Region:Middle East

Author(s):Dev

Product Code:KRAB7250

Pages:99

Published On:October 2025

By Type:The market is segmented into various types of credit cards, including Standard Credit Cards, Rewards Credit Cards, Secured Credit Cards, Business Credit Cards, Premium Credit Cards, Co-branded Credit Cards, and Others. Among these, Rewards Credit Cards are particularly popular due to their attractive benefits and cashback offers, appealing to consumers who frequently use credit for purchases.

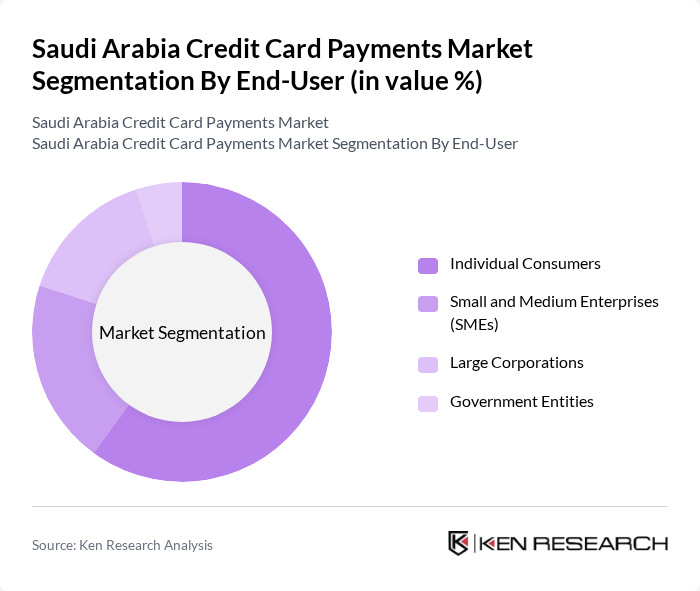

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Individual Consumers dominate the market, driven by the increasing trend of personal credit usage and the growing number of young professionals seeking credit options for everyday purchases.

The Saudi Arabia Credit Card Payments Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi National Bank, Al Rajhi Bank, Riyad Bank, Samba Financial Group, Arab National Bank, Banque Saudi Fransi, National Commercial Bank, Alinma Bank, Gulf International Bank, Saudi Investment Bank, Bank Albilad, Bank of Jordan, Emirates NBD, Qatar National Bank, Abu Dhabi Commercial Bank contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia credit card payments market appears promising, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence in fraud detection is expected to enhance security, fostering greater consumer trust. Additionally, the ongoing expansion of mobile payment solutions will likely facilitate seamless transactions, further driving credit card adoption. As the government continues to support cashless initiatives, the market is poised for significant growth, aligning with the broader economic goals of Vision 2030.

| Segment | Sub-Segments |

|---|---|

| By Type | Standard Credit Cards Rewards Credit Cards Secured Credit Cards Business Credit Cards Premium Credit Cards Co-branded Credit Cards Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Application | Online Shopping In-store Purchases Bill Payments Travel and Entertainment |

| By Distribution Channel | Banks Financial Institutions Online Platforms Retail Outlets |

| By Pricing Strategy | Fixed Annual Fees No Annual Fees Tiered Pricing |

| By Customer Segment | High-Income Individuals Middle-Income Individuals Students |

| By Payment Method | Contactless Payments Chip and PIN Transactions Mobile Wallet Integration |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Credit Card Usage | 150 | General Consumers, Young Professionals |

| Merchant Acceptance of Credit Cards | 100 | Retail Owners, Payment Processors |

| Banking Sector Insights | 80 | Bank Executives, Financial Analysts |

| Fintech Innovations in Payments | 70 | Fintech Founders, Product Managers |

| Regulatory Impact on Credit Card Market | 60 | Regulatory Officials, Compliance Officers |

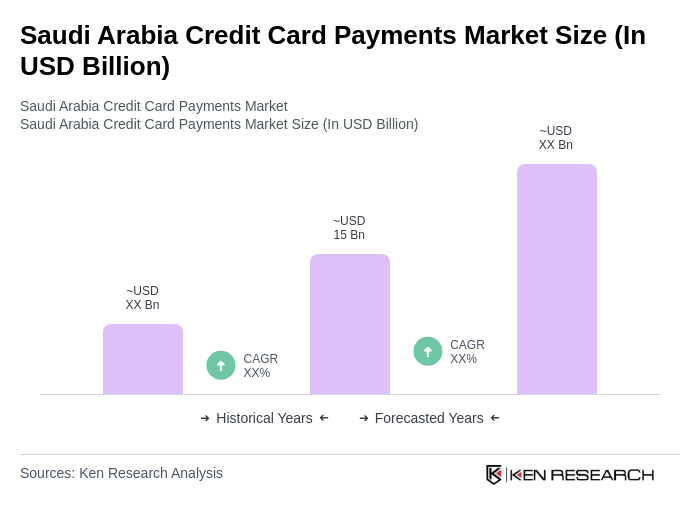

The Saudi Arabia Credit Card Payments Market is valued at approximately USD 15 billion, reflecting a significant increase driven by the adoption of digital payment solutions and a growing preference for cashless transactions among consumers.