Region:Middle East

Author(s):Dev

Product Code:KRAD5139

Pages:80

Published On:December 2025

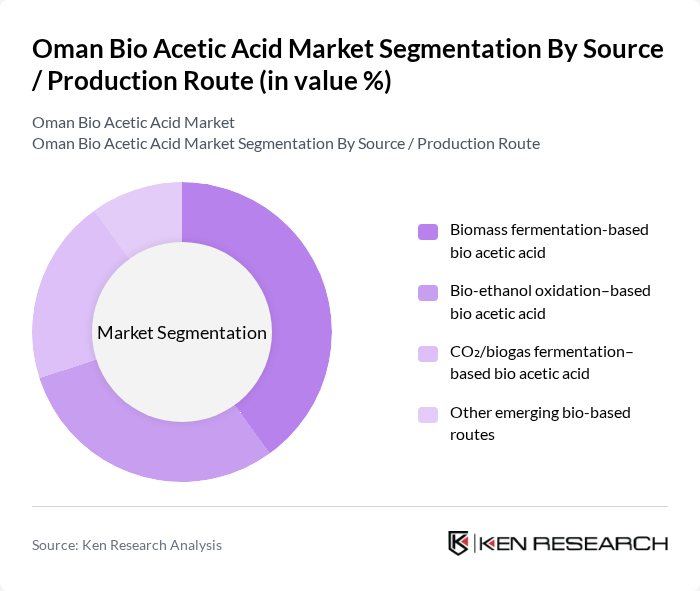

By Source / Production Route:The market is segmented based on the source or production route of bio acetic acid. The primary subsegments include biomass fermentation-based bio acetic acid, bio-ethanol oxidation-based bio acetic acid, CO?/biogas fermentation-based bio acetic acid, and other emerging bio-based routes. Each of these production methods has unique advantages and applications, influencing their market share and growth potential.

The biomass fermentation-based bio acetic acid segment is currently dominating the market due to its established technology and cost-effectiveness. This method utilizes renewable biomass, making it a preferred choice for manufacturers aiming to reduce their carbon footprint. The increasing focus on sustainability and the availability of feedstock have further propelled its growth. Additionally, advancements in fermentation technology are enhancing yield and efficiency, solidifying its position as the leading production route in the bio acetic acid market.

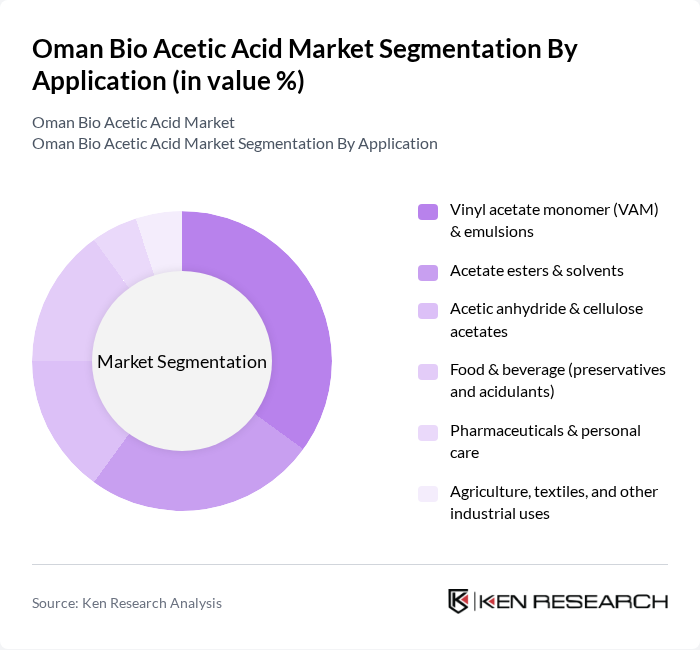

By Application:The applications of bio acetic acid are diverse, including vinyl acetate monomer (VAM) & emulsions, acetate esters & solvents, acetic anhydride & cellulose acetates, food & beverage (preservatives and acidulants), pharmaceuticals & personal care, and agriculture, textiles, and other industrial uses. Each application area has distinct requirements and growth drivers, contributing to the overall market dynamics.

The vinyl acetate monomer (VAM) & emulsions application segment is leading the market due to its extensive use in the production of adhesives, paints, and coatings. The demand for VAM is driven by the construction and automotive industries, which require high-performance materials. Additionally, the growing trend towards eco-friendly products is pushing manufacturers to adopt bio-based alternatives, further enhancing the market for bio acetic acid in this application area.

The Oman Bio Acetic Acid Market is characterized by a dynamic mix of regional and international players. Leading participants such as OQ (Oman’s integrated energy & chemicals company), BP plc (technology partner for the Oman acetic acid complex), SABIC (Saudi Basic Industries Corporation), LyondellBasell Industries N.V., Celanese Corporation, Eastman Chemical Company, Wacker Chemie AG, Afyren, Godavari Biorefineries Ltd., LanzaTech Global, Inc., Corbion N.V., Novozymes A/S, Aemetis, Inc., Local and regional chemical distributors in Oman and GCC, Emerging bio-acetic acid technology start-ups active in MEA contribute to innovation, geographic expansion, and service delivery in this space.

The future of the bio acetic acid market in Oman appears promising, driven by increasing consumer demand for sustainable products and supportive government policies. As the market matures, advancements in production technologies are expected to lower costs, making bio acetic acid more competitive. Additionally, the growing emphasis on environmental sustainability will likely encourage further investments in bio-based chemicals, fostering innovation and expanding applications across various industries, including packaging and textiles.

| Segment | Sub-Segments |

|---|---|

| By Source / Production Route | Biomass fermentation-based bio acetic acid Bio-ethanol oxidation–based bio acetic acid CO?/biogas fermentation–based bio acetic acid Other emerging bio-based routes |

| By Application | Vinyl acetate monomer (VAM) & emulsions Acetate esters & solvents Acetic anhydride & cellulose acetates Food & beverage (preservatives and acidulants) Pharmaceuticals & personal care Agriculture, textiles, and other industrial uses |

| By End-User Industry | Petrochemicals & downstream polymers (incl. VAM users) Food & beverage processors Pharmaceutical and healthcare manufacturers Paints, coatings, and adhesives producers Agriculture, textiles, and specialty chemicals Others |

| By Distribution Channel | Direct offtake agreements with industrial users Contracts with regional chemical distributors Spot trade via regional traders and brokers Others |

| By Packaging Type | ISO tanks and bulk tankers IBCs and large drums Smaller drums and specialty packaging Others |

| By Omani Region / Industrial Cluster | Muscat & Barka industrial areas Sohar Industrial Port & Freezone Duqm Special Economic Zone Salalah Free Zone & other regions |

| By Policy & Sustainability Framework | Alignment with Oman Vision 2040 & green chemistry goals Incentives in free zones and industrial estates R&D and innovation grants for bio-based chemicals Carbon footprint reduction and ESG-linked initiatives |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Industry | 80 | Product Development Managers, Quality Assurance Officers |

| Pharmaceutical Sector | 70 | Regulatory Affairs Specialists, R&D Managers |

| Industrial Applications | 60 | Procurement Managers, Operations Directors |

| Research Institutions | 40 | Academic Researchers, Lab Managers |

| Government Regulatory Bodies | 40 | Policy Makers, Environmental Analysts |

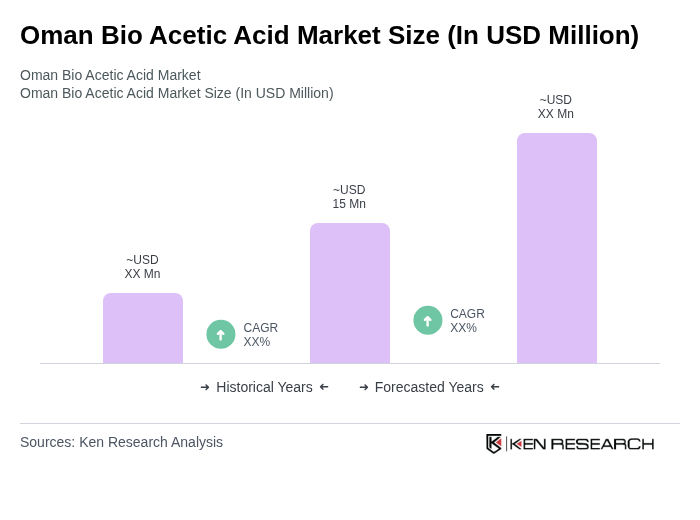

The Oman Bio Acetic Acid Market is valued at approximately USD 15 million, reflecting a growing trend towards bio-based chemicals as sustainable alternatives to fossil-based products. This market growth is influenced by increasing environmental awareness and demand for greener production methods.