Region:Middle East

Author(s):Shubham

Product Code:KRAD6637

Pages:99

Published On:December 2025

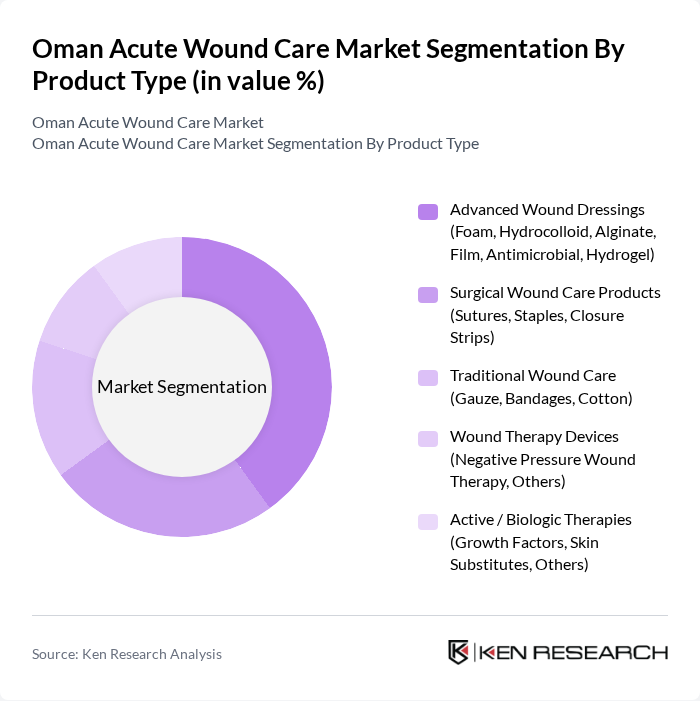

By Product Type:The product type segmentation includes various categories such as advanced wound dressings, surgical wound care products, traditional wound care, wound therapy devices, and active/biologic therapies. Among these, advanced wound dressings are leading the market due to their effectiveness in promoting faster healing and reducing infection rates. The increasing awareness of the benefits of advanced dressings, such as hydrocolloids and antimicrobial options, is driving their adoption in both hospital and home care settings.

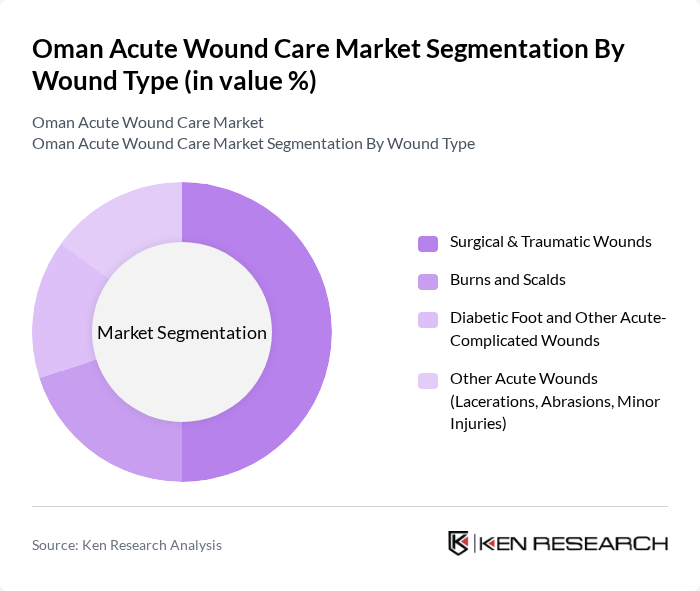

By Wound Type:The wound type segmentation encompasses surgical & traumatic wounds, burns and scalds, diabetic foot and other acute-complicated wounds, and other acute wounds such as lacerations and abrasions. Surgical and traumatic wounds dominate this segment due to the high incidence of surgeries and accidents, leading to a significant demand for effective wound care solutions. The increasing number of surgical procedures and trauma cases in Oman is driving the growth of this segment.

The Oman Acute Wound Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as Smith & Nephew plc, Mölnlycke Health Care AB, 3M Company (3M Health Care), ConvaTec Group plc, Medtronic plc, Johnson & Johnson (including Ethicon), B. Braun Melsungen AG, Coloplast A/S, Paul Hartmann AG, Essity AB (including Leukoplast, Cutimed), Medline Industries LP, Cardinal Health, Inc., Hollister Incorporated, Integra LifeSciences Holdings Corporation, Local & Regional Distributors (e.g., Oman Pharmaceutical Products Co. LLC, National Pharmaceutical Industries Co. SAOG) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman acute wound care market appears promising, driven by ongoing investments in healthcare infrastructure and technology. As the government prioritizes healthcare improvements, the integration of telemedicine and digital health solutions is expected to enhance patient access to wound care services. Additionally, the focus on personalized wound management strategies will likely lead to better patient outcomes, fostering a more robust market environment. Overall, these trends indicate a positive trajectory for the industry in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Advanced Wound Dressings (Foam, Hydrocolloid, Alginate, Film, Antimicrobial, Hydrogel) Surgical Wound Care Products (Sutures, Staples, Closure Strips) Traditional Wound Care (Gauze, Bandages, Cotton) Wound Therapy Devices (Negative Pressure Wound Therapy, Others) Active / Biologic Therapies (Growth Factors, Skin Substitutes, Others) |

| By Wound Type | Surgical & Traumatic Wounds Burns and Scalds Diabetic Foot and Other Acute-Complicated Wounds Other Acute Wounds (Lacerations, Abrasions, Minor Injuries) |

| By End-User | Public Hospitals (MOH & Government Hospitals) Private Hospitals and Specialty Clinics Ambulatory Surgical Centers Home Healthcare & Community Care Settings Long-term Care & Rehabilitation Facilities |

| By Distribution Channel | Institutional Sales (Tender / Bulk Procurement) Retail Pharmacies & Drug Stores Hospital Pharmacies Online Pharmacies & E-commerce Platforms |

| By Region | Muscat Dhofar (incl. Salalah) Al Batinah (incl. Sohar) Ad Dakhiliyah (incl. Nizwa) Other Governorates |

| By Care Setting | Inpatient Care Outpatient & Day-care Settings Emergency & Trauma Care |

| By Mode of Purchase | Tender-based Procurement Contracted Supply Agreements Spot Purchases / Ad-hoc Procurements |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Wound Care Departments | 100 | Wound Care Specialists, Nursing Staff |

| Outpatient Clinics | 80 | General Practitioners, Clinic Managers |

| Home Healthcare Providers | 60 | Home Care Nurses, Patient Care Coordinators |

| Pharmaceutical Distributors | 50 | Sales Representatives, Product Managers |

| Patient Feedback on Wound Care Products | 75 | Patients with Acute Wounds, Caregivers |

The Oman Acute Wound Care Market is valued at approximately USD 15 million, reflecting a five-year historical analysis. This growth is driven by the increasing prevalence of chronic diseases and advancements in wound care technologies.