Region:North America

Author(s):Dev

Product Code:KRAA0384

Pages:81

Published On:August 2025

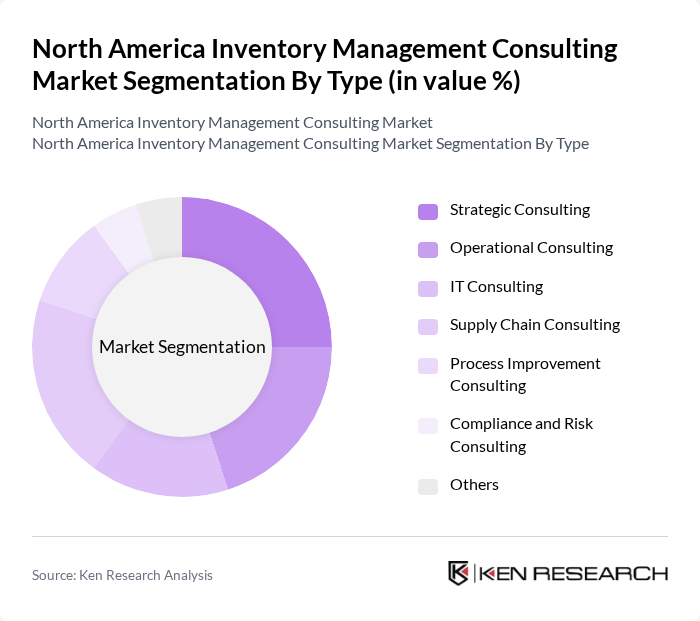

By Type:The market is segmented into various types of consulting services, including Strategic Consulting, Operational Consulting, IT Consulting, Supply Chain Consulting, Process Improvement Consulting, Compliance and Risk Consulting, and Others. Each of these segments plays a crucial role in addressing specific client needs and challenges in inventory management. Strategic Consulting focuses on long-term planning and business alignment; Operational Consulting addresses process efficiency; IT Consulting implements digital solutions; Supply Chain Consulting optimizes end-to-end logistics; Process Improvement Consulting targets workflow enhancements; Compliance and Risk Consulting ensures regulatory adherence and risk mitigation; Others include niche and specialized advisory services .

The Strategic Consulting segment is currently leading the market due to its focus on long-term planning and alignment of inventory management strategies with overall business objectives. Companies are increasingly recognizing the importance of strategic insights to navigate market fluctuations and consumer demands effectively. This segment is characterized by a high demand for tailored solutions that address unique business challenges, making it a preferred choice for many organizations .

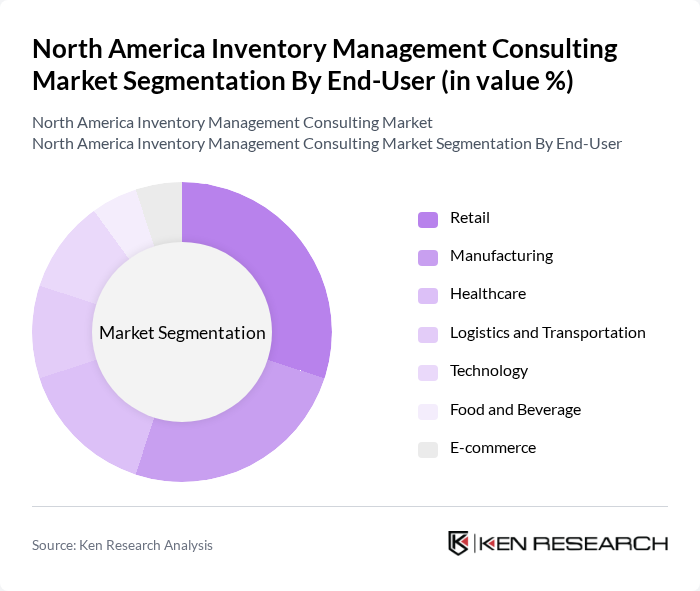

By End-User:The market is segmented by end-users, including Retail, Manufacturing, Healthcare, Logistics and Transportation, Technology, Food and Beverage, E-commerce, and Others. Each end-user segment has unique requirements and challenges that consulting services aim to address. Retailers focus on demand forecasting and omnichannel integration; Manufacturing emphasizes lean inventory and automation; Healthcare requires regulatory compliance and critical inventory tracking; Logistics and Transportation prioritize real-time visibility; Technology companies seek scalable digital solutions; Food and Beverage require spoilage reduction and traceability; E-commerce emphasizes rapid fulfillment and returns management; Others include specialized verticals with unique inventory needs .

The Retail segment is the largest end-user in the market, driven by the need for efficient inventory management to meet consumer demands and manage supply chain complexities. Retailers are increasingly adopting advanced inventory management solutions to enhance customer experience and optimize stock levels, making this segment a focal point for consulting services .

The North America Inventory Management Consulting Market is characterized by a dynamic mix of regional and international players. Leading participants such as Accenture, Deloitte Consulting, IBM Consulting, PwC Advisory Services, KPMG, EY (Ernst & Young), Capgemini, Cognizant Technology Solutions, Boston Consulting Group (BCG), Bain & Company, Protiviti, RSM US LLP, Slalom Consulting, West Monroe Partners, Chainalytics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the North American inventory management consulting market appears promising, driven by technological advancements and evolving consumer behaviors. As businesses increasingly prioritize digital transformation, the demand for consulting services that integrate IoT and AI into inventory management will grow. Additionally, sustainability practices are becoming essential, prompting firms to adopt eco-friendly solutions. These trends indicate a shift towards more agile and responsive inventory management strategies, positioning consulting firms to capitalize on emerging opportunities in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Strategic Consulting Operational Consulting IT Consulting Supply Chain Consulting Process Improvement Consulting Compliance and Risk Consulting Others |

| By End-User | Retail Manufacturing Healthcare Logistics and Transportation Technology Food and Beverage E-commerce Others |

| By Industry Vertical | Consumer Goods Automotive Pharmaceuticals Electronics Aerospace & Defense Energy & Utilities Others |

| By Service Model | On-site Consulting Remote Consulting Hybrid Consulting Subscription-based Services Project-based Services Others |

| By Consulting Duration | Short-term Consulting Long-term Consulting Project-based Consulting Retainer-based Consulting Others |

| By Geographic Focus | United States Canada Mexico Regional Focus Local Focus Others |

| By Client Size | Large Enterprises Medium Enterprises Small Enterprises Startups Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Inventory Management | 100 | Inventory Managers, Supply Chain Analysts |

| Manufacturing Inventory Optimization | 60 | Operations Managers, Production Planners |

| E-commerce Inventory Solutions | 50 | eCommerce Managers, Logistics Coordinators |

| Technology Adoption in Inventory Management | 40 | IT Managers, Technology Consultants |

| Consulting Services for Inventory Management | 45 | Consultants, Business Development Managers |

The North America Inventory Management Consulting Market is valued at approximately USD 11.5 billion, reflecting a significant demand for inventory optimization and management consulting services driven by complex supply chains and the need for operational efficiency.