Region:Central and South America

Author(s):Geetanshi

Product Code:KRAB0120

Pages:92

Published On:August 2025

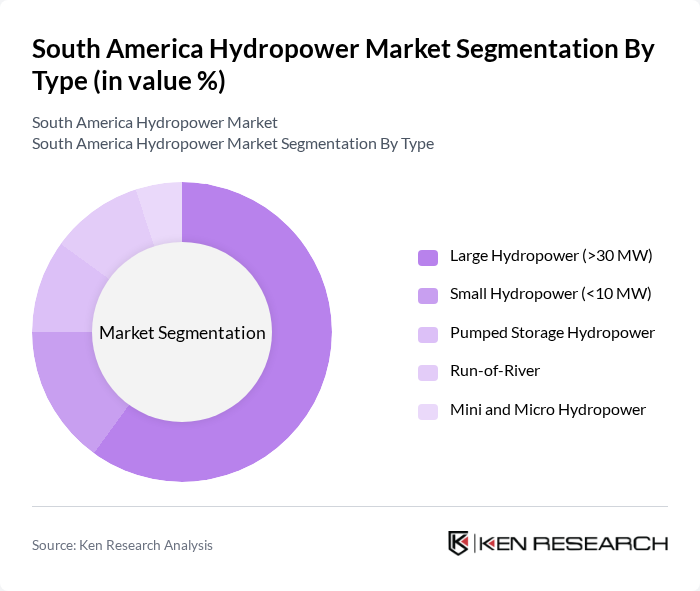

By Type:The hydropower market can be segmented into various types, including Large Hydropower (>30 MW), Small Hydropower (<10 MW), Pumped Storage Hydropower, Run-of-River, and Mini and Micro Hydropower. Each of these segments plays a crucial role in the overall energy landscape, catering to different energy needs and operational scales .

TheLarge Hydropowersegment dominates the market due to its ability to generate significant amounts of electricity, making it a preferred choice for large-scale energy projects. Countries like Brazil have invested heavily in large hydropower plants, which provide a stable and reliable energy source. The trend towards renewable energy and government incentives further bolster this segment's growth, as it aligns with sustainability goals and energy security .

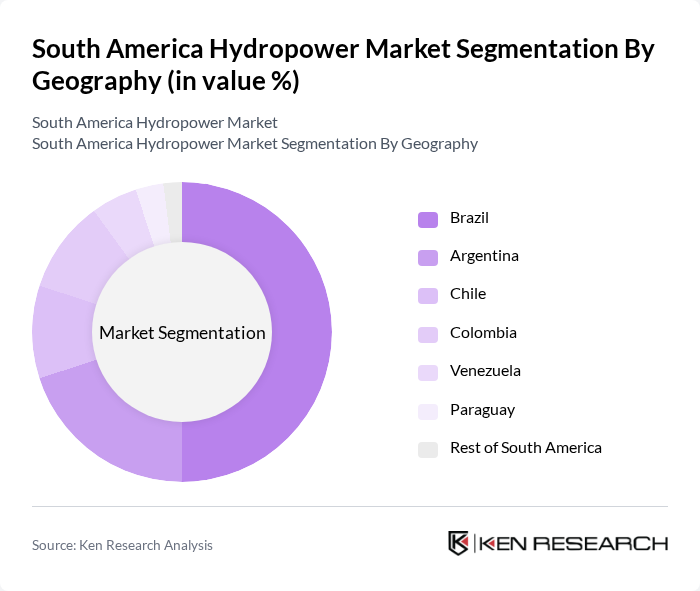

By Geography:The hydropower market can also be segmented geographically into Brazil, Argentina, Chile, Colombia, Venezuela, Paraguay, and the Rest of South America. Each region has unique characteristics and resources that influence its hydropower development .

Brazilleads the geographical segmentation due to its vast river systems and established hydropower infrastructure, including the iconic Itaipu Dam. Argentina follows, benefiting from significant investments in renewable energy and a growing focus on sustainability. Other countries like Chile and Colombia are also making strides in hydropower development, but they currently lag behind the leaders in terms of installed capacity and market presence .

The South America Hydropower Market is characterized by a dynamic mix of regional and international players. Leading participants such as Eletrobras, Enel Américas S.A., Engie Brasil Energia S.A., AES Brasil Energia S.A., Copel (Companhia Paranaense de Energia), CEMIG (Companhia Energética de Minas Gerais), Duke Energy International Geração Paranapanema, Norte Energia S.A., Tractebel Energia S.A. (now Engie Brasil Energia S.A.), EDP Energias do Brasil S.A., Furnas Centrais Elétricas S.A., Companhia Hidro Elétrica do São Francisco (CHESF), Itaipu Binacional, ODEBRECHT Energia, ContourGlobal plc contribute to innovation, geographic expansion, and service delivery in this space .

The South American hydropower market is poised for transformative growth, driven by increasing energy demands and supportive government policies. In future, the integration of smart grid technologies and advancements in energy storage will enhance operational efficiency and reliability. Additionally, the focus on climate resilience will encourage investments in sustainable hydropower projects. As private sector participation rises, innovative financing models will emerge, facilitating the development of new projects and the expansion of existing facilities, ultimately strengthening the region's energy landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Large Hydropower (>30 MW) Small Hydropower (<10 MW) Pumped Storage Hydropower Run-of-River Mini and Micro Hydropower |

| By Geography | Brazil Argentina Chile Colombia Venezuela Paraguay Rest of South America |

| By End-User | Utilities Independent Power Producers (IPPs) Industrial Commercial & Residential |

| By Application | Electricity Generation Grid Stability & Ancillary Services Renewable Energy Integration Off-Grid Solutions |

| By Technology | Turbine Technology Generator Technology Control Systems Hybrid Systems (e.g., Hydro-Solar) |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Government Energy Policy Makers | 60 | Energy Ministers, Regulatory Authority Officials |

| Hydropower Project Developers | 50 | Project Managers, Business Development Executives |

| Environmental NGOs and Advocacy Groups | 40 | Environmental Analysts, Program Directors |

| Utility Companies and Energy Distributors | 55 | Operations Managers, Energy Traders |

| Academic and Research Institutions | 45 | Energy Researchers, Professors in Renewable Energy |

The South America Hydropower Market is valued at approximately USD 35 billion, driven by abundant water resources, increasing electricity demand, and a strong emphasis on renewable energy sources, which are crucial for reducing greenhouse gas emissions in the region.