Region:Middle East

Author(s):Rebecca

Product Code:KRAD2775

Pages:93

Published On:November 2025

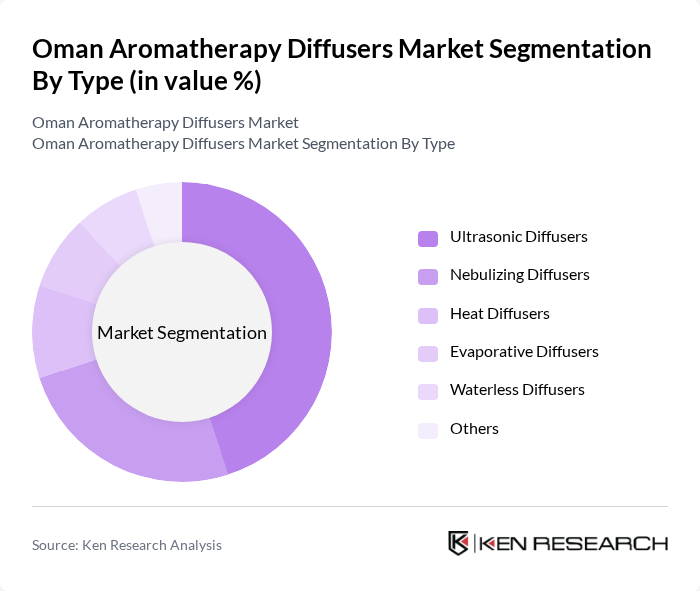

By Type:The market is segmented into various types of diffusers, including Ultrasonic Diffusers, Nebulizing Diffusers, Heat Diffusers, Evaporative Diffusers, Waterless Diffusers, and Others. Among these, Ultrasonic Diffusers are the most popular due to their ability to disperse essential oils effectively while maintaining the integrity of the oils. They are favored for their quiet operation and energy efficiency, making them ideal for home and office use. Nebulizing Diffusers also hold a significant share, appealing to consumers looking for a more potent aroma experience without the use of water. The growing adoption of smart ultrasonic diffusers with app connectivity and customizable features is a notable trend in this segment .

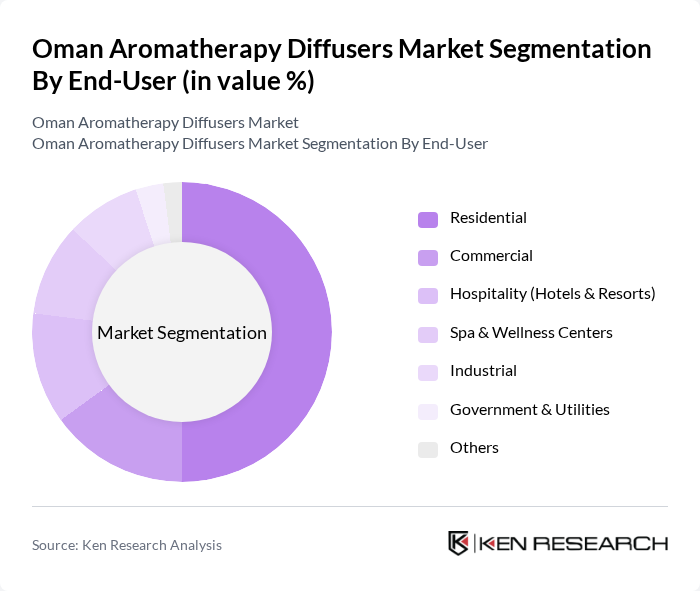

By End-User:The end-user segmentation includes Residential, Commercial, Hospitality (Hotels & Resorts), Spa & Wellness Centers, Industrial, Government & Utilities, and Others. The Residential segment leads the market, driven by the growing trend of home wellness and self-care. Consumers are increasingly investing in aromatherapy diffusers to enhance their living spaces and promote relaxation. The Hospitality sector is also significant, as hotels and resorts incorporate aromatherapy to improve guest experiences and create a calming atmosphere. The spa and wellness segment continues to expand, leveraging aromatherapy diffusers to provide premium relaxation services .

The Oman Aromatherapy Diffusers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Young Living Essential Oils, doTERRA International, NOW Foods, SpaRoom, Muji, GreenAir, Inc., Vitruvi, Organic Aromas, Edens Garden, Puzhen Life Co. Ltd., ZAQ, InnoGear, URPOWER, Asakuki, ArtNaturals contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman aromatherapy diffusers market appears promising, driven by increasing consumer interest in wellness and holistic health solutions. As the market evolves, innovations in product design and technology, such as smart diffusers, are expected to gain traction. Additionally, the integration of aromatherapy with home automation systems is likely to enhance user experience, making these products more appealing to tech-savvy consumers. The focus on sustainability will also shape product offerings, aligning with global trends towards eco-friendly solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Ultrasonic Diffusers Nebulizing Diffusers Heat Diffusers Evaporative Diffusers Waterless Diffusers Others |

| By End-User | Residential Commercial Hospitality (Hotels & Resorts) Spa & Wellness Centers Industrial Government & Utilities Others |

| By Distribution Channel | Online Retail Offline Retail (Specialty Stores, Hypermarkets/Supermarkets) Direct Sales Wholesale/Distributors Others |

| By Essential Oil Type | Lavender Eucalyptus Peppermint Tea Tree Citrus Oils (e.g., Orange, Lemon) Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Aromatherapy Purpose | Relaxation Stress Relief Sleep Aid Mood Enhancement Air Purification Others |

| By Brand | International Brands Regional/Middle East Brands Private Labels Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Aromatherapy Products | 80 | Store Managers, Product Buyers |

| Consumer Preferences for Diffusers | 100 | Aromatherapy Users, Health Enthusiasts |

| Distribution Channels Analysis | 60 | Distributors, Wholesalers |

| Market Trends in Essential Oils | 90 | Manufacturers, Retail Analysts |

| Consumer Awareness and Education | 70 | Wellness Coaches, Health Bloggers |

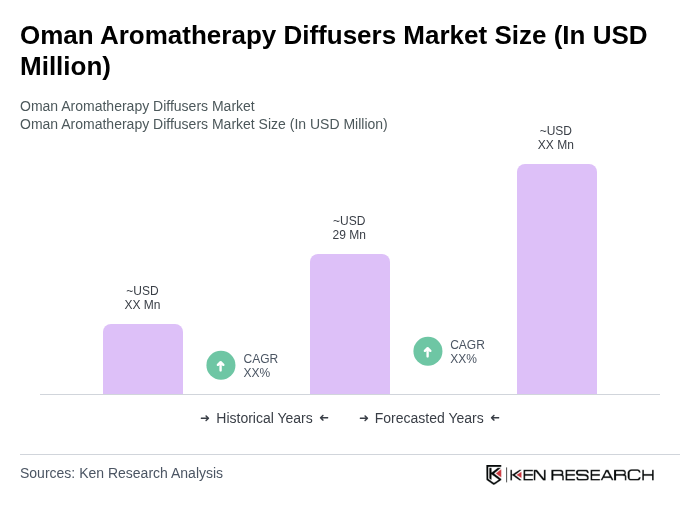

The Oman Aromatherapy Diffusers Market is valued at approximately USD 29 million, reflecting a growing consumer interest in wellness and the therapeutic benefits of essential oils, alongside trends in home decor that incorporate aromatherapy products.