Middle East Contact Center Software Market Overview

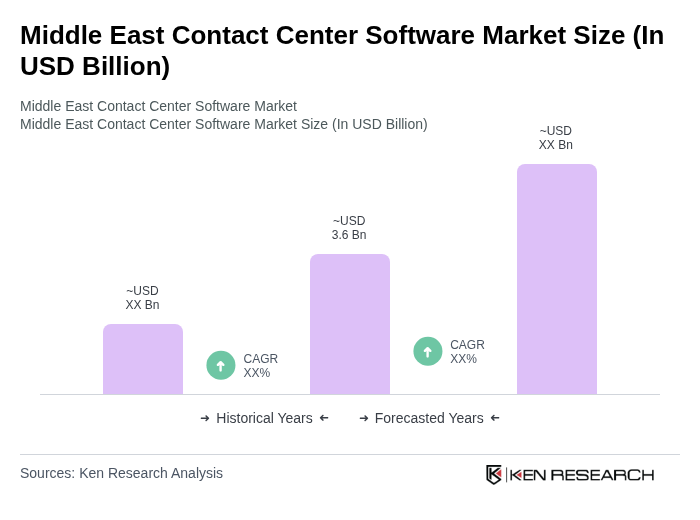

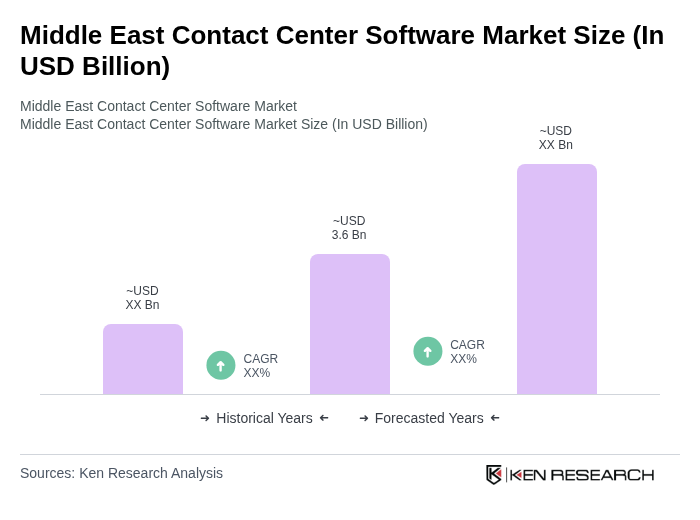

- The Middle East Contact Center Software Market is valued at USD 3.6 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for customer engagement solutions, the rapid adoption of cloud-based and AI-powered platforms, and the need for enhanced customer service experiences across banking, telecom, and retail sectors. The surge in remote work, digital transformation initiatives, and the integration of advanced self-service and omnichannel capabilities are also accelerating market expansion .

- Countries such as the United Arab Emirates and Saudi Arabia dominate the market due to their advanced telecommunications infrastructure, high internet penetration rates, and a strong focus on customer service excellence. These nations are investing heavily in technology to improve customer interactions, making them key players in the contact center software landscape. The UAE, in particular, is recognized for its robust digital infrastructure and multilingual workforce, while Saudi Arabia’s Vision 2030 is driving digital transformation and technology adoption across industries .

- The UAE Cabinet Resolution No. 58 of 2022, issued by the United Arab Emirates Cabinet, mandates that all customer service centers in key sectors must implement advanced digital and software solutions to enhance service quality, customer satisfaction, and operational efficiency. This regulation requires compliance with specific digital transformation standards, including the adoption of AI-powered and omnichannel platforms, and is enforced through periodic audits and licensing requirements for customer service operations .

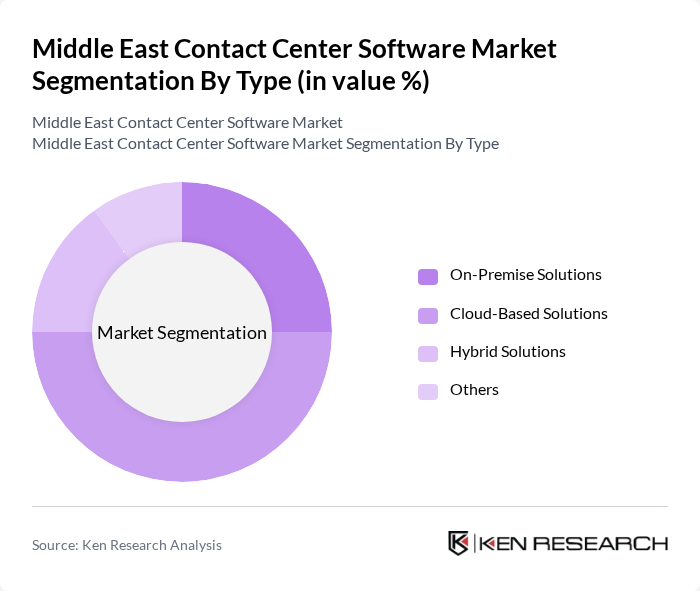

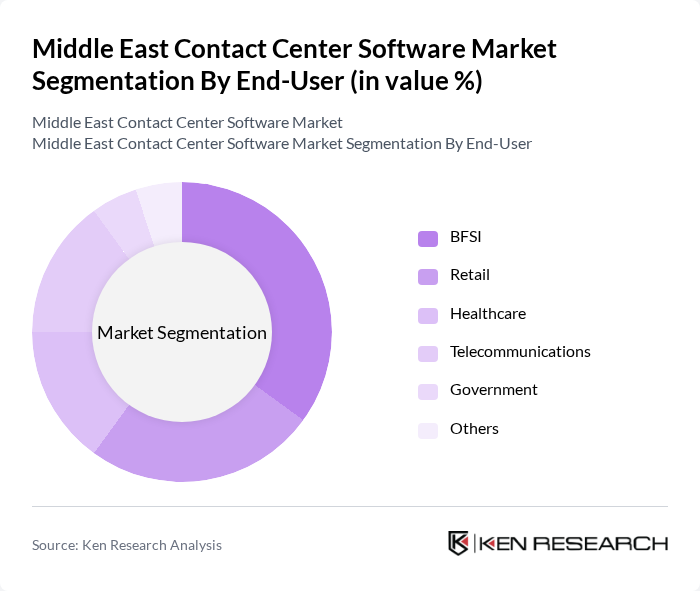

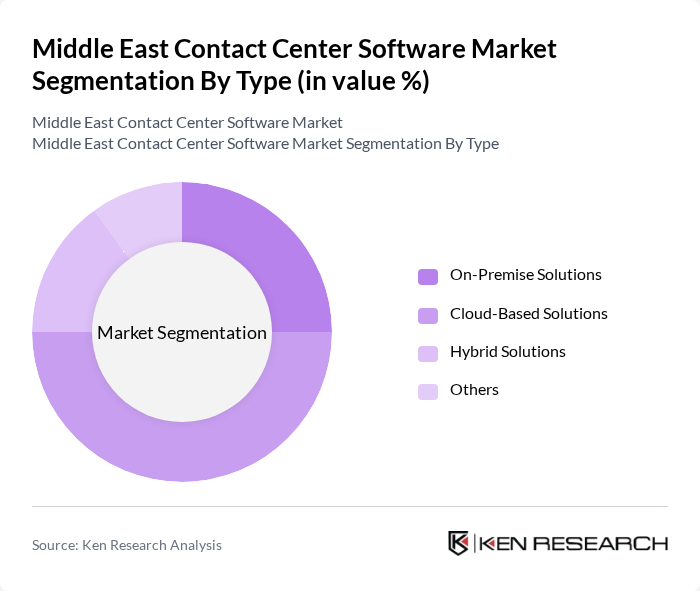

Middle East Contact Center Software Market Segmentation

By Type:The market is segmented into On-Premise Solutions, Cloud-Based Solutions, Hybrid Solutions, and Others. Among these, Cloud-Based Solutions are gaining significant traction due to their scalability, cost-effectiveness, and ease of integration with existing systems. Businesses are increasingly opting for cloud solutions to enhance operational efficiency, enable remote work, and leverage advanced analytics and AI-driven automation for better customer service .

By End-User:The end-user segmentation includes BFSI, Retail, Healthcare, Telecommunications, Government, and Others. The BFSI sector is the leading end-user, driven by the need for efficient customer service, regulatory compliance, and secure digital interactions. Financial institutions are increasingly adopting contact center software to enhance customer engagement, automate routine queries, and streamline operations. Retail and telecommunications sectors are also rapidly expanding their adoption to support omnichannel customer journeys and real-time analytics .

Middle East Contact Center Software Market Competitive Landscape

The Middle East Contact Center Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Avaya, Cisco Systems, Inc., Genesys, NICE Systems, Five9, Talkdesk, RingCentral, 8x8, Zendesk, Freshdesk, Aspect Software, SAP, Oracle, Microsoft, Salesforce, Teleperformance SE, Concentrix Corporation, Fusion BPO Services, Cupola Teleservices Ltd, Call Center Solutions Dubai, CsMena, Call Center Solutions LLC, Twilio Inc., Vonage, Orange Business, Silah Gulf, Bevatel, Kalaam Telecom contribute to innovation, geographic expansion, and service delivery in this space .

Middle East Contact Center Software Market Industry Analysis

Growth Drivers

- Increasing Demand for Customer Engagement Solutions:The Middle East's customer engagement solutions market is projected to reach $1.5 billion in future, driven by a growing emphasis on enhancing customer experiences. With 78% of businesses prioritizing customer satisfaction, the demand for effective contact center software is surging. This trend is supported by the region's increasing internet penetration, which stood at approximately 78% in future, facilitating more interactions through digital channels and necessitating robust engagement tools.

- Rise in Digital Transformation Initiatives:In future, the Middle East is expected to invest approximately $36 billion in digital transformation initiatives, reflecting a significant increase from previous periods. This investment is crucial for businesses aiming to modernize operations and improve service delivery. As organizations adopt advanced technologies, the need for sophisticated contact center software that integrates seamlessly with digital platforms becomes essential, driving market growth significantly.

- Expansion of E-commerce and Online Services:The e-commerce sector in the Middle East is projected to grow to $37 billion in future, up from $20 billion in previous periods. This rapid expansion is fueled by changing consumer behaviors and increased online shopping. Consequently, businesses are investing in contact center software to manage customer inquiries effectively, ensuring timely support and enhancing overall customer satisfaction, which is vital for retaining competitive advantage in the booming online marketplace.

Market Challenges

- High Initial Investment Costs:The initial investment for implementing advanced contact center software can exceed $500,000 for medium-sized enterprises in the Middle East. This significant financial barrier often deters businesses from upgrading their systems. Additionally, ongoing maintenance and operational costs can further strain budgets, particularly for smaller companies, limiting their ability to compete effectively in a rapidly evolving market landscape.

- Data Privacy and Security Concerns:With the implementation of stringent data protection regulations, such as the UAE's Data Protection Law, businesses face challenges in ensuring compliance. In future, 60% of companies in the region reported concerns regarding data breaches, which can lead to substantial financial penalties and reputational damage. This apprehension can hinder the adoption of new contact center technologies, as organizations prioritize security over innovation.

Middle East Contact Center Software Market Future Outlook

The Middle East contact center software market is poised for significant evolution, driven by technological advancements and changing consumer expectations. As businesses increasingly adopt AI-driven solutions, the integration of analytics will enhance operational efficiency and customer insights. Furthermore, the shift towards remote work is likely to persist, prompting companies to invest in flexible, cloud-based contact center solutions that support a distributed workforce while maintaining high service standards and customer satisfaction.

Market Opportunities

- Growth in Cloud-Based Solutions:The cloud-based contact center software market is expected to grow by 25% annually, driven by the increasing demand for scalable and cost-effective solutions. This trend allows businesses to enhance operational flexibility and reduce infrastructure costs, making it an attractive option for companies looking to optimize their customer service capabilities.

- Increasing Focus on Omnichannel Support:As customer preferences evolve, the demand for omnichannel support is rising, with 75% of consumers expecting seamless interactions across various platforms. This shift presents a significant opportunity for contact center software providers to develop integrated solutions that enhance customer experiences, thereby driving market growth and fostering customer loyalty.