Region:Middle East

Author(s):Rebecca

Product Code:KRAD4973

Pages:82

Published On:December 2025

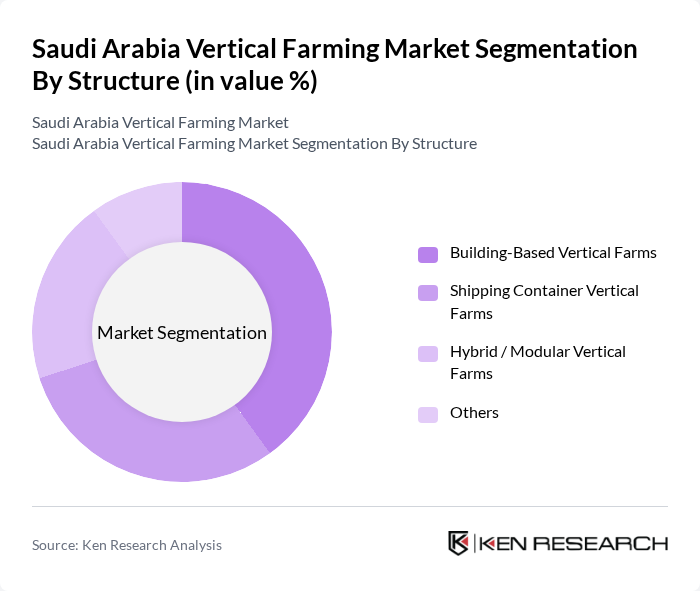

By Structure:The structure of vertical farms in Saudi Arabia can be categorized into several types, including building-based vertical farms, shipping container vertical farms, hybrid/modular vertical farms, and others. Building-based vertical farms are gaining traction due to their ability to utilize existing urban infrastructure and support larger-scale operations, aligning with evidence that building-based facilities capture the largest share of vertical farming revenues in the country. Shipping container farms offer flexibility and mobility for smaller or distributed installations, while hybrid farms combine various technologies and structural formats to optimize space and resources, catering to diverse agricultural and institutional needs.

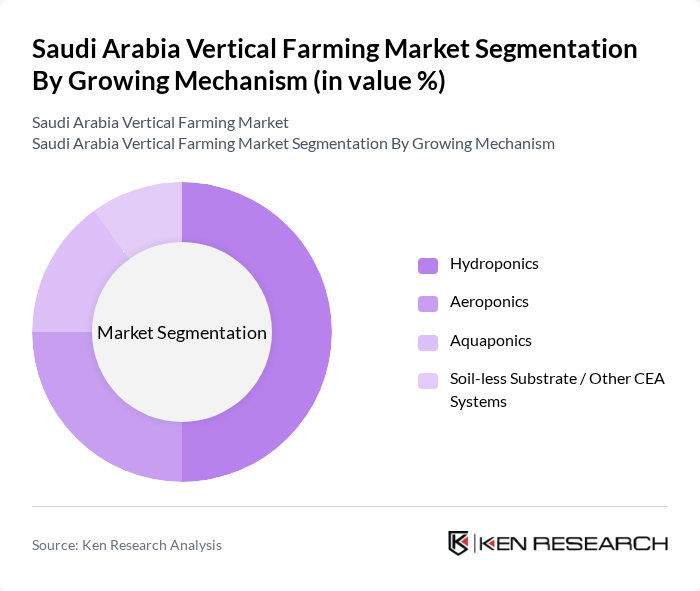

By Growing Mechanism:The growing mechanisms employed in vertical farming include hydroponics, aeroponics, aquaponics, and soil-less substrate/other Controlled Environment Agriculture (CEA) systems. Hydroponics is the most widely used method due to its efficiency in water and nutrient usage, operational predictability, and established supply chains, and it holds the largest share of vertical farming deployments across the Middle East, including Saudi Arabia. Aeroponics is gaining popularity for its ability to produce high yields with minimal resource input in high?tech facilities, while aquaponics combines fish farming with plant cultivation to create a sustainable ecosystem, and soil-less substrate / other CEA systems are used where specific crop or technology requirements favor alternative growing media.

The Saudi Arabia Vertical Farming Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pure Harvest Smart Farms (Saudi Arabia / UAE), Red Sea Farms (Saudi Arabia), Mowreq Specialized Agriculture (Mowreq Farms, Saudi Arabia), Greener Crop (Saudi Arabia / UAE), Bustanica (Emirates Crop One, regional reference player), iFarm (Technology Provider Active in Saudi Projects), GrowGroup IFS (Technology & Project Developer in the Middle East), Priva (Controlled Environment & Automation Solutions), Signify (Philips Horticulture LED Solutions), Netafim (Irrigation & Fertigation Solutions in CEA), AeroFarms (Technology & Know?How Deployed in the Region), Green Sense Farms Middle East (Regional Vertical Farming Operator), Agricool Saudi (Emerging Local Vertical Farming Initiative), Local Municipal / Government?Backed Vertical Farming Projects (Riyadh, NEOM, etc.), Other Notable Startups and Technology Partners Active in Saudi Arabia contribute to innovation, geographic expansion, and service delivery in this space.

The future of vertical farming in Saudi Arabia appears promising, driven by increasing urbanization and the pressing need for sustainable agricultural practices. As the government continues to invest in innovative farming technologies, the market is likely to witness significant advancements in efficiency and productivity. Furthermore, the integration of smart technologies, such as AI and IoT, will enhance operational capabilities, making vertical farming more attractive to investors and consumers alike, ultimately contributing to food security in the region.

| Segment | Sub-Segments |

|---|---|

| By Structure | Building-Based Vertical Farms Shipping Container Vertical Farms Hybrid / Modular Vertical Farms Others |

| By Growing Mechanism | Hydroponics Aeroponics Aquaponics Soil?less Substrate / Other CEA Systems |

| By Offering | Hardware (Lighting, Climate Control, Irrigation & Nutrient Delivery, Sensors & Control Systems) Software & Data Analytics Services (Design, Integration, Operation & Maintenance) |

| By Crop Type | Leafy Greens (Lettuce, Spinach, Kale, etc.) Herbs (Basil, Mint, Parsley, etc.) Microgreens & Sprouts Fruits & Vegetables (Tomatoes, Strawberries, Peppers, etc.) Flowers & Ornamentals Others |

| By Farm Location | On?Grid Urban Farms (Riyadh, Jeddah, Dammam, etc.) Peri?Urban / Industrial Zone Farms On?Site Farms for Foodservice & Retail Remote / Off?Grid Farms |

| By End-User | Retail & Modern Trade (Supermarkets / Hypermarkets) HoReCa (Hotels, Restaurants & Catering) Food Processing & Packaged Foods Companies Institutional Buyers (Hospitals, Schools, Compounds) Direct-to-Consumer / Subscription Boxes Others |

| By Ownership & Investment Source | Government & Semi?Government Entities Private Local Investors & Family Offices Foreign Strategic Investors & Joint Ventures Venture Capital & PE?Backed Startups Corporate / Food Company?Owned Farms Others |

| By Region | Central Region Western Region Eastern Region Northern Region Southern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Vertical Farms | 90 | Farm Owners, Operations Managers |

| Research Institutions in Agriculture | 70 | Researchers, Academic Professors |

| Government Agricultural Departments | 45 | Policy Makers, Agricultural Advisors |

| Retailers of Fresh Produce | 80 | Store Managers, Procurement Officers |

| Technology Providers for Vertical Farming | 60 | Product Managers, Sales Directors |

The Saudi Arabia Vertical Farming Market is valued at approximately USD 180 million, driven by the increasing demand for sustainable agricultural practices, urbanization, and food security initiatives in the region.