Region:Middle East

Author(s):Rebecca

Product Code:KRAD7496

Pages:83

Published On:December 2025

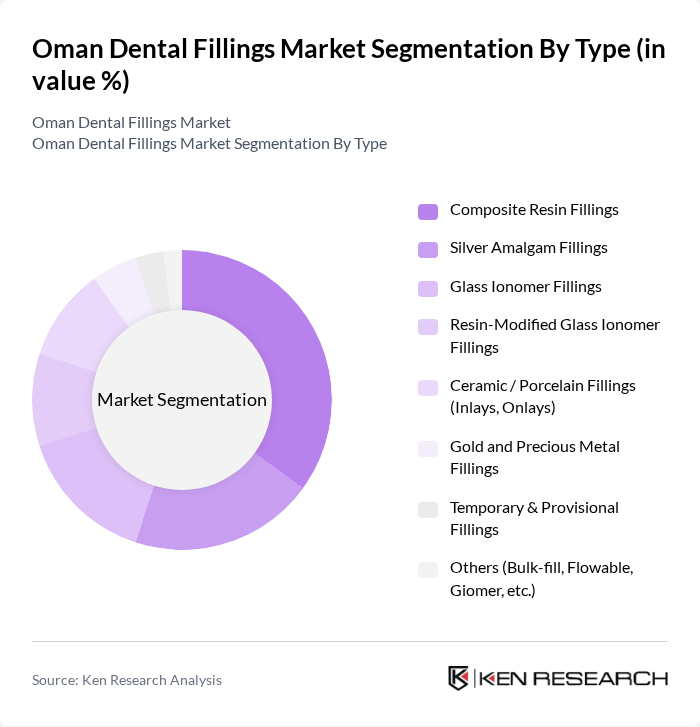

By Type:The market is segmented into various types of dental fillings, including Composite Resin Fillings, Silver Amalgam Fillings, Glass Ionomer Fillings, Resin-Modified Glass Ionomer Fillings, Ceramic / Porcelain Fillings (Inlays, Onlays), Gold and Precious Metal Fillings, Temporary & Provisional Fillings, and Others (Bulk-fill, Flowable, Giomer, etc.). This structure aligns with global product segmentation for dental and tooth-filling materials. Among these, Composite Resin Fillings are gaining popularity due to their aesthetic appeal and versatility, reflecting the global shift toward tooth-colored, adhesive restorations. They are widely used for both anterior and posterior teeth restorations, driven by consumer preference for materials that blend seamlessly with natural teeth and support minimally invasive cavity preparation.

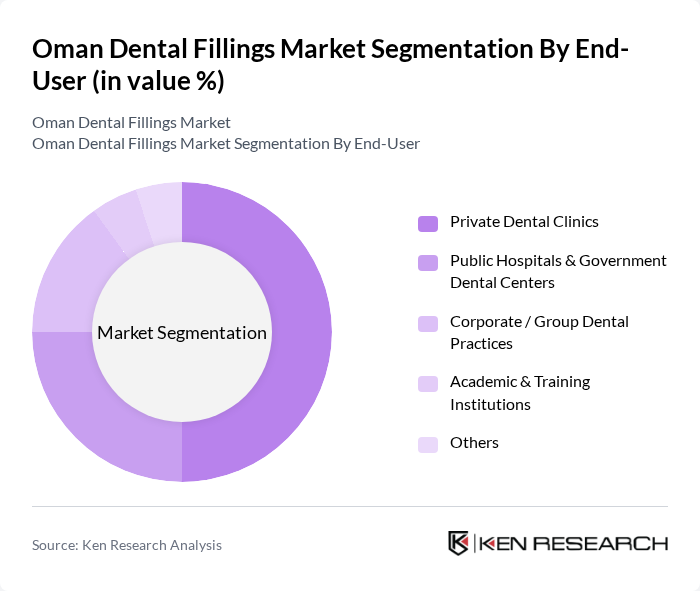

By End-User:The end-user segmentation includes Private Dental Clinics, Public Hospitals & Government Dental Centers, Corporate / Group Dental Practices, Academic & Training Institutions, and Others. This end?user mix is consistent with broader dental consumables and services markets where private dental clinics and small practices are the primary channel for restorative procedures. Private Dental Clinics dominate the market due to their accessibility, higher patient throughput, and the growing trend of individuals seeking personalized dental care and cosmetic procedures. These clinics often offer a wider range of services and advanced technologies, such as digital imaging and adhesive restorative systems, attracting patients who prefer tailored treatment options and shorter waiting times.

The Oman Dental Fillings Market is characterized by a dynamic mix of regional and international players. Leading participants such as 3M Company, Dentsply Sirona, GC Corporation, Ivoclar Vivadent AG, Coltene Holding AG, Kuraray Noritake Dental Inc., Shofu Inc., VOCO GmbH, DMG Chemisch-Pharmazeutische Fabrik GmbH, Tokuyama Dental Corporation, SDI Limited, Kulzer GmbH, FGM Dental Group, Ultradent Products, Inc., Local & Regional Distributors (e.g., Oman Dental Supplies LLC, Gulf Healthcare Supply partners) contribute to innovation, geographic expansion, and service delivery in this space.

The Oman dental fillings market is poised for growth as trends indicate a shift towards minimally invasive procedures and increased demand for aesthetic solutions. With the integration of digital dentistry, practices are becoming more efficient, enhancing patient experiences. Additionally, the focus on sustainable dental materials is likely to gain traction, aligning with global environmental trends. As dental insurance coverage expands, more individuals will seek preventive and restorative treatments, further driving market growth in the near future.

| Segment | Sub-Segments |

|---|---|

| By Type | Composite Resin Fillings Silver Amalgam Fillings Glass Ionomer Fillings Resin-Modified Glass Ionomer Fillings Ceramic / Porcelain Fillings (Inlays, Onlays) Gold and Precious Metal Fillings Temporary & Provisional Fillings Others (Bulk-fill, Flowable, Giomer, etc.) |

| By End-User | Private Dental Clinics Public Hospitals & Government Dental Centers Corporate / Group Dental Practices Academic & Training Institutions Others |

| By Material Composition | Metal-based Fillings (Amalgam, Gold Alloys) Resin-based Composite Fillings Glass Ionomer & Hybrid Ionomer Fillings Ceramic & CAD/CAM-based Restorative Materials Others |

| By Application Area | Anterior Teeth (Aesthetic Restorations) Posterior Teeth (Load-bearing Restorations) Multi-surface & Complex Restorations |

| By Distribution Channel | Direct Sales to Clinics & Hospitals Local Dental Distributors & Dealers Online B2B Platforms & E-commerce Tenders & Institutional Procurement Others |

| By Region | Muscat Governorate Dhofar (incl. Salalah) Al Batinah (incl. Sohar) Ad Dakhiliyah (incl. Nizwa) Other Governorates |

| By Patient Demographics | Pediatric (0–14 years) Adults (15–59 years) Geriatric (60+ years) Medical Tourists & Expatriates |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General Dental Practices | 90 | Dentists, Clinic Managers |

| Specialized Dental Clinics | 70 | Orthodontists, Endodontists |

| Dental Supply Distributors | 45 | Sales Managers, Product Specialists |

| Patient Surveys on Filling Preferences | 140 | Dental Patients, Caregivers |

| Healthcare Policy Makers | 40 | Health Ministry Officials, Regulatory Bodies |

The Oman Dental Fillings Market is valued at approximately USD 7 million, reflecting a historical analysis and benchmarking against global dental fillings markets and regional dental services spending.