Region:Africa

Author(s):Dev

Product Code:KRAB5425

Pages:94

Published On:October 2025

By Type:The market is segmented into various types, including Mobile POS systems, Fixed POS terminals, Cloud-based POS solutions, Integrated payment solutions, and Others. Among these, Mobile POS systems are gaining traction due to their flexibility and ease of use, allowing retailers to process transactions anywhere, thus enhancing customer service. Cloud-based solutions are also becoming increasingly popular as they offer scalability and lower upfront costs, making them attractive for small to medium-sized enterprises.

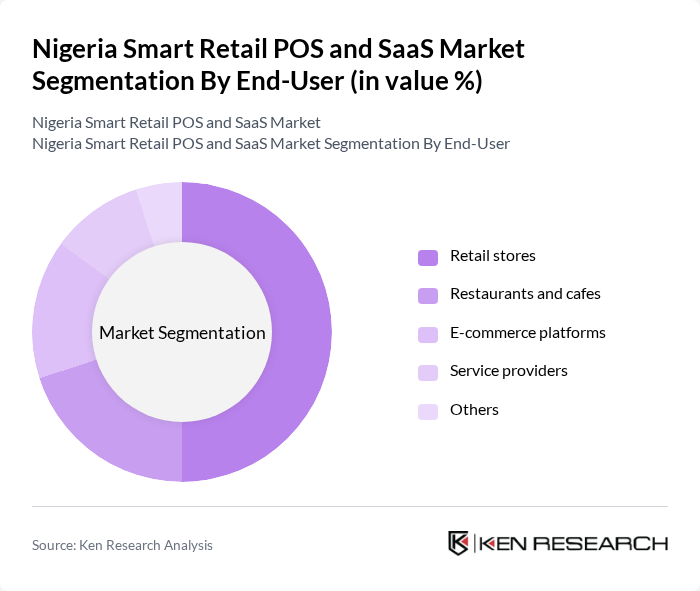

By End-User:The end-user segmentation includes Retail stores, Restaurants and cafes, E-commerce platforms, Service providers, and Others. Retail stores dominate the market as they increasingly adopt POS systems to streamline operations and enhance customer experiences. The rise of e-commerce platforms is also notable, as they require integrated payment solutions to facilitate online transactions, thus driving demand for SaaS offerings.

The Nigeria Smart Retail POS and SaaS Market is characterized by a dynamic mix of regional and international players. Leading participants such as Interswitch Limited, Paystack, Flutterwave, Paga, OPay, YAPILI, Kudi, Remita, VFD Group, Zenith Bank, First Bank of Nigeria, Access Bank, GTBank, Union Bank, Ecobank Nigeria contribute to innovation, geographic expansion, and service delivery in this space.

The future of Nigeria's Smart Retail POS and SaaS market appears promising, driven by technological advancements and evolving consumer preferences. As businesses increasingly adopt AI and machine learning for enhanced customer experiences, the integration of these technologies into POS systems will become crucial. Additionally, the shift towards omnichannel retailing will necessitate seamless payment solutions, further propelling market growth. Stakeholders must remain agile to adapt to these trends and capitalize on emerging opportunities in the digital payment landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile POS systems Fixed POS terminals Cloud-based POS solutions Integrated payment solutions Others |

| By End-User | Retail stores Restaurants and cafes E-commerce platforms Service providers Others |

| By Sales Channel | Direct sales Online sales Distributors and resellers Others |

| By Payment Method | Card payments Mobile payments QR code payments Others |

| By Deployment Model | On-premise solutions Cloud-based solutions Hybrid solutions Others |

| By Customer Size | Small enterprises Medium enterprises Large enterprises Others |

| By Industry Vertical | Food and beverage Apparel and accessories Electronics and appliances Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail POS Adoption | 150 | Retail Managers, IT Directors |

| SaaS Utilization in SMEs | 100 | Business Owners, Operations Managers |

| Consumer Preferences for Digital Payments | 120 | End-users, Customer Experience Managers |

| Market Trends in E-commerce | 80 | E-commerce Managers, Digital Marketing Heads |

| Impact of Government Policies on Retail Technology | 70 | Policy Makers, Industry Analysts |

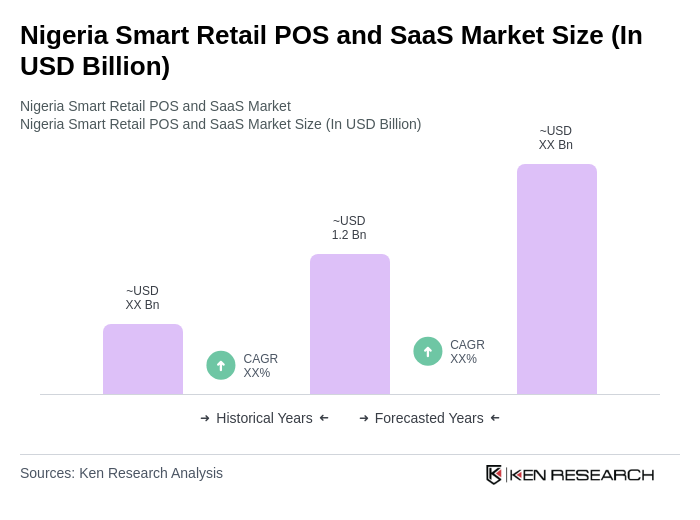

The Nigeria Smart Retail POS and SaaS Market is valued at approximately USD 1.2 billion, driven by the increasing adoption of digital payment solutions and the rise of e-commerce, alongside the demand for efficient retail management systems.