Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4058

Pages:100

Published On:December 2025

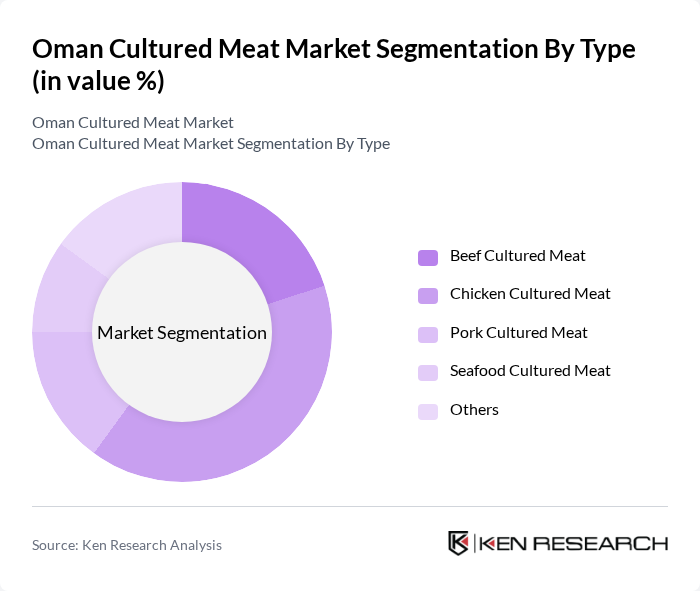

By Type:The market is segmented into various types of cultured meat, including beef, chicken, pork, seafood, and others. Each type caters to different consumer preferences and dietary requirements. Among these, chicken cultured meat is currently leading the market due to its widespread acceptance and versatility in various cuisines. The increasing focus on health and sustainability is driving consumers towards chicken as a preferred protein source, making it a dominant segment.

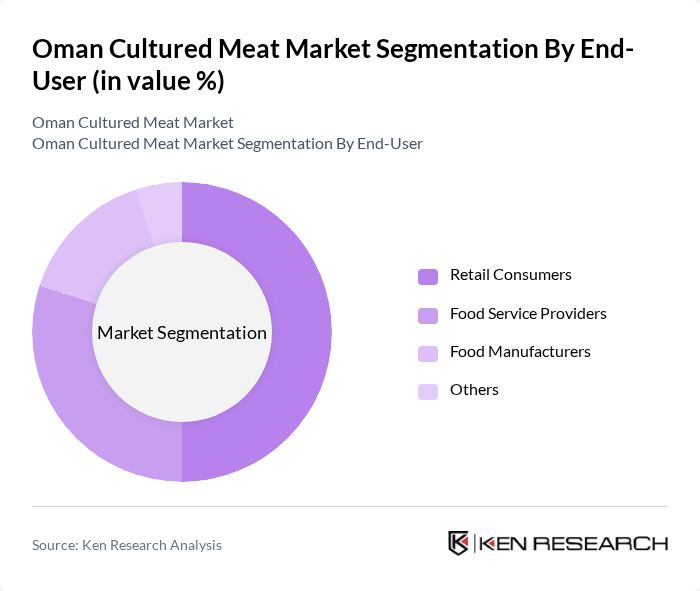

By End-User:The cultured meat market is segmented by end-users, including retail consumers, food service providers, food manufacturers, and others. Retail consumers are the largest segment, driven by the growing trend of health-conscious eating and the increasing availability of cultured meat products in supermarkets and online platforms. The convenience and perceived health benefits of cultured meat are attracting more consumers, making this segment a key driver of market growth.

The Oman Cultured Meat Market is characterized by a dynamic mix of regional and international players. Leading participants such as Eat Just, Inc., Mosa Meat, Memphis Meats, Aleph Farms, Future Meat Technologies, SuperMeat, Just Eat, BioTech Foods, New Age Meats, Higher Steaks, Cultured Decadence, Wild Type, Redefine Meat, Finless Foods, Vow Foods contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cultured meat market in Oman appears promising, driven by increasing consumer awareness and a growing preference for sustainable food options. As technological advancements continue to lower production costs, the market is likely to see a rise in product availability and consumer acceptance. Furthermore, government initiatives aimed at fostering innovation will play a crucial role in shaping the industry landscape, potentially leading to a more robust market presence for cultured meat in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Beef Cultured Meat Chicken Cultured Meat Pork Cultured Meat Seafood Cultured Meat Others |

| By End-User | Retail Consumers Food Service Providers Food Manufacturers Others |

| By Distribution Channel | Online Retail Supermarkets and Hypermarkets Specialty Stores Others |

| By Packaging Type | Vacuum Packaging Modified Atmosphere Packaging Others |

| By Price Range | Premium Mid-range Budget Others |

| By Production Method | Bioreactor Cultivation Cell Culture Techniques Others |

| By Consumer Demographics | Age Group Income Level Lifestyle Preferences Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Awareness of Cultured Meat | 120 | General Consumers, Health-Conscious Shoppers |

| Food Industry Stakeholders | 90 | Producers, Distributors, Retail Managers |

| Culinary Perspectives on Cultured Meat | 75 | Chefs, Food Service Operators, Culinary Experts |

| Regulatory Insights | 45 | Government Officials, Food Safety Regulators |

| Environmental Impact Awareness | 65 | Sustainability Advocates, Environmental Scientists |

The Oman Cultured Meat Market is valued at approximately USD 50 million, reflecting a growing consumer demand for sustainable and ethical food sources, alongside advancements in cellular agriculture technology.