Region:Middle East

Author(s):Rebecca

Product Code:KRAE0865

Pages:83

Published On:December 2025

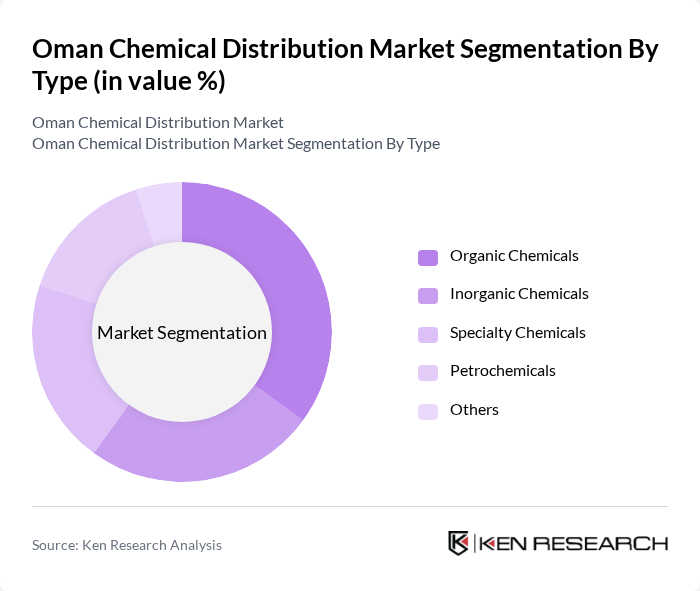

By Type:The chemical distribution market in Oman is segmented into various types, including organic chemicals, inorganic chemicals, specialty chemicals, petrochemicals, and others. Among these, organic chemicals are currently dominating the market due to their extensive applications in industries such as agriculture, pharmaceuticals, and manufacturing. The increasing demand for eco-friendly products and sustainable practices is further driving the growth of organic chemicals, making them a preferred choice for many businesses.

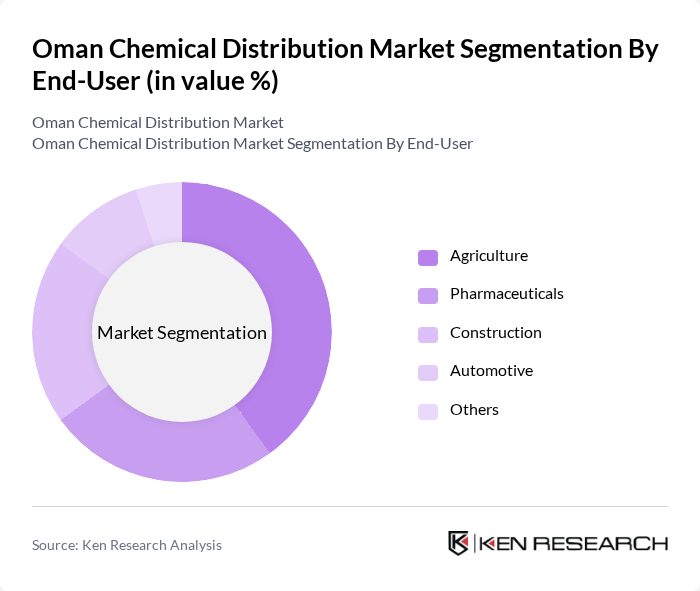

By End-User:The end-user segmentation of the chemical distribution market includes agriculture, pharmaceuticals, construction, automotive, and others. The agriculture sector is the leading end-user, driven by the increasing need for fertilizers and pesticides to enhance crop yield. The growing population and the demand for food security are propelling the agricultural sector's growth, thereby increasing the demand for chemical distribution services tailored to this industry.

The Oman Chemical Distribution Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Oil Marketing Company, Gulf Chemicals and Industrial Oils, Al Jazeera Chemical Products, Oman Chemical Company, National Chemical Company, Muscat Chemicals, Al-Futtaim Group, Oman Cables Industry, Oman Chlorine, Gulf Petrochemicals and Chemicals Association, Oman Methanol Company, Oman Oil Refineries and Petroleum Industries Company, Sohar International Urea and Chemical Industries, Oman Polypropylene Company, Oman Fertilizer Company contribute to innovation, geographic expansion, and service delivery in this space.

The Oman chemical distribution market is poised for significant transformation, driven by a shift towards sustainable practices and digitalization. As companies increasingly adopt eco-friendly chemicals, the market is expected to see a rise in demand for innovative solutions. Additionally, the integration of digital technologies in distribution processes will enhance efficiency and transparency. In future, these trends are likely to reshape the competitive landscape, fostering collaboration between local distributors and global players to meet evolving market needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Organic Chemicals Inorganic Chemicals Specialty Chemicals Petrochemicals Others |

| By End-User | Agriculture Pharmaceuticals Construction Automotive Others |

| By Application | Coatings Adhesives Plastics Textiles Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Geography | Muscat Salalah Sohar Nizwa Others |

| By Product Form | Liquid Solid Gas Others |

| By Regulatory Compliance | ISO Standards REACH Compliance Local Regulations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Chemical Distributors | 100 | Distribution Managers, Sales Directors |

| Agricultural Chemical Suppliers | 80 | Procurement Managers, Product Managers |

| Construction Chemicals Market | 70 | Project Managers, Supply Chain Coordinators |

| Specialty Chemicals for Manufacturing | 60 | Operations Managers, Quality Assurance Heads |

| Regulatory Compliance in Chemical Distribution | 50 | Compliance Officers, Regulatory Affairs Managers |

The Oman Chemical Distribution Market is valued at approximately USD 1.1 billion, reflecting a five-year historical analysis. This valuation highlights the market's growth driven by advancements in digital inventory systems and a focus on sustainability.