Region:Middle East

Author(s):Rebecca

Product Code:KRAD6189

Pages:93

Published On:December 2025

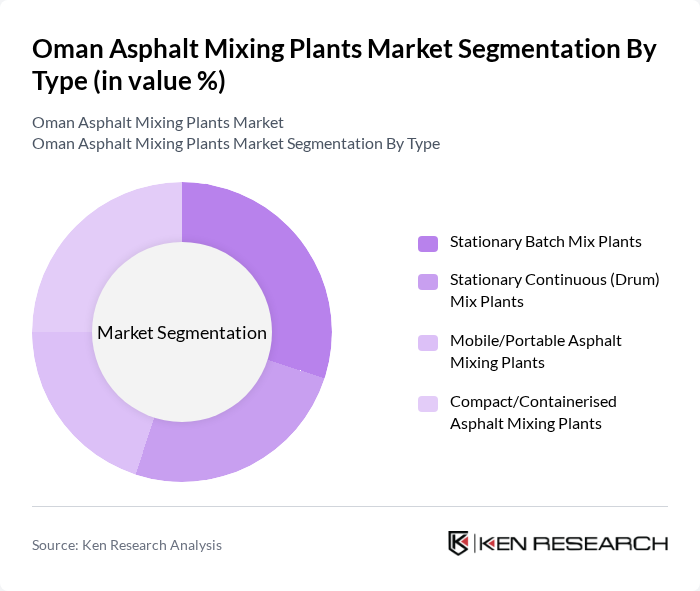

By Type:The market is segmented into various types of asphalt mixing plants, including stationary batch mix plants, stationary continuous (drum) mix plants, mobile/portable asphalt mixing plants, and compact/containerised asphalt mixing plants. Each type serves different operational needs and project requirements, with stationary configurations typically preferred for high-volume highway and expressway works and mobile/compact plants increasingly adopted for remote projects, maintenance works, and time-bound urban jobs where rapid setup and relocation are essential.

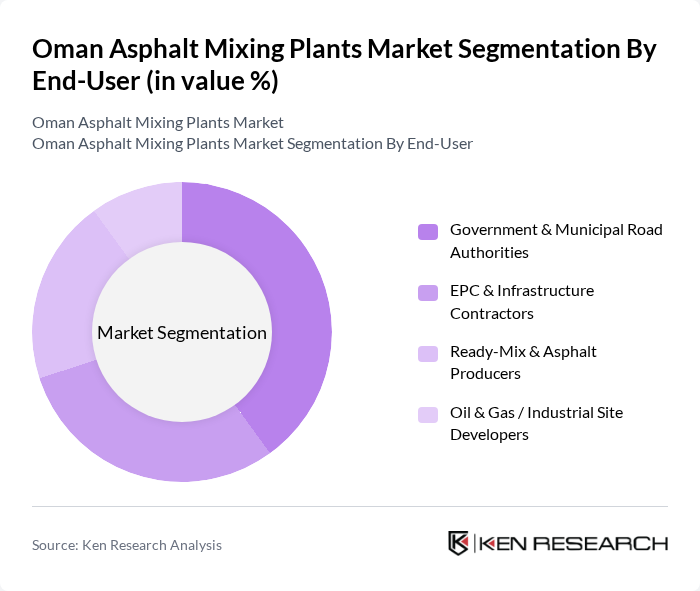

By End-User:The end-user segmentation includes government and municipal road authorities, EPC and infrastructure contractors, ready-mix and asphalt producers, and oil & gas/industrial site developers. Each end-user category has distinct requirements and influences the demand for asphalt mixing plants in Oman, with public sector road authorities driving specification standards and long-term highway programs, EPC and infrastructure contractors demanding high throughput and reliability for turnkey projects, commercial asphalt producers focusing on plant efficiency and mix flexibility, and oil & gas/industrial developers requiring durable pavement solutions for heavy-duty internal road networks and logistics facilities.

The Oman Asphalt Mixing Plants Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Asphalt LLC, Al Tasnim Enterprises LLC (Asphalt & Contracting Division), Galfar Engineering & Contracting SAOG (Roads & Bridges Division), STFA Oman LLC, Larsen & Toubro Oman LLC, Sinohydro Corporation Limited – Oman Operations, Strabag Oman LLC, Al Rawas Asphalt & Transport LLC, Al Jazeera Engineering & Construction LLC, Al Kiyumi Global LLC (Roads & Infrastructure), Al Nab’a Infrastructure & Asphalt LLC, Oman Road Engineering Company LLC, Al Shanfari Asphalt & Road Contracting LLC, Carillion Alawi LLC, Khalid Bin Ahmed & Sons LLC (Infrastructure Division) contribute to innovation, geographic expansion, and service delivery in this space.

The Oman asphalt mixing plants market is poised for significant growth, driven by ongoing infrastructure investments and a focus on quality road construction. As urbanization accelerates, the demand for efficient and sustainable asphalt solutions will increase. The integration of advanced technologies, such as IoT and eco-friendly practices, will further enhance operational efficiency. Additionally, public-private partnerships are expected to play a crucial role in expanding market opportunities, fostering innovation and collaboration within the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Stationary Batch Mix Plants Stationary Continuous (Drum) Mix Plants Mobile/Portable Asphalt Mixing Plants Compact/Containerised Asphalt Mixing Plants |

| By End-User | Government & Municipal Road Authorities EPC & Infrastructure Contractors Ready-Mix & Asphalt Producers Oil & Gas / Industrial Site Developers |

| By Application | National & Expressway Road Construction Urban Roads & Municipal Infrastructure Airport Runways & Taxiways Industrial Yards, Ports & Parking Areas |

| By Capacity | Up to 80 TPH –160 TPH –240 TPH Above 240 TPH |

| By Technology | Hot Mix Asphalt (HMA) Plants Warm Mix Asphalt (WMA) Plants Cold & Recycled Asphalt (RAP/RAS) Plants Low-Emission & Energy-Efficient Plants |

| By Region | Muscat Governorate Dhofar (Salalah & Surrounding Areas) Al Batinah North & South Al Sharqiyah & Interior Governorates |

| By Investment Source | Government-Funded Projects Private Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Construction Projects | 100 | Project Managers, Civil Engineers |

| Asphalt Plant Operations | 60 | Plant Managers, Technical Directors |

| Government Infrastructure Initiatives | 40 | Policy Makers, Regulatory Officials |

| Private Sector Construction Firms | 50 | Business Development Managers, Procurement Officers |

| Consulting Firms in Construction | 40 | Market Analysts, Industry Consultants |

The Oman Asphalt Mixing Plants Market is valued at approximately USD 15 million, contributing to the broader Middle East & Africa asphalt mixing plant market, which generated around USD 296.5 million.