Region:Middle East

Author(s):Dev

Product Code:KRAD7671

Pages:92

Published On:December 2025

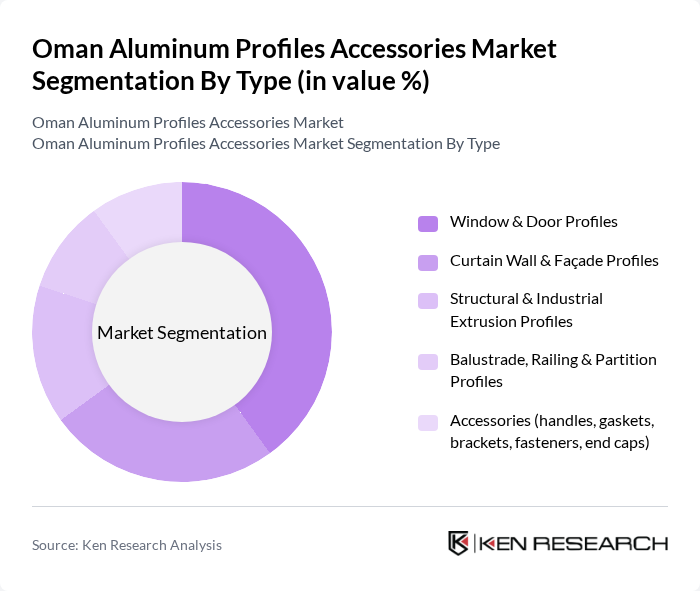

By Type:The market is segmented into various types of aluminum profiles and accessories, including Window & Door Profiles, Curtain Wall & Façade Profiles, Structural & Industrial Extrusion Profiles, Balustrade, Railing & Partition Profiles, and Accessories (handles, gaskets, brackets, fasteners, end caps). This structure is aligned with the global aluminum profiles and accessories market, where profiles for building envelopes and structural framing represent the largest share. Among these, Window & Door Profiles are the most dominant in Oman due to their extensive use in residential and commercial buildings, supported by ongoing housing programs, refurbishment of older stock, and the preference for thermally improved, modern architectural designs using aluminum frames in urban developments.

By End-User:The end-user segmentation includes Residential Building & Housing, Commercial & Hospitality, Industrial & Warehousing, Infrastructure & Public / Government Projects, and Energy & Utilities (solar PV, power, oil & gas facilities). This segmentation reflects the typical demand structure for aluminum profiles and accessories, where building and construction remains the leading end-use globally and in the Middle East. The Residential Building & Housing segment leads the market in Oman, driven by increasing urbanization, population growth in key cities, and government-backed housing and mortgage programs that support new housing projects, which require a significant amount of aluminum profiles for windows, doors, balcony systems, railings, and interior partitions. Commercial & Hospitality, including hotels, malls, mixed-use towers, and tourism infrastructure, also represents a substantial share as developers favor aluminum curtain walls, façades, and glazing systems to achieve modern aesthetics and comply with energy and sustainability requirements.

The Oman Aluminum Profiles Accessories Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Aluminium Extrusion Company LLC (Oman Aluminum Extrusion), National Aluminum Products Company SAOG (NAPCO), Sohar Aluminium LLC, Assarain Aluminium LLC, Al Arabian Aluminium & Glass LLC (Muscat), Al Hutaib Aluminium & Glass LLC, Gulf Extrusions Co. LLC, Arabian Extrusions Factory LLC, Emirates Extrusion Factory LLC, Aluminium Products Company (ALUPCO), Al Ghurair Construction – Aluminium, Al Jaber Aluminum Extrusions (ALEXCO), Jindal Aluminium Ltd., Gulf Aluminium Rolling Mill Co. (GARMCO), Balexco – Bahrain Aluminium Extrusion Company contribute to innovation, geographic expansion, and service delivery in this space, supported by strong primary aluminum production capacity in Oman and neighboring GCC countries.

The future of the Oman aluminum profiles accessories market appears promising, driven by ongoing construction projects and a shift towards sustainable building practices. As the government continues to invest in infrastructure and local manufacturing, the market is expected to see increased innovation and product development. Additionally, the growing emphasis on energy efficiency and smart building technologies will likely create new avenues for growth, positioning local manufacturers to capitalize on emerging trends in the construction sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Window & Door Profiles Curtain Wall & Façade Profiles Structural & Industrial Extrusion Profiles Balustrade, Railing & Partition Profiles Accessories (handles, gaskets, brackets, fasteners, end caps) |

| By End-User | Residential Building & Housing Commercial & Hospitality Industrial & Warehousing Infrastructure & Public / Government Projects Energy & Utilities (solar PV, power, oil & gas facilities) |

| By Application | Windows, Doors & Shopfront Systems Curtain Walls, Skylights & Facades Railings, Fencing, Balconies & Pergolas Partitions, Ceilings & Interior Fit?outs Solar Mounting Systems & Industrial Frames |

| By Distribution Channel | Direct Sales to Fabricators, EPCs & Contractors Authorized Distributors & Stockists OEM / Project-Based Supply Agreements Retail & Trade Counters Online / E?Procurement Platforms |

| By Region | Muscat Dhofar Al Batinah (North & South) Al Dakhiliyah & Al Sharqiyah Al Dhahirah, Al Wusta & Musandam |

| By Product Finish | Anodized Powder Coated Mill Finish Wood-Effect & Decorative Finishes Thermal Break & Insulated Systems |

| By Customization Level | Standard Catalogue Profiles & Accessories Project-Specific Custom Extrusions System-Based Solutions (complete window/door/façade systems) Turnkey Design?to?Fabrication Solutions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Accessories | 100 | Project Managers, Procurement Officers |

| Automotive Components Supply | 80 | Manufacturing Engineers, Supply Chain Managers |

| Architectural Applications | 70 | Architects, Design Engineers |

| Industrial Applications | 60 | Operations Managers, Quality Control Inspectors |

| Retail Distribution Channels | 90 | Retail Managers, Sales Directors |

The Oman Aluminum Profiles Accessories Market is valued at approximately USD 230 million, reflecting a robust growth trajectory driven by increasing demand for lightweight and durable materials in construction and infrastructure projects across Oman and the GCC region.