Region:Global

Author(s):Shubham

Product Code:KRAA3134

Pages:91

Published On:August 2025

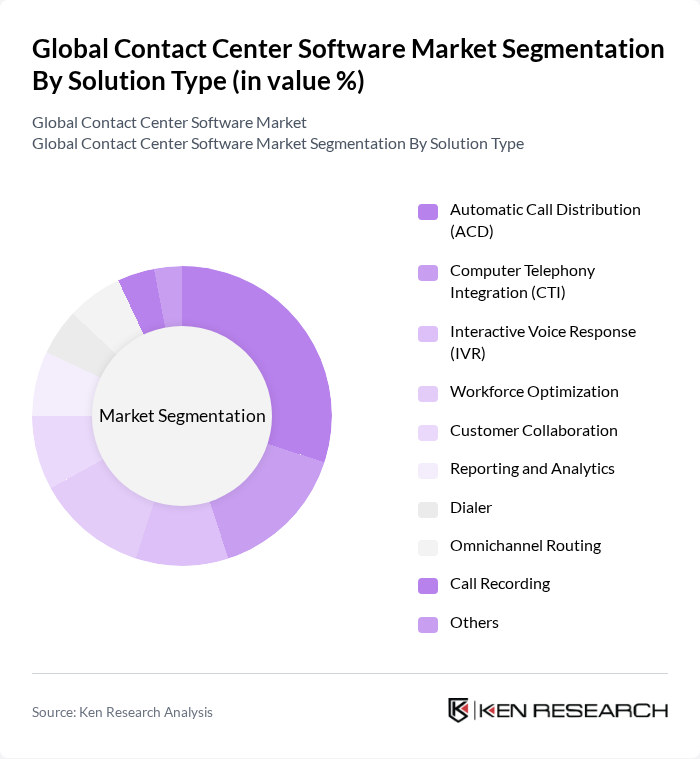

By Solution Type:The solution type segmentation includes various subsegments such as Automatic Call Distribution (ACD), Computer Telephony Integration (CTI), Interactive Voice Response (IVR), Workforce Optimization, Customer Collaboration, Reporting and Analytics, Dialer, Omnichannel Routing, Call Recording, and Others. Among these,Automatic Call Distribution (ACD)remains the leading subsegment, as it efficiently manages incoming calls and routes them to the appropriate agents, enhancing customer satisfaction and operational efficiency. The growing emphasis on customer experience, the integration of AI for intelligent routing, and the need for effective call management systems are driving the demand for ACD solutions .

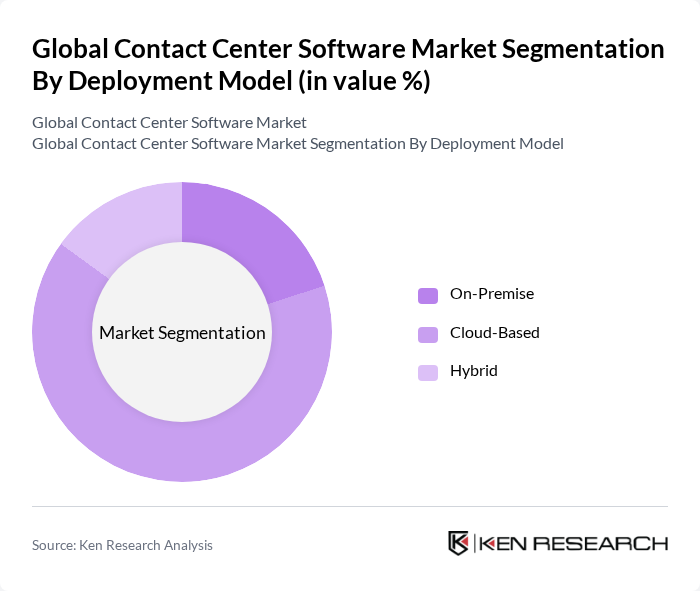

By Deployment Model:The deployment model segmentation includes On-Premise, Cloud-Based, and Hybrid solutions. TheCloud-Basedmodel is currently dominating the market due to its scalability, cost-effectiveness, rapid deployment, and seamless integration with existing systems. Businesses are increasingly opting for cloud solutions to enhance flexibility, support remote workforces, and reduce operational costs, which is driving the growth of this segment .

The Global Contact Center Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Salesforce, Inc., Genesys Telecommunications Laboratories, Inc., Cisco Systems, Inc., Avaya LLC, NICE Ltd., Five9, Inc., Zendesk, Inc., Talkdesk, Inc., RingCentral, Inc., 8x8, Inc., Freshworks Inc., Mitel Networks Corporation, Alvaria, Inc. (formerly Aspect Software), Verint Systems Inc., TTEC Holdings, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the contact center software market is poised for significant transformation, driven by technological advancements and evolving consumer expectations. As organizations increasingly prioritize customer experience, the integration of AI and machine learning will enhance service delivery. Furthermore, the shift towards omnichannel support will enable businesses to engage customers across various platforms seamlessly. This evolution will likely lead to increased investments in innovative solutions, fostering a competitive landscape that prioritizes efficiency and customer satisfaction.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Automatic Call Distribution (ACD) Computer Telephony Integration (CTI) Interactive Voice Response (IVR) Workforce Optimization Customer Collaboration Reporting and Analytics Dialer Omnichannel Routing Call Recording Others |

| By Deployment Model | On-Premise Cloud-Based Hybrid |

| By Service | Professional Services Managed Services |

| By End-User Industry | IT and Telecommunication BFSI (Banking, Financial Services, and Insurance) Healthcare Retail and Consumer Goods Government and Public Sector Media and Entertainment Education Travel and Hospitality Others |

| By Organization Size | Large Enterprises Small and Mid-sized Enterprises (SMEs) |

| By Customer Interaction Channel | Voice Chat Social Media Video SMS |

| By Geography | North America Europe Asia Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Contact Center Solutions | 120 | IT Managers, Customer Experience Directors |

| SMB Contact Center Software | 90 | Small Business Owners, Operations Managers |

| Cloud-based Contact Center Adoption | 60 | Cloud Solutions Architects, IT Directors |

| Omni-channel Customer Support | 50 | Customer Service Managers, Marketing Directors |

| AI-driven Contact Center Technologies | 55 | Product Managers, Technology Specialists |

The Global Contact Center Software Market is valued at approximately USD 52 billion, reflecting significant growth driven by the demand for customer engagement solutions and the integration of advanced technologies like AI and automation in contact center operations.