Region:Middle East

Author(s):Rebecca

Product Code:KRAB7348

Pages:90

Published On:October 2025

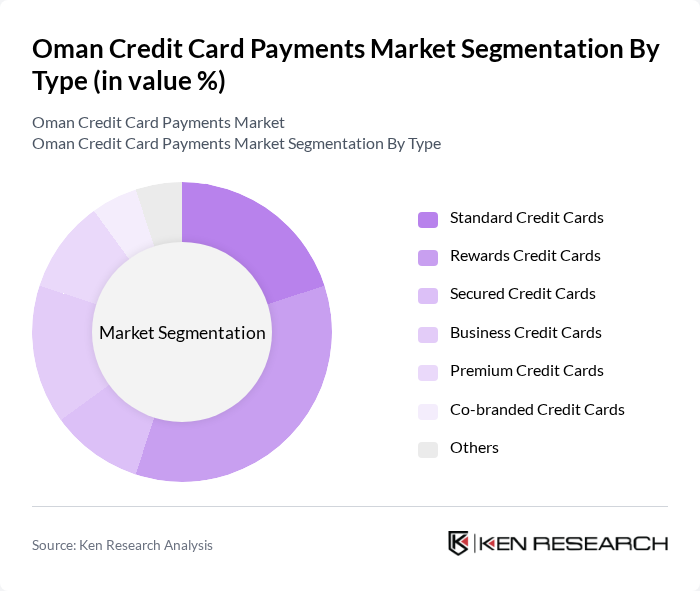

By Type:The segmentation by type includes various categories of credit cards that cater to different consumer needs and preferences. The subsegments are Standard Credit Cards, Rewards Credit Cards, Secured Credit Cards, Business Credit Cards, Premium Credit Cards, Co-branded Credit Cards, and Others. Among these, Rewards Credit Cards are particularly popular due to their attractive benefits and cashback offers, appealing to consumers who frequently use their cards for purchases.

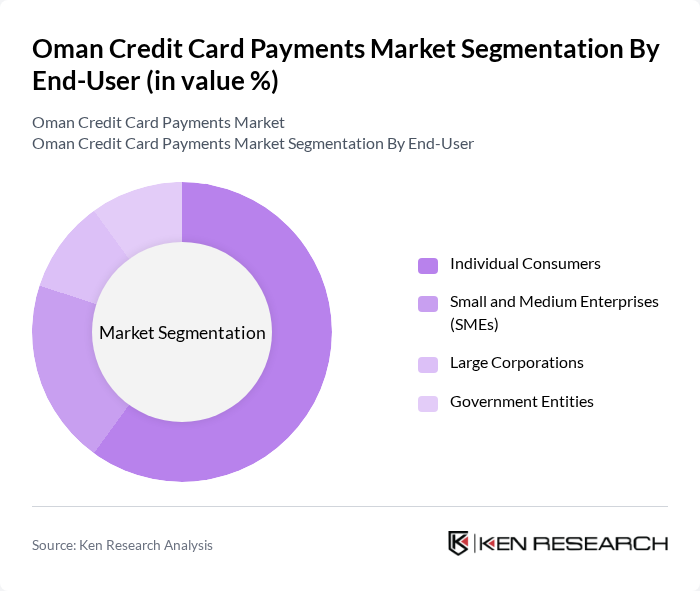

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Individual Consumers dominate the market, driven by the increasing trend of personal credit usage for everyday purchases and online shopping. SMEs are also increasingly adopting credit cards to manage cash flow and expenses, but the individual consumer segment remains the largest due to the sheer volume of transactions.

The Oman Credit Card Payments Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bank Muscat, Oman Arab Bank, National Bank of Oman, Dhofar Bank, Bank Sohar, Oman International Bank, HSBC Oman, Standard Chartered Bank Oman, Alizz Islamic Bank, Muscat Bank, Qatar National Bank Oman, Abu Dhabi Commercial Bank Oman, Emirates NBD Oman, Bank of Beirut and the Arab Countries, Oman Investment and Finance Company contribute to innovation, geographic expansion, and service delivery in this space.

The Oman credit card payments market is poised for transformative growth, driven by technological advancements and changing consumer behaviors. The increasing integration of mobile wallets and contactless payment solutions is expected to enhance user convenience. Additionally, the rise of fintech innovations will likely address security concerns, fostering greater trust in digital transactions. As the government continues to support cashless initiatives, the market is set to evolve, creating a more inclusive and efficient payment ecosystem for consumers and businesses alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Standard Credit Cards Rewards Credit Cards Secured Credit Cards Business Credit Cards Premium Credit Cards Co-branded Credit Cards Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Application | Online Shopping In-store Purchases Bill Payments Travel and Entertainment |

| By Distribution Channel | Banks Financial Institutions Online Platforms Retail Outlets |

| By Customer Segment | Millennials Gen X Baby Boomers High Net Worth Individuals |

| By Payment Method | Contactless Payments Chip and PIN Transactions Mobile Payments Online Payment Gateways |

| By Policy Support | Government Subsidies for Digital Payments Tax Incentives for Credit Card Usage Consumer Protection Policies Financial Literacy Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Credit Card Usage | 150 | General Consumers, Young Professionals |

| SME Payment Processing | 100 | Business Owners, Financial Managers |

| Banking Sector Insights | 80 | Bank Executives, Product Development Teams |

| Consumer Satisfaction and Preferences | 120 | Frequent Credit Card Users, Loyalty Program Members |

| Market Trends and Innovations | 70 | Payment Technology Experts, Financial Analysts |

The Oman Credit Card Payments Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of digital payment solutions, increased consumer spending, and the expansion of e-commerce platforms.