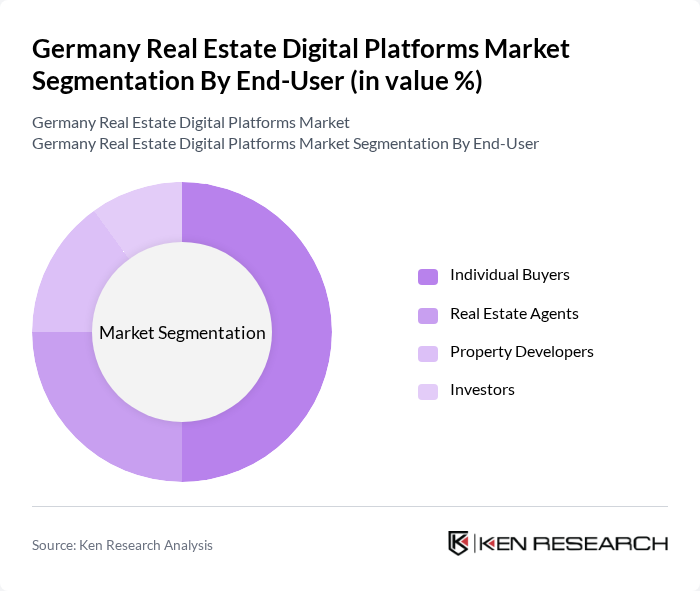

By End-User:The end-user segmentation includes Individual Buyers, Real Estate Agents, Property Developers, and Investors. Each group utilizes digital platforms differently, with Individual Buyers and Real Estate Agents being the most significant users, as they seek efficient ways to buy, sell, or rent properties.

The Germany Real Estate Digital Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as ImmobilienScout24, Immowelt AG, Homeday GmbH, Engel & Völkers AG, Vonovia SE, Deutsche Wohnen SE, Ziegert Group, PlanetHome AG, eBay Kleinanzeigen, Baufi24 GmbH, Findeo GmbH, HousingAnywhere, PlanRadar, Casavo, Flatfox contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Germany real estate digital platforms market appears promising, driven by ongoing technological advancements and increasing consumer acceptance of digital transactions. As urbanization continues, platforms that leverage AI and big data analytics will likely gain a competitive edge. Additionally, the integration of sustainable practices and smart technologies will shape the market landscape, aligning with government initiatives for smart cities. The focus on enhancing user experience through innovative solutions will further propel growth in this sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Portals Commercial Portals Rental Platforms Investment Platforms Auction Platforms Property Management Platforms Others |

| By End-User | Individual Buyers Real Estate Agents Property Developers Investors |

| By Sales Channel | Online Direct Sales Affiliate Marketing Partnerships with Real Estate Agencies Others |

| By Pricing Model | Subscription-Based Pay-Per-Listing Freemium Models Commission-Based |

| By Geographic Focus | Urban Areas Suburban Areas Rural Areas Others |

| By User Demographics | Millennials Gen X Baby Boomers Others |

| By Service Type | Listing Services Marketing Services Analytics Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Real Estate Platforms | 60 | Real Estate Agents, Platform Managers |

| Commercial Property Listings | 50 | Commercial Brokers, Property Developers |

| Real Estate Investment Platforms | 40 | Investors, Financial Analysts |

| Property Management Software Users | 40 | Property Managers, IT Managers |

| End-User Experience with Digital Platforms | 50 | Home Buyers, Renters |

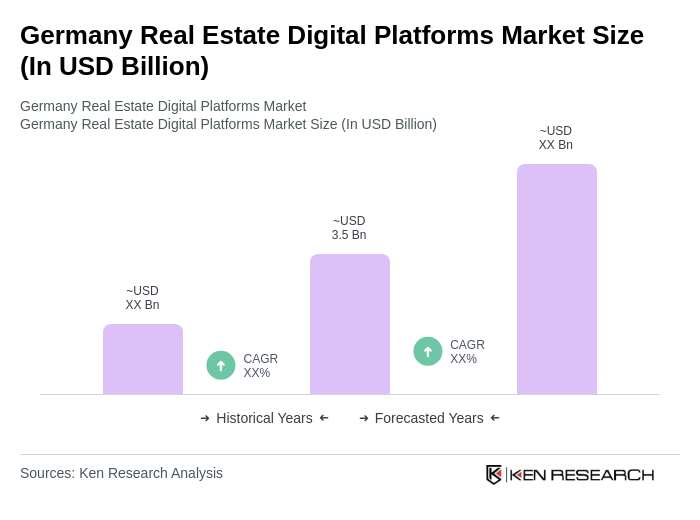

The Germany Real Estate Digital Platforms Market is valued at approximately USD 3.5 billion, reflecting significant growth driven by increased digitization, consumer demand for online transactions, and the rise of remote work influencing residential property searches.