Region:Middle East

Author(s):Geetanshi

Product Code:KRAE5871

Pages:82

Published On:December 2025

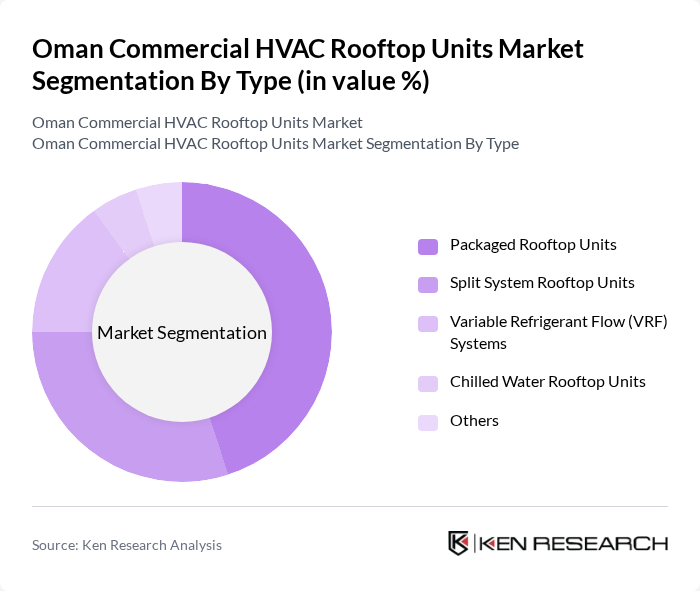

By Type:The market is segmented into various types of rooftop units, including packaged rooftop units, split system rooftop units, variable refrigerant flow (VRF) systems, chilled water rooftop units, and others. In line with global and regional rooftop markets, packaged rooftop units are the most widely deployed in commercial buildings because they integrate all major components in a single weatherproof housing, offer straightforward installation on building roofs, and free up rentable indoor space. Their compact design and factory-assembled configuration make them suitable for retail, small to medium offices, restaurants, and low-rise mixed-use buildings. Split system rooftop-based configurations are also gaining traction, particularly in larger commercial spaces, malls, and institutional buildings where zoning, individual control of different areas, and flexibility in indoor unit placement are essential. VRF-based rooftop and modular systems see increasing use where precise load matching, part-load efficiency, and simultaneous heating and cooling are prioritized, while chilled water rooftop units are typically applied in complexes that already utilize central chilled water plants.

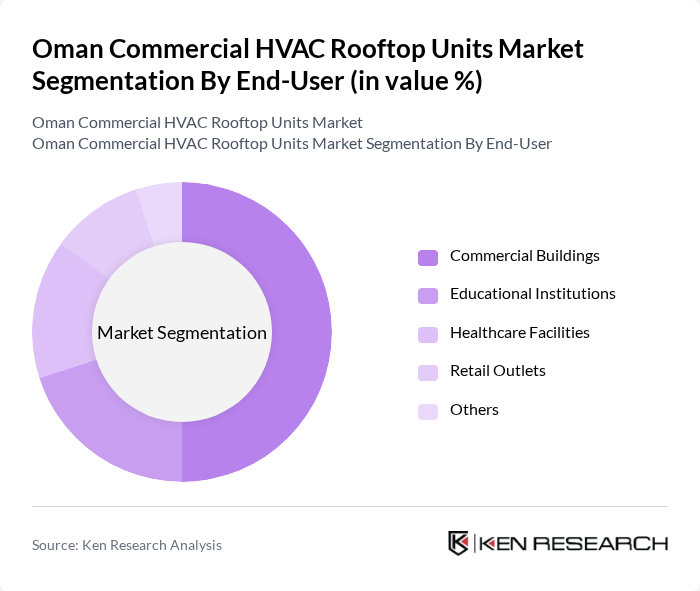

By End-User:The end-user segment includes commercial buildings, educational institutions, healthcare facilities, retail outlets, and others. Commercial buildings are the leading end-user segment, supported by the expansion of office space, hospitality assets, mixed-use developments, and business parks, which commonly specify rooftop units for ease of installation and maintenance. Educational institutions and healthcare facilities also represent significant demand due to their requirement for dependable climate control, indoor air quality management, and adherence to ventilation and comfort standards, particularly in classrooms, patient areas, and diagnostic zones. Retail outlets, including malls, hypermarkets, and high-street stores, increasingly favor rooftop units to optimize floor space and achieve better control over operating costs, while the others segment includes light industrial facilities, warehouses, and public buildings that rely on rooftop units for space-efficient cooling and heating solutions.

The Oman Commercial HVAC Rooftop Units Market is characterized by a dynamic mix of regional and international players. Leading participants such as Daikin Middle East and Africa, Trane Technologies, Carrier Global Corporation, Johnson Controls International, LG Electronics, Mitsubishi Electric, York International, Gree Electric Appliances, Fujitsu General, Rheem Manufacturing Company, Lennox International, Bosch Thermotechnology, Panasonic Corporation, Hitachi Ltd., Samsung Electronics contribute to innovation, geographic expansion, and service delivery in this space.

The Oman Commercial HVAC Rooftop Units Market is poised for significant growth as urbanization accelerates and energy efficiency becomes a priority. In future, the integration of smart technologies and IoT-enabled systems is expected to reshape the market landscape, enhancing operational efficiency. Additionally, the increasing focus on indoor air quality will drive demand for advanced HVAC solutions. As businesses seek to comply with sustainability regulations, the market will likely see a surge in retrofitting existing buildings with modern HVAC systems, further expanding opportunities for growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Packaged Rooftop Units Split System Rooftop Units Variable Refrigerant Flow (VRF) Systems Chilled Water Rooftop Units Others |

| By End-User | Commercial Buildings Educational Institutions Healthcare Facilities Retail Outlets Others |

| By Application | New Construction Projects Renovation Projects Maintenance and Replacement Others |

| By Energy Source | Electric Gas Hybrid Systems Others |

| By Size | Small Units Medium Units Large Units Others |

| By Installation Type | Rooftop Installation Ground Installation Others |

| By Maintenance Type | Preventive Maintenance Corrective Maintenance Predictive Maintenance Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Office Buildings | 100 | Facility Managers, Building Owners |

| Retail Outlets | 80 | Store Managers, Operations Directors |

| Hospitality Sector | 70 | Hotel Managers, Maintenance Supervisors |

| Industrial Facilities | 60 | Plant Managers, Engineering Heads |

| Healthcare Institutions | 50 | Facility Directors, HVAC Technicians |

The Oman Commercial HVAC Rooftop Units Market is valued at approximately USD 12 million, reflecting its significance within the broader Oman HVAC and air-conditioning markets, driven by urbanization and construction activities.