Region:Central and South America

Author(s):Shubham

Product Code:KRAC0764

Pages:96

Published On:August 2025

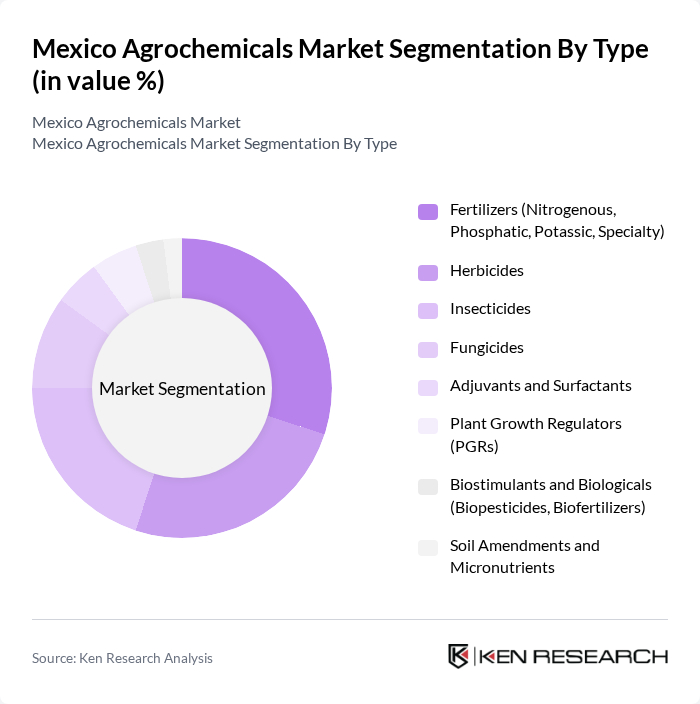

By Type:The agrochemicals market can be segmented into various types, including fertilizers, herbicides, insecticides, fungicides, adjuvants and surfactants, plant growth regulators (PGRs), biostimulants and biologicals, and soil amendments and micronutrients. Each of these subsegments plays a crucial role in enhancing agricultural productivity and addressing specific crop needs.

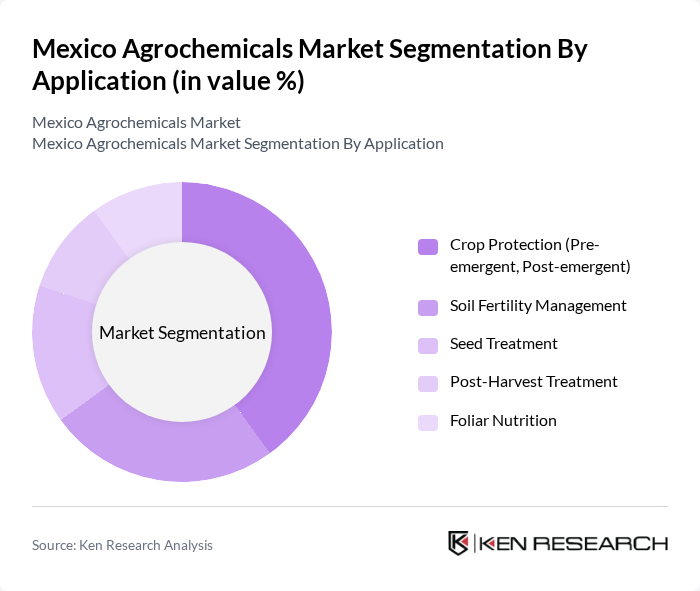

By Application:The applications of agrochemicals are diverse, including crop protection (both pre-emergent and post-emergent), soil fertility management, seed treatment, post-harvest treatment, and foliar nutrition. Each application serves a specific purpose in the agricultural process, ensuring optimal crop growth and yield, with crop protection and soil fertility remaining core use-cases among Mexican producers.

The Mexico Agrochemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bayer de México, S.A. de C.V. (Bayer CropScience), Syngenta México, S.A. de C.V., BASF Mexicana, S.A. de C.V., Corteva Agriscience México, S. de R.L. de C.V., FMC Agroquímica de México, S. de R.L. de C.V., ADAMA México, S.A. de C.V., Nufarm México, S.A. de C.V., UPL México, S.A. de C.V., Nutrien Ag Solutions México, S. de R.L. de C.V., Yara México, S.A. de C.V., Sumitomo Chemical México, S.A. de C.V., Rovensa Group (Tradecorp México / Oro Agri México), Helm de México, S.A. de C.V. (HELM AG), ICL Specialty Fertilizers México, S.A. de C.V., SQM México, S.A. de C.V. contribute to innovation, geographic expansion, and service delivery in this space.

The Mexico agrochemicals market is poised for transformation as it embraces sustainable practices and technological advancements. By 2024, the integration of digital farming solutions is expected to enhance operational efficiency, while the shift towards biopesticides and biofertilizers will cater to the growing demand for environmentally friendly products. Companies that adapt to these trends will likely gain a competitive edge, positioning themselves favorably in a rapidly evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Fertilizers (Nitrogenous, Phosphatic, Potassic, Specialty) Herbicides Insecticides Fungicides Adjuvants and Surfactants Plant Growth Regulators (PGRs) Biostimulants and Biologicals (Biopesticides, Biofertilizers) Soil Amendments and Micronutrients |

| By Application | Crop Protection (Pre-emergent, Post-emergent) Soil Fertility Management Seed Treatment Post-Harvest Treatment Foliar Nutrition |

| By End-User | Commercial Farmers and Agribusinesses Smallholder Farmers Agricultural Cooperatives and Producer Organizations Government and Extension Agencies |

| By Distribution Channel | Direct Sales to Large Growers Agri-Retailers and Farm Supply Stores Distributors/Wholesalers Online and Omni-channel Platforms |

| By Region | Northwest (Sinaloa, Sonora, Baja California) Northeast (Tamaulipas, Nuevo León, Coahuila) Bajío and West (Guanajuato, Jalisco, Michoacán) Central (Estado de México, Puebla, Hidalgo) South–Southeast (Veracruz, Chiapas, Oaxaca, Yucatán) |

| By Product Formulation | Liquid Formulations (EC, SC, SL) Solid Formulations (WG, WP, Granular) Controlled/Slow-Release and Encapsulated |

| By Price Range | Premium Products Mid-Range Products Budget Products |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corn Agrochemical Usage | 150 | Farmers, Agronomists, Crop Consultants |

| Cotton Pest Management Practices | 100 | Farm Managers, Agricultural Extension Workers |

| Fruit and Vegetable Agrochemical Applications | 80 | Horticulturists, Cooperative Leaders |

| Regulatory Compliance Insights | 60 | Regulatory Officials, Compliance Managers |

| Market Trends in Organic Agrochemicals | 70 | Organic Farmers, Sustainability Advocates |

The Mexico Agrochemicals Market is valued at approximately USD 4.5 billion, driven by the increasing demand for food production, advancements in agricultural technology, and the need for sustainable farming practices to enhance crop yields and quality.