Region:Global

Author(s):Dev

Product Code:KRAA5317

Pages:86

Published On:January 2026

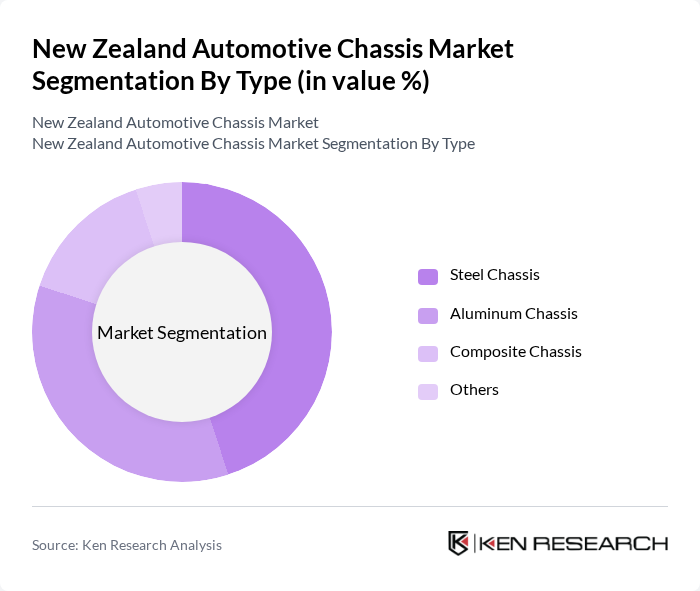

By Type:The market is segmented into various types of chassis, including Steel Chassis, Aluminum Chassis, Composite Chassis, and Others. Steel Chassis is widely used due to its strength and cost-effectiveness, while Aluminum Chassis is gaining traction for its lightweight properties, which enhance fuel efficiency. Composite Chassis, although less common, is preferred in high-performance vehicles for its superior strength-to-weight ratio. The Others category includes specialized chassis types that cater to niche markets.

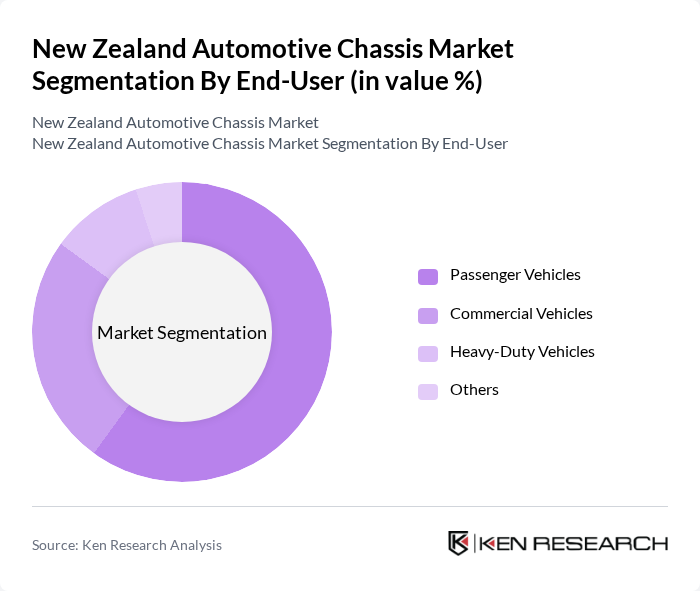

By End-User:The end-user segmentation includes Passenger Vehicles, Commercial Vehicles, Heavy-Duty Vehicles, and Others. Passenger Vehicles dominate the market due to the high volume of personal vehicle sales, while Commercial Vehicles are significant for their role in logistics and transportation. Heavy-Duty Vehicles, although a smaller segment, are crucial for industries requiring robust chassis for heavy loads. The Others category encompasses specialized vehicles used in various sectors.

The New Zealand Automotive Chassis Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fisher & Paykel Automotive, APL Chassis, Hino Motors New Zealand, Toyota New Zealand, Ford New Zealand, Mitsubishi Motors New Zealand, Isuzu New Zealand, Nissan New Zealand, Holden New Zealand, Mercedes-Benz New Zealand, Volkswagen New Zealand, BMW New Zealand, Subaru New Zealand, Hyundai New Zealand, Kia New Zealand contribute to innovation, geographic expansion, and service delivery in this space.

The future of the New Zealand automotive chassis market appears promising, driven by technological advancements and a growing emphasis on sustainability. As manufacturers increasingly adopt lightweight materials and integrate smart technologies into chassis designs, the market is expected to evolve significantly. Additionally, the expansion of the electric vehicle sector will further stimulate innovation, leading to enhanced safety features and improved performance. Overall, the market is poised for growth, with a focus on meeting consumer demands and regulatory requirements.

| Segment | Sub-Segments |

|---|---|

| By Type | Steel Chassis Aluminum Chassis Composite Chassis Others |

| By End-User | Passenger Vehicles Commercial Vehicles Heavy-Duty Vehicles Others |

| By Vehicle Type | SUVs Sedans Trucks Others |

| By Material | Steel Aluminum Carbon Fiber Others |

| By Manufacturing Process | Stamping Welding Assembly Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North Island South Island Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Chassis Manufacturers | 100 | Production Managers, Quality Assurance Engineers |

| Automotive Component Suppliers | 80 | Supply Chain Managers, Procurement Specialists |

| Vehicle Assembly Plants | 70 | Operations Directors, Engineering Leads |

| Automotive Regulatory Bodies | 50 | Policy Makers, Compliance Officers |

| Market Research Analysts | 60 | Market Analysts, Industry Consultants |

The New Zealand Automotive Chassis Market is valued at approximately USD 1.3 billion, reflecting a significant growth trend driven by the demand for lightweight and fuel-efficient vehicles, as well as advancements in manufacturing technologies.