Region:Middle East

Author(s):Shubham

Product Code:KRAC3526

Pages:91

Published On:October 2025

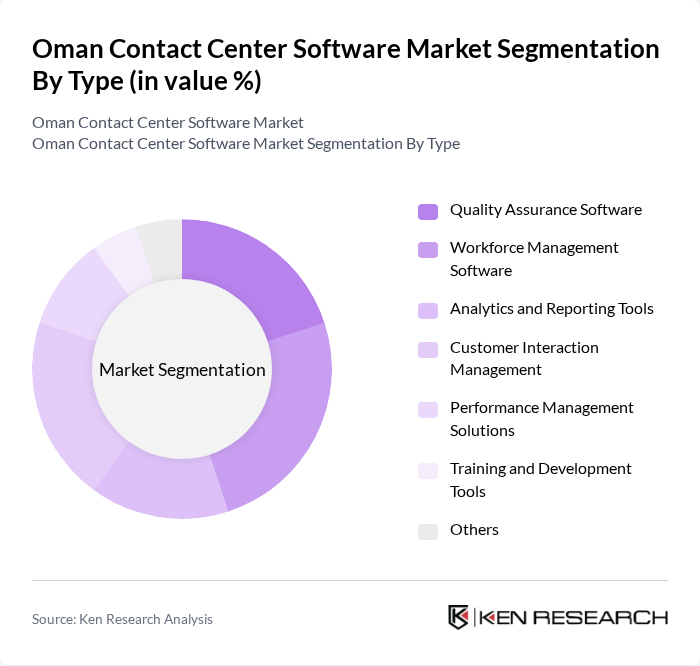

By Type:The market is segmented into various types of software solutions that cater to different operational needs within contact centers. The subsegments include Quality Assurance Software, Workforce Management Software, Analytics and Reporting Tools, Customer Interaction Management, Performance Management Solutions, Training and Development Tools, and Others. Each of these subsegments plays a crucial role in enhancing the efficiency and effectiveness of contact center operations.

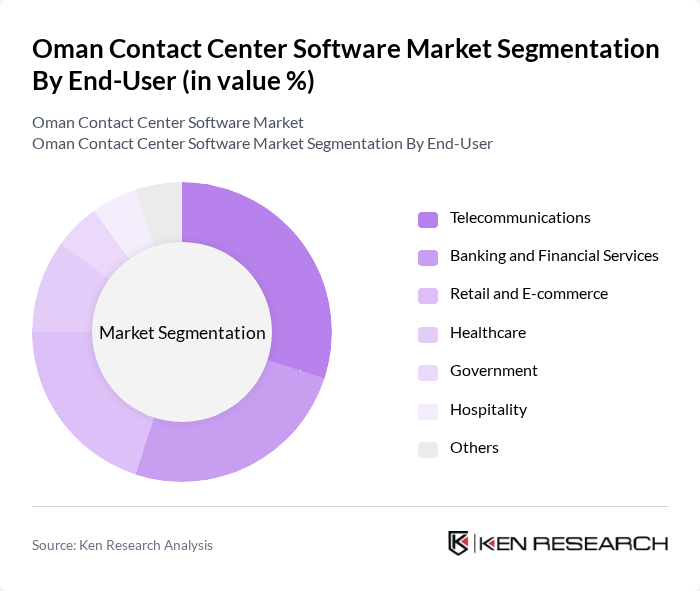

By End-User:The contact center software market is also segmented by end-user industries, which include Telecommunications, Banking and Financial Services, Retail and E-commerce, Healthcare, Government, Hospitality, and Others. Each sector has unique requirements and challenges that drive the adoption of specific contact center solutions tailored to their operational needs.

The Oman Contact Center Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Avaya Inc., Cisco Systems, Inc., Genesys Telecommunications Laboratories, Inc., NICE Ltd., Five9, Inc., Talkdesk, Inc., RingCentral, Inc., 8x8, Inc., Zendesk, Inc., Freshworks Inc., Aspect Software, Inc., Mitel Networks Corporation, Verint Systems Inc., SAP SE, Oracle Corporation, CallMiner, Inc., InContact, Inc. (NICE inContact), CloudTalk.io, SS&C Technologies Holdings, Inc., NewVoiceMedia Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The Oman contact center software market is poised for significant evolution, driven by technological advancements and changing consumer expectations. As businesses increasingly adopt AI and automation, the demand for sophisticated software solutions will rise. Additionally, the integration of omnichannel communication strategies will enhance customer interactions. With government initiatives supporting digital transformation, the market is expected to witness robust growth, fostering innovation and improved service delivery across various sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Quality Assurance Software Workforce Management Software Analytics and Reporting Tools Customer Interaction Management Performance Management Solutions Training and Development Tools Others |

| By End-User | Telecommunications Banking and Financial Services Retail and E-commerce Healthcare Government Hospitality Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud On-Premises |

| By Application | Customer Support Sales and Marketing Technical Support Back Office Operations |

| By Industry Vertical | IT and Software Manufacturing Education Transportation and Logistics |

| By Service Type | Managed Services Professional Services Consulting Services |

| By Pricing Model | Subscription-Based Pay-As-You-Go One-Time License Fee Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector Contact Centers | 45 | Customer Service Managers, IT Directors |

| Telecommunications Customer Support | 40 | Operations Managers, Technical Support Leads |

| Retail Industry Help Desks | 40 | Customer Experience Managers, IT Support Staff |

| Healthcare Call Centers | 40 | Patient Services Coordinators, IT Administrators |

| Government Service Hotlines | 35 | Public Relations Officers, IT Managers |

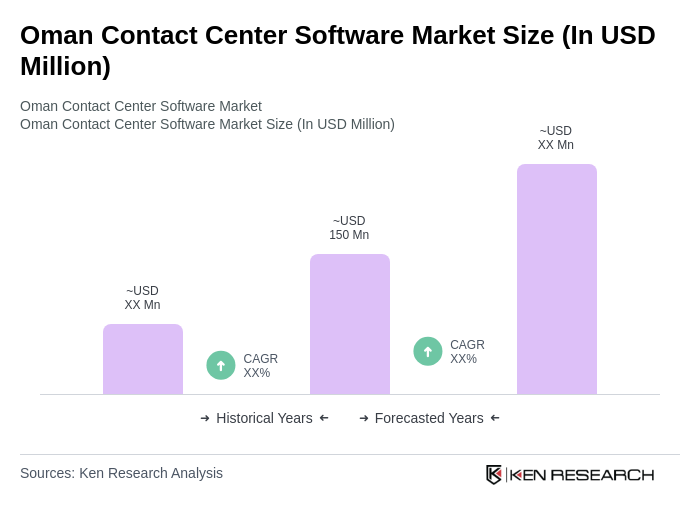

The Oman Contact Center Software Market is valued at approximately USD 150 million, reflecting a significant growth driven by the demand for enhanced customer service solutions and the adoption of cloud-based technologies among businesses in Oman.