Philippines Smart Retail POS and SaaS Market Overview

- The Philippines Smart Retail POS and SaaS Market is valued at USD 1.2 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of digital payment solutions, the rise of e-commerce, and the need for efficient inventory management systems among retailers. The shift towards cashless transactions and the integration of advanced technologies in retail operations have significantly contributed to the market's expansion.

- Metro Manila, Cebu, and Davao are the dominant cities in the Philippines Smart Retail POS and SaaS Market. Metro Manila leads due to its high population density, economic activity, and concentration of retail businesses. Cebu and Davao follow closely, benefiting from their growing urbanization and increasing consumer spending, which drives demand for advanced retail solutions.

- In 2023, the Philippine government implemented the Digital Payments Transformation Roadmap, aiming to increase digital payment adoption to 50% of total transactions by 2025. This initiative encourages businesses to adopt digital payment systems, including smart retail POS solutions, to enhance efficiency and customer experience, thereby fostering growth in the market.

Philippines Smart Retail POS and SaaS Market Segmentation

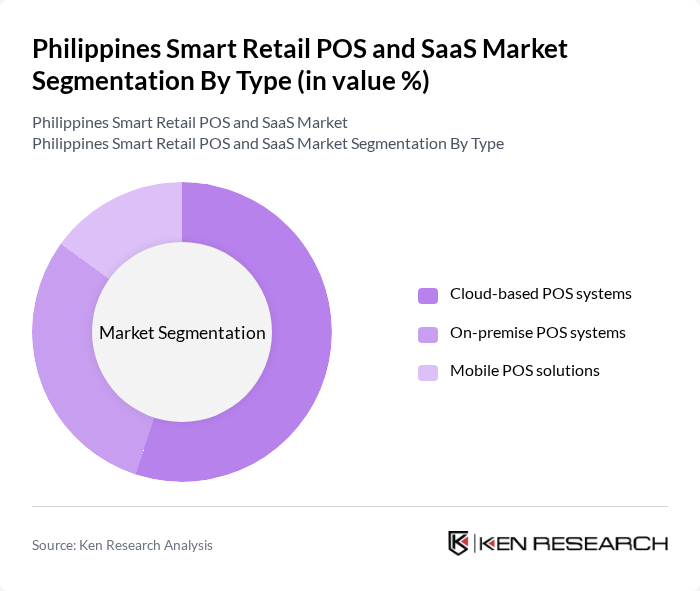

By Type:The market is segmented into three main types: Cloud-based POS systems, On-premise POS systems, and Mobile POS solutions. Among these, Cloud-based POS systems are gaining significant traction due to their flexibility, scalability, and lower upfront costs. Retailers are increasingly opting for cloud solutions to streamline operations and enhance customer engagement through real-time data access.

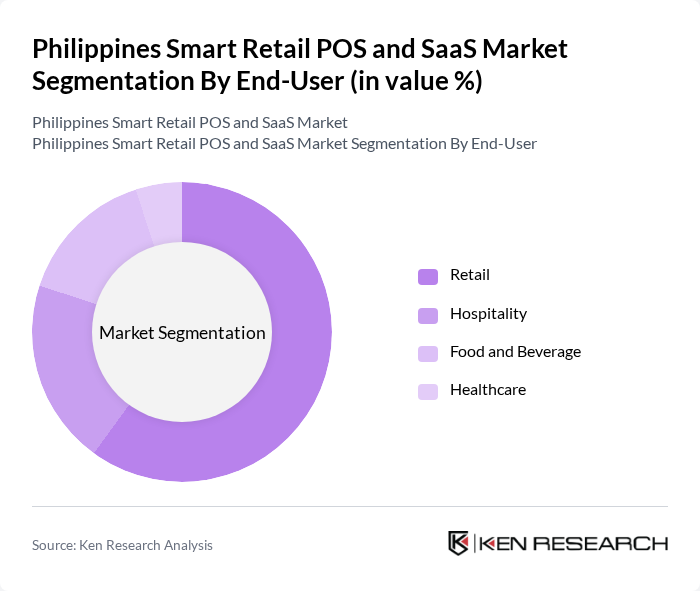

By End-User:The end-user segmentation includes Retail, Hospitality, Food and Beverage, and Healthcare. The Retail sector dominates the market, driven by the increasing number of retail outlets and the need for efficient transaction processing. Retailers are adopting smart POS systems to enhance customer experience and streamline operations, making this segment the largest contributor to market growth.

Philippines Smart Retail POS and SaaS Market Competitive Landscape

The Philippines Smart Retail POS and SaaS Market is characterized by a dynamic mix of regional and international players. Leading participants such as Globe Telecom, Inc., PayMaya Philippines, Inc., POSitive Technologies, Inc., APT Technologies, Inc., iPOS Solutions, Inc., Xendit, Inc., Mynt (Globe Fintech Innovations, Inc.), Smart Communications, Inc., Cashalo, Inc., TendoPay, Inc., ZALORA Philippines, Foodpanda Philippines, Grab Philippines, Lazada Philippines, Metrobank Card Corporation contribute to innovation, geographic expansion, and service delivery in this space.

Philippines Smart Retail POS and SaaS Market Industry Analysis

Growth Drivers

- Increasing Adoption of Digital Payment Solutions:The Philippines has seen a significant rise in digital payment adoption, with the volume of digital transactions reaching approximately 1.5 billion, a 20% increase from the previous year. The Bangko Sentral ng Pilipinas (BSP) aims for 50% of all transactions to be digital by 2025, driven by the growing smartphone penetration rate, which stood at 80% in future. This shift is propelling the demand for smart retail POS systems that facilitate seamless transactions.

- Rising Demand for Inventory Management Systems:The retail sector in the Philippines is increasingly recognizing the importance of efficient inventory management. In future, the retail industry reported losses of around PHP 35 billion due to stockouts and overstocking issues. As a result, businesses are investing in advanced inventory management systems integrated with POS solutions. This trend is expected to continue, with an estimated 45% of retailers planning to upgrade their systems by future to enhance operational efficiency and reduce losses.

- Growth of E-commerce and Omnichannel Retailing:E-commerce in the Philippines is projected to reach PHP 1.2 trillion by future, driven by a 30% annual growth rate. This surge is prompting traditional retailers to adopt omnichannel strategies, integrating online and offline sales channels. As a result, the demand for smart retail POS systems that support omnichannel operations is increasing, with 65% of retailers indicating plans to implement such systems to enhance customer experience and streamline operations.

Market Challenges

- High Initial Investment Costs:The implementation of smart retail POS systems often requires substantial upfront investments, which can be a barrier for small and medium-sized enterprises (SMEs). In future, the average cost of a comprehensive POS system in the Philippines was estimated at PHP 160,000, including hardware and software. Many SMEs, which constitute 99.5% of all businesses in the country, struggle to allocate such funds, limiting their ability to adopt modern retail technologies.

- Limited Internet Connectivity in Rural Areas:Despite urban areas experiencing rapid digitalization, rural regions in the Philippines still face significant challenges regarding internet connectivity. As of future, only 35% of rural households had access to reliable internet services. This lack of connectivity hampers the ability of retailers in these areas to utilize cloud-based POS systems effectively, creating a digital divide that limits market growth and the adoption of advanced retail technologies.

Philippines Smart Retail POS and SaaS Market Future Outlook

The future of the Philippines Smart Retail POS and SaaS market appears promising, driven by technological advancements and changing consumer behaviors. As digital payment solutions become more prevalent, retailers are expected to increasingly adopt integrated POS systems that enhance customer experiences. Additionally, the government's push for digital transformation will likely foster innovation and investment in the sector. With the rise of e-commerce and omnichannel strategies, businesses will continue to seek solutions that streamline operations and improve efficiency, positioning the market for sustained growth.

Market Opportunities

- Expansion of Mobile Payment Solutions:The mobile payment sector in the Philippines is projected to grow significantly, with transaction values expected to reach PHP 600 billion by future. This growth presents an opportunity for POS providers to develop systems that integrate mobile payment options, catering to the increasing consumer preference for cashless transactions and enhancing the overall shopping experience.

- Integration of AI and Machine Learning in POS Systems:The integration of AI and machine learning technologies into POS systems is gaining traction, with an estimated 35% of retailers planning to adopt these technologies by future. This trend offers opportunities for software developers to create intelligent systems that provide real-time analytics, personalized customer experiences, and improved inventory management, driving operational efficiency and customer satisfaction.