Region:Middle East

Author(s):Rebecca

Product Code:KRAC3272

Pages:98

Published On:October 2025

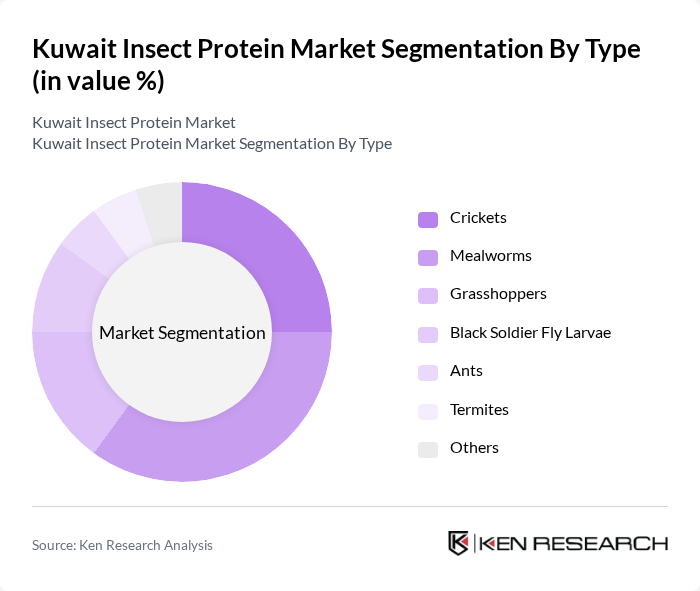

By Type:The insect protein market in Kuwait is segmented into Crickets, Mealworms, Grasshoppers, Black Soldier Fly Larvae, Ants, Termites, and Others. Mealworms and Crickets are the most prominent types due to their high protein content, favorable amino acid profiles, and adaptability in both human food and animal feed applications. Mealworms, in particular, are gaining traction as a sustainable and nutritious ingredient, reflecting global trends in consumer preference for environmentally friendly protein sources.

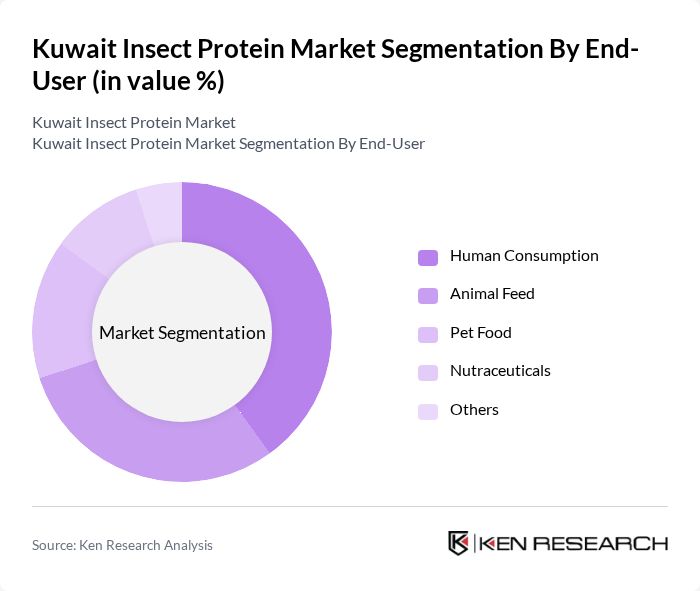

By End-User:The end-user segmentation includes Human Consumption, Animal Feed, Pet Food, Nutraceuticals, and Others. Human Consumption currently leads the market, driven by rising consumer acceptance of insect-based foods and a growing focus on high-protein, low-fat dietary options. The Animal Feed segment is also significant, as livestock and aquaculture producers increasingly seek sustainable, cost-effective alternatives to conventional feed ingredients.

The Kuwait Insect Protein Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aspire Food Group, Ÿnsect, Protix, AgriProtein, EnviroFlight, Entomo Farms, InnovaFeed, Hexafly, nextProtein, Global Bugs, Beta Hatch, Goterra, Darling Ingredients Inc., Nutrition Technologies, and JR Unique Foods Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the insect protein market in Kuwait appears promising, driven by increasing consumer interest in sustainable food sources and government initiatives supporting alternative proteins. As awareness grows, the market is likely to see innovations in product development and distribution channels. Collaborations with food technology firms will enhance product offerings, while investments in research and development will further improve farming techniques, making insect protein a more viable option for consumers and businesses alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Crickets Mealworms Grasshoppers Black Soldier Fly Larvae Ants Termites Others |

| By End-User | Human Consumption Animal Feed Pet Food Nutraceuticals Others |

| By Application | Food Products Supplements Animal Nutrition Cosmetics Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Direct Sales Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value Pricing Others |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-Friendly Packaging Others |

| By Source of Procurement | Local Suppliers International Suppliers In-House Production Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Insect Protein Producers | 50 | Farm Owners, Production Managers |

| Food Manufacturers Utilizing Insect Protein | 60 | Product Development Managers, Quality Assurance Officers |

| Retailers Selling Insect Protein Products | 60 | Category Managers, Purchasing Agents |

| Consumers of Alternative Proteins | 100 | Health-Conscious Consumers, Eco-Friendly Shoppers |

| Regulatory Bodies and Food Safety Experts | 40 | Food Safety Inspectors, Regulatory Affairs Specialists |

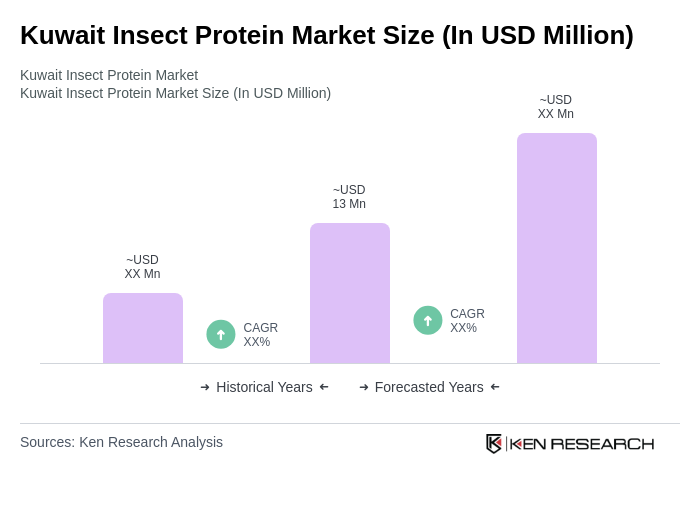

The Kuwait Insect Protein Market is valued at approximately USD 13 million, reflecting a growing interest in sustainable food sources and advancements in insect farming technologies. This market is expected to expand as consumer acceptance of insect-based products increases.