Region:Middle East

Author(s):Shubham

Product Code:KRAA8678

Pages:99

Published On:November 2025

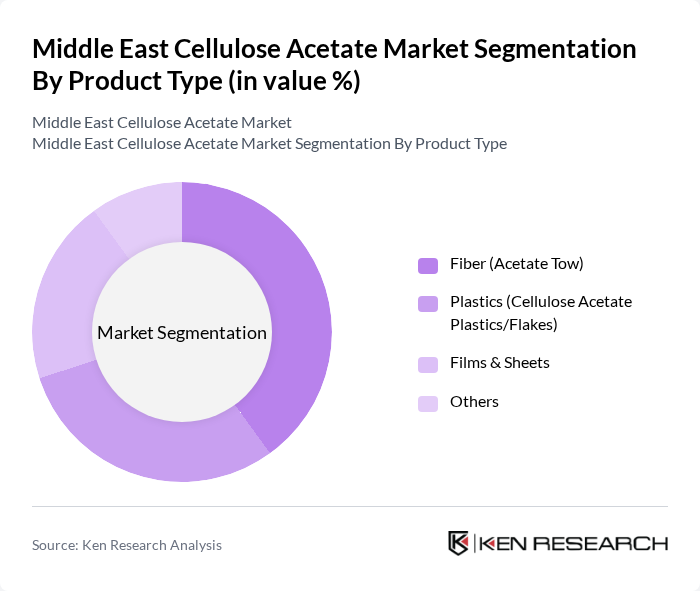

By Product Type:The cellulose acetate market can be segmented into various product types, including Fiber (Acetate Tow), Plastics (Cellulose Acetate Plastics/Flakes), Films & Sheets, and Others. Each of these subsegments plays a crucial role in meeting the diverse needs of industries ranging from textiles to packaging .

The Fiber (Acetate Tow) subsegment is currently dominating the market due to its extensive use in the production of cigarette filters, which are a significant application of cellulose acetate. The increasing consumption of tobacco products in the region, coupled with the growing trend towards more sustainable and biodegradable materials, has led to a surge in demand for acetate tow. This subsegment is favored for its excellent filtration properties and biodegradability, making it a preferred choice among manufacturers .

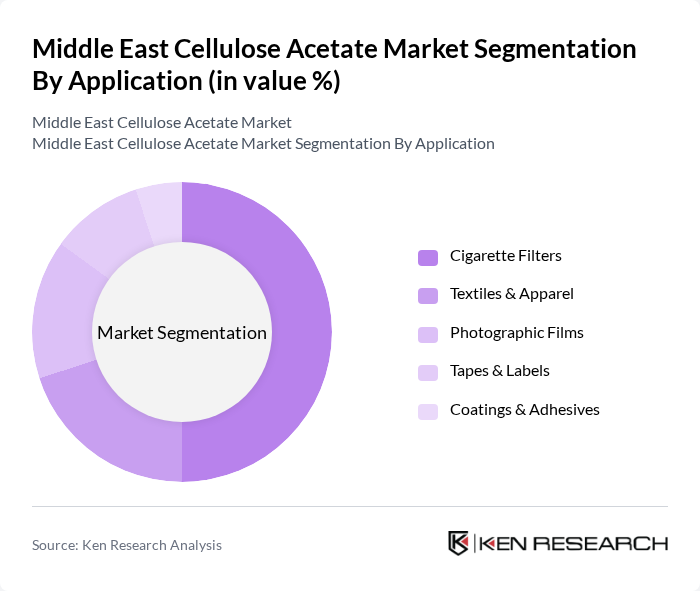

By Application:The cellulose acetate market can be segmented by application into Cigarette Filters, Textiles & Apparel, Photographic Films, Tapes & Labels, Coatings & Adhesives, and Others. Each application area showcases the versatility of cellulose acetate in various industries .

The Cigarette Filters application is the leading segment in the cellulose acetate market, accounting for a significant portion of the overall demand. This dominance is attributed to the high consumption of tobacco products in the region, where cellulose acetate is preferred for its effective filtration capabilities. Additionally, the increasing focus on reducing environmental impact has led to innovations in biodegradable filter options, further driving the growth of this application .

The Middle East Cellulose Acetate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Eastman Chemical Company, Celanese Corporation, Mitsubishi Chemical Group Corporation, Daicel Corporation, Sappi Limited, Rayonier Advanced Materials Inc. (RYAM), Cerdia International GmbH, Sichuan Push Acetati Co., Ltd., Rotuba Extruders, Inc., Fibrant B.V., Ahlstrom-Munksjö Oyj, Lenzing AG, Solvay S.A., Acetate Products Ltd., BASF SE contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Middle East cellulose acetate market appears promising, driven by increasing investments in sustainable technologies and a growing emphasis on eco-friendly products. As industries adapt to stringent environmental regulations, the demand for cellulose acetate is expected to rise, particularly in packaging and textiles. Furthermore, the ongoing development of innovative production techniques will likely enhance efficiency and reduce costs, positioning cellulose acetate as a viable alternative in various applications, thus fostering market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Fiber (Acetate Tow) Plastics (Cellulose Acetate Plastics/Flakes) Films & Sheets Others |

| By Application | Cigarette Filters Textiles & Apparel Photographic Films Tapes & Labels Coatings & Adhesives Others |

| By End-Use Industry | Packaging Automotive Electronics Healthcare Consumer Goods Industrial Applications Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Geography | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Bahrain, Oman) Levant Region (Jordan, Lebanon, Syria, Palestine, Iraq) North Africa (Egypt, Morocco, Algeria, Tunisia, Libya) Others (Rest of Middle East & Africa) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Textile Industry Applications | 100 | Textile Manufacturers, Product Development Managers |

| Packaging Sector Insights | 80 | Packaging Engineers, Supply Chain Managers |

| Automotive Component Usage | 60 | Procurement Managers, R&D Engineers |

| Consumer Goods Market | 90 | Brand Managers, Marketing Directors |

| Pharmaceutical Applications | 50 | Regulatory Affairs Specialists, Quality Control Managers |

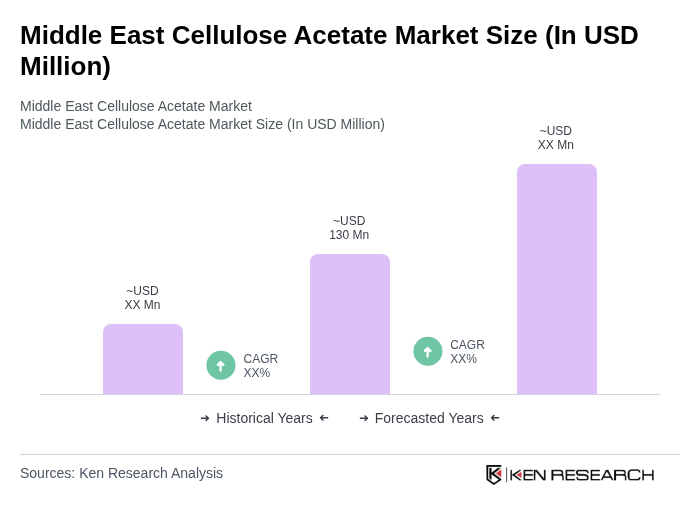

The Middle East Cellulose Acetate Market is valued at approximately USD 130 million, reflecting a five-year historical analysis. This valuation highlights the growing demand for cellulose acetate across various applications, including textiles, cigarette filters, and packaging.