Region:Middle East

Author(s):Geetanshi

Product Code:KRAC2344

Pages:90

Published On:October 2025

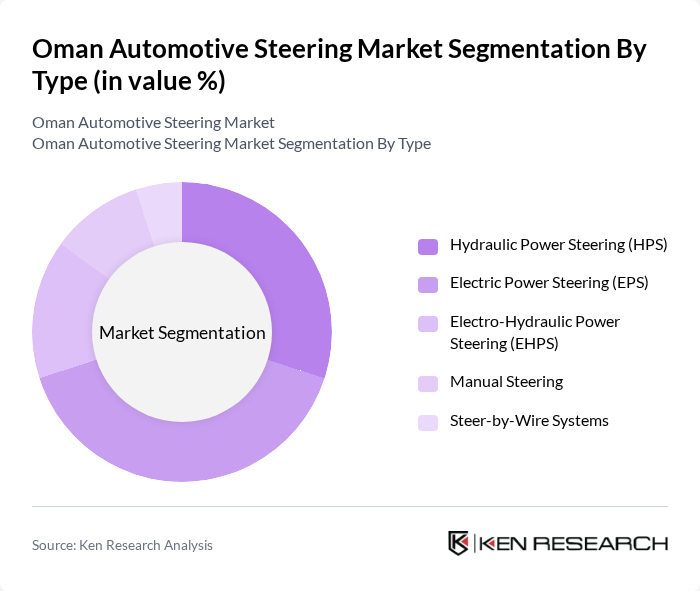

By Type:The market can be segmented into various types of steering systems, including Hydraulic Power Steering (HPS), Electric Power Steering (EPS), Electro-Hydraulic Power Steering (EHPS), Manual Steering, and Steer-by-Wire Systems. Each type serves different vehicle requirements and consumer preferences, with EPS systems experiencing the most rapid adoption due to technological advancements and integration capabilities with modern vehicle electronics.

The Electric Power Steering (EPS) segment is currently dominating the market due to its energy efficiency, lightweight design, and enhanced driving comfort. As consumers increasingly seek fuel-efficient and environmentally friendly vehicles, EPS systems have gained substantial traction in the Omani market. The growing trend towards electric vehicles further supports the demand for EPS, as it aligns with the industry's shift towards sustainable technologies. Additionally, advancements in EPS technology, including the development of brushless motor systems and the integration of sensors for improved steering control, are driving its popularity. The seamless compatibility of EPS with advanced driver-assistance systems such as lane-keeping assist and automated parking has made it the preferred choice for automotive manufacturers operating in Oman.

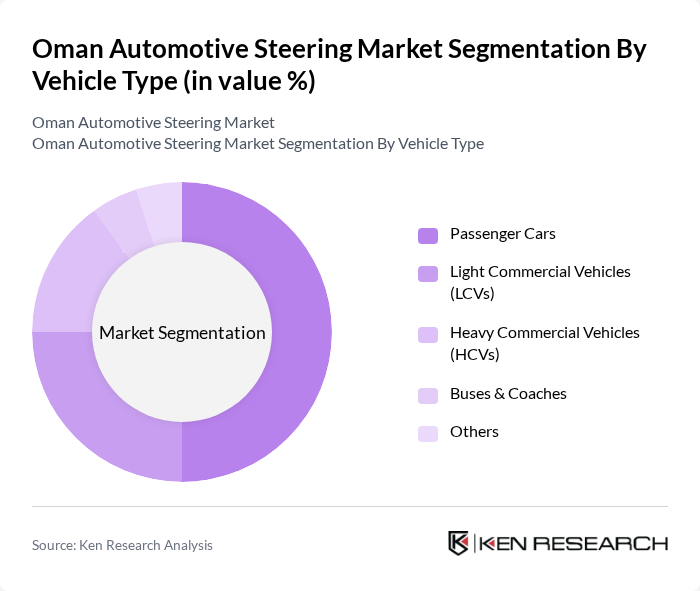

By Vehicle Type:The market is also segmented based on vehicle types, including Passenger Cars, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), Buses & Coaches, and Others. Each vehicle type has distinct steering system requirements based on size, weight, and intended use, with passenger cars representing the dominant segment in the Omani automotive market.

Passenger Cars represent the largest segment in the market, driven by the high demand for personal vehicles and the expanding automotive retail sector in Oman. The growing middle-class population and rising disposable incomes have led to a surge in passenger car sales, which in turn boosts the demand for advanced steering systems. The Omani passenger car market has shown consistent growth, with vehicle sales demonstrating strong momentum and continued expansion trends. Additionally, the trend towards electric and hybrid vehicles is further propelling the growth of this segment, as manufacturers increasingly adopt modern steering technologies to enhance vehicle performance, safety, and compliance with government-mandated safety standards. The integration of EPS systems with driver assistance features has become a key differentiator in the passenger car segment, driving consumer preferences towards vehicles equipped with advanced steering technologies.

The Oman Automotive Steering Market is characterized by a dynamic mix of regional and international players. Leading participants such as ZF Friedrichshafen AG, JTEKT Corporation, Nexteer Automotive, Bosch Automotive Steering GmbH, thyssenkrupp AG, Mando Corporation, Hyundai Mobis Co., Ltd., NSK Ltd., Aisin Corporation, DENSO Corporation, American Axle & Manufacturing Holdings, Inc. (AAM), Sona BLW Precision Forgings Ltd. (Sona Comstar), ACDelco (General Motors), Hitachi Astemo, Ltd., Delphi Technologies (BorgWarner Inc.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman automotive steering market appears promising, driven by the increasing adoption of electric vehicles and advancements in autonomous driving technologies. As the government continues to invest in infrastructure and promote electric vehicle adoption, the demand for innovative steering solutions is expected to rise. Additionally, the integration of advanced driver assistance systems will further enhance the market's growth, positioning Oman as a competitive player in the automotive sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Hydraulic Power Steering (HPS) Electric Power Steering (EPS) Electro-Hydraulic Power Steering (EHPS) Manual Steering Steer-by-Wire Systems |

| By Vehicle Type | Passenger Cars Light Commercial Vehicles (LCVs) Heavy Commercial Vehicles (HCVs) Buses & Coaches Others |

| By Component | Steering Gear Steering Column Steering Wheel Sensors & Actuators Others |

| By Sales Channel | OEMs Aftermarket |

| By Distribution Mode | Direct Sales Distributors Retail Outlets |

| By Price Range | Economy Mid-Range Premium |

| By Application | Personal Use Commercial Use Fleet Management Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturers | 45 | Product Managers, R&D Heads |

| Automotive Distributors | 60 | Sales Directors, Supply Chain Managers |

| Retail Automotive Service Providers | 70 | Service Managers, Workshop Owners |

| Government Regulatory Bodies | 50 | Policy Makers, Regulatory Analysts |

| Automotive Parts Suppliers | 75 | Procurement Managers, Operations Directors |

The Oman Automotive Steering Market is valued at approximately USD 1.15 billion, reflecting a significant growth driven by the increasing demand for advanced steering technologies, particularly electric power steering systems, and the rising automotive production and sales in the region.