Region:Middle East

Author(s):Shubham

Product Code:KRAD5453

Pages:84

Published On:December 2025

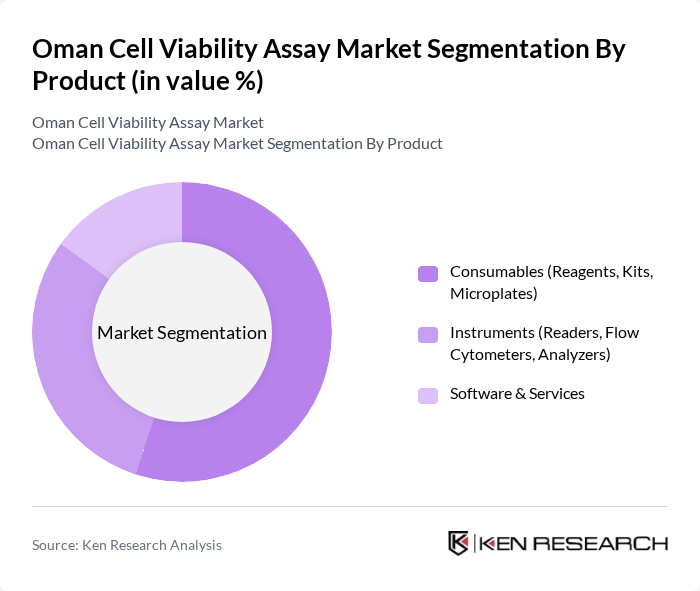

By Product:The product segmentation of the market includes consumables, instruments, and software & services. Among these, consumables, which encompass reagents, kits, and microplates, dominate the market due to their essential role in conducting assays. The increasing demand for high-quality reagents and kits in research and clinical settings drives this segment's growth. Instruments, including readers and flow cytometers, also play a significant role, but consumables are more frequently purchased, leading to their market leadership.

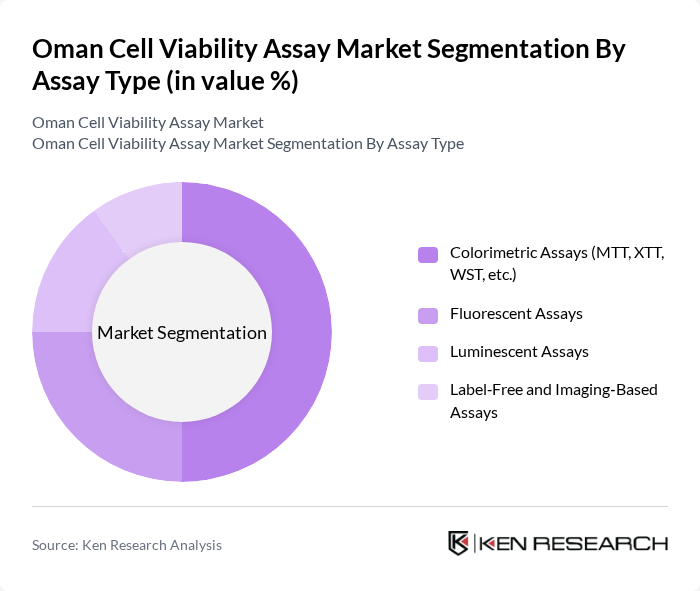

By Assay Type:The assay type segmentation includes colorimetric assays, fluorescent assays, luminescent assays, and label-free and imaging-based assays. Colorimetric assays, such as MTT and WST, dominate the market due to their widespread use in drug discovery and development. Their simplicity, cost-effectiveness, and reliability make them the preferred choice among researchers. Fluorescent assays are also gaining traction, but colorimetric assays remain the leading sub-segment due to their established protocols and ease of use.

The Oman Cell Viability Assay Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thermo Fisher Scientific Inc., Merck KGaA (including MilliporeSigma), Bio-Rad Laboratories, Inc., Promega Corporation, PerkinElmer, Inc. (Revvity), Abcam plc, BD Biosciences (Becton, Dickinson and Company), Agilent Technologies, Inc., Sartorius AG, Lonza Group AG, Canvax Biotech, Creative Bioarray, BioTek Instruments (Agilent), Enzo Life Sciences, Inc., Local Distributors in Oman (e.g., Scientific & Analytical Equipment Suppliers) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman cell viability assay market appears promising, driven by increasing investments in biotechnology and a growing focus on personalized medicine. As the healthcare landscape evolves, the integration of artificial intelligence and automation in laboratory settings is expected to enhance assay efficiency and accuracy. Furthermore, collaborations between academic institutions and industry players will likely foster innovation, leading to the development of novel assay technologies that cater to the specific needs of the Omani market.

| Segment | Sub-Segments |

|---|---|

| By Product | Consumables (Reagents, Kits, Microplates) Instruments (Readers, Flow Cytometers, Analyzers) Software & Services |

| By Assay Type | Colorimetric Assays (MTT, XTT, WST, etc.) Fluorescent Assays Luminescent Assays Label?Free and Imaging?Based Assays |

| By Application | Drug Discovery and Development Toxicity and Safety Testing Cancer and Stem Cell Research Clinical & Diagnostic Applications Other Research Applications |

| By Technology Platform | Flow Cytometry Microplate Readers High?Content Screening / Imaging Systems Automated Cell Counters Others |

| By End-User | Pharmaceutical & Biopharmaceutical Companies Biotechnology Firms Academic and Research Institutions Contract Research Organizations (CROs) Hospital & Clinical Laboratories Others |

| By Region | Muscat Salalah Sohar Duqm & Other Governorates |

| By Funding Source | Government & Public Sector Funding Private Sector Investments International Grants & Multilateral Agencies University & Institutional Research Budgets |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Biomedical Research Laboratories | 80 | Lab Managers, Research Scientists |

| Pharmaceutical Companies | 60 | Clinical Research Coordinators, Quality Control Managers |

| Academic Institutions | 50 | Professors, Graduate Researchers |

| Healthcare Providers | 40 | Pathologists, Laboratory Technicians |

| Biotechnology Firms | 70 | Product Development Managers, Regulatory Affairs Specialists |

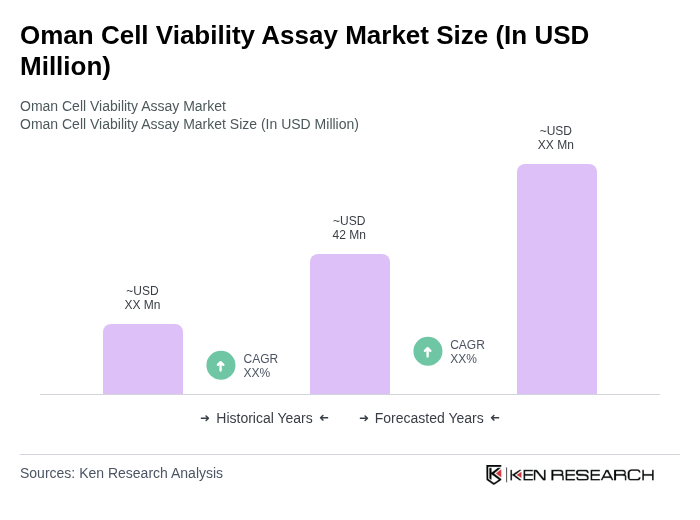

The Oman Cell Viability Assay Market is valued at approximately USD 42 million, reflecting a five-year historical analysis. This growth is attributed to the rising prevalence of chronic diseases and increased investments in biotechnology and pharmaceutical research.