Region:Middle East

Author(s):Dev

Product Code:KRAD5185

Pages:87

Published On:December 2025

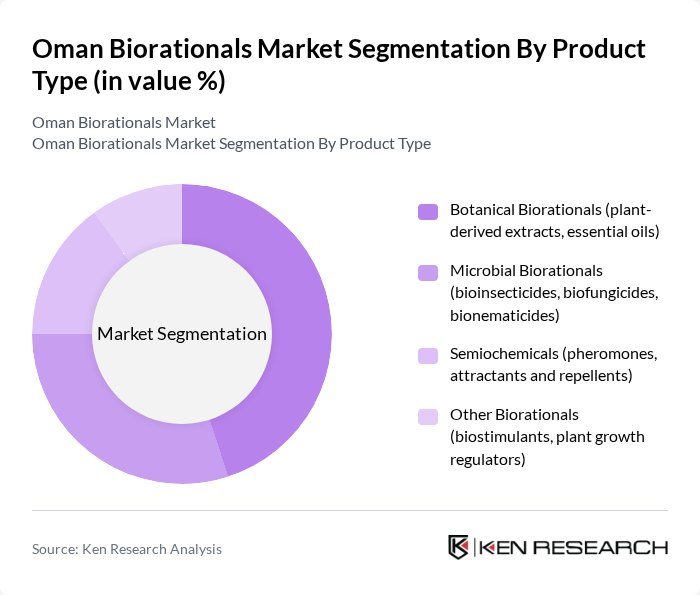

By Product Type:The market is segmented into various product types, including botanical biorationals, microbial biorationals, semiochemicals, and other biorationals. Among these, botanical biorationals, which include plant-derived extracts and essential oils, are gaining significant traction due to their natural origin and effectiveness in pest management. Microbial biorationals, such as bioinsecticides and biofungicides, are also increasingly popular as they offer targeted pest control with minimal environmental impact. The demand for semiochemicals, including pheromones, is rising as they provide innovative solutions for pest monitoring and control.

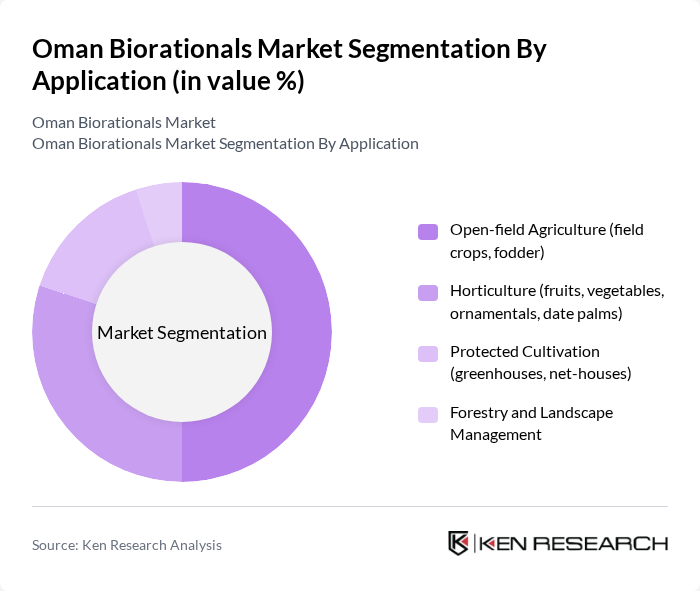

By Application:The application of biorationals spans several sectors, including open-field agriculture, horticulture, protected cultivation, and forestry. Open-field agriculture is the leading application area, driven by the need for sustainable pest management in large-scale farming. Horticulture, particularly for fruits and vegetables, is also a significant segment as consumers increasingly demand organic produce. Protected cultivation methods, such as greenhouses, are gaining popularity due to their ability to enhance crop yields while minimizing pest damage.

The Oman Biorationals Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Syngenta AG, Bayer AG, FMC Corporation, Corteva Agriscience, UPL Limited, Koppert Biological Systems, Certis Belchim B.V., Valent BioSciences LLC, Novozymes A/S, Omnia Holdings Limited (Omnia Nutriology), Al Ariq Group (Oman), Bahwan Agro (Suhail Bahwan Group, Oman), Gulf Biotech Company, Al Safwa Agricultural & Veterinary LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman biorationals market appears promising, driven by increasing government support and a shift towards sustainable agricultural practices. As consumer preferences continue to evolve towards organic products, the demand for biorational solutions is expected to rise. Additionally, advancements in technology and research will likely lead to the development of more effective biorational products, enhancing their appeal and accessibility in the agricultural sector, thus fostering market expansion.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Botanical Biorationals (plant-derived extracts, essential oils) Microbial Biorationals (bioinsecticides, biofungicides, bionematicides) Semiochemicals (pheromones, attractants and repellents) Other Biorationals (biostimulants, plant growth regulators) |

| By Application | Open-field Agriculture (field crops, fodder) Horticulture (fruits, vegetables, ornamentals, date palms) Protected Cultivation (greenhouses, net-houses) Forestry and Landscape Management |

| By Crop Type | Fruits and Vegetables (tomato, cucumber, capsicum, leafy greens) Cereals and Grains (wheat, barley, sorghum) Date Palm and Tree Crops Fodder and Forage Crops |

| By Distribution Channel | Direct Sales to Large Farms and Government Projects Agri-input Dealers and Cooperatives Specialized Horticulture & Greenhouse Suppliers Online and Digital Agri Platforms |

| By Application Method | Foliar Application / Foliar Spray Soil and Drip Irrigation Application Seed and Seedling Treatment Post-harvest and Storage Treatment |

| By Region | Muscat & Al Batinah Coastal Plains Dhofar (Salalah and surrounding areas) Al Dakhiliyah & Al Sharqiyah (interior oases, date-growing belts) Other Governorates (Al Wusta, Musandam, Al Buraimi, etc.) |

| By Policy & Support Mechanism | Subsidies for Organic and Bio-based Inputs Government-backed Extension & IPM Programs Research & Demonstration Grants for Biorationals Certification and Compliance Support for Organic Production |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Crop Protection Products | 100 | Agricultural Producers, Crop Consultants |

| Organic Fertilizers | 80 | Farmers, Agricultural Retailers |

| Biopesticides | 70 | Agrochemical Distributors, Environmental Scientists |

| Soil Amendments | 60 | Soil Health Experts, Agronomists |

| Integrated Pest Management Practices | 90 | Farm Managers, Agricultural Extension Officers |

The Oman Biorationals Market is valued at approximately USD 140 million, reflecting a significant growth trend driven by the increasing demand for sustainable agricultural practices and organic produce, as well as government initiatives promoting bio-based inputs.