Oman Digestive Health Supplements Market Overview

- The Oman Digestive Health Supplements Market is valued at USD 30 million, based on a five-year historical analysis. This growth is primarily driven by increasing consumer interest in herbal and natural remedies, along with a heightened awareness of gut health. The rising prevalence of lifestyle-related health issues has further influenced the adoption of digestive health supplements among consumers.

- Key urban centers such as Muscat and Salalah dominate the market due to their advanced retail infrastructure and higher health awareness among the population. These cities provide a conducive environment for the consumption of digestive health products, supported by a growing number of pharmacies and wellness centers.

- In 2023, Oman’s Ministry of Health implemented the “Regulation for Registration of Food Supplements and Herbal Products, 2023,” mandating that all nutraceutical and dietary supplement products, including digestive health formulations, must be registered and comply with efficacy and safety standards. This regulation aims to enhance quality control and consumer protection in the industry.

Oman Digestive Health Supplements Market Segmentation

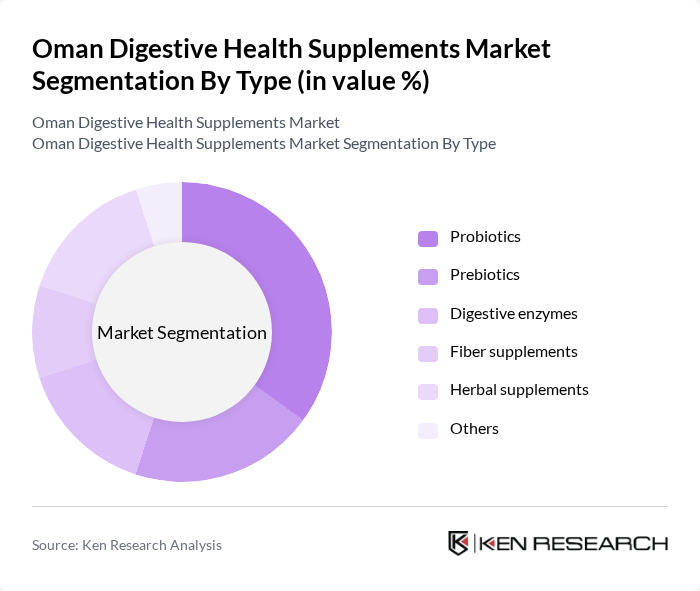

By Type:The market is segmented into various types of digestive health supplements, including probiotics, prebiotics, digestive enzymes, fiber supplements, herbal supplements, and others. Among these, probiotics are gaining significant traction due to their proven benefits in promoting gut health and enhancing digestion. The increasing consumer awareness regarding the importance of gut microbiota is driving the demand for probiotic supplements, making them the leading sub-segment in this category.

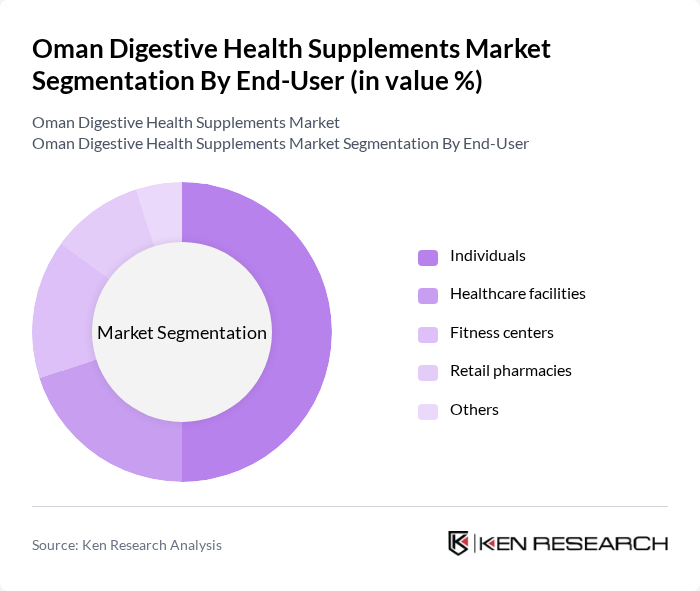

By End-User:The end-user segmentation includes individuals, healthcare facilities, fitness centers, retail pharmacies, and others. Individuals represent the largest segment, driven by a growing trend of self-care and preventive health measures. The increasing focus on personal health and wellness has led to a surge in the consumption of digestive health supplements among individuals, making this segment the most significant contributor to market growth.

Oman Digestive Health Supplements Market Competitive Landscape

The Oman Digestive Health Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herbalife Nutrition Ltd., Amway Corporation, Nestlé S.A., Abbott Laboratories, GNC Holdings, Inc., Nature's Way Products, LLC, Garden of Life, LLC, NOW Foods, Solgar Inc., Swanson Health Products, BioCare Copenhagen, Enzymedica, Inc., Renew Life, Jarrow Formulas, Inc., NutraBlast contribute to innovation, geographic expansion, and service delivery in this space.

Oman Digestive Health Supplements Market Industry Analysis

Growth Drivers

- Increasing Health Awareness Among Consumers:The health consciousness among Omani consumers has surged, with 68% of the population actively seeking dietary supplements to enhance their well-being. This trend is supported by the Ministry of Health's initiatives promoting healthy lifestyles, which have led to a 15% increase in health supplement sales recently. Furthermore, the rise of social media influencers advocating for digestive health has significantly contributed to consumer education and product demand.

- Rising Prevalence of Digestive Disorders:Oman has witnessed a notable increase in digestive disorders, with approximately 30% of the population experiencing issues such as irritable bowel syndrome and acid reflux. According to the World Health Organization, the prevalence of these conditions has risen by 20% over the past five years. This alarming trend has prompted consumers to seek effective digestive health supplements, driving market growth as individuals prioritize their digestive well-being.

- Growth in the Aging Population:The aging demographic in Oman is projected to reach 1.2 million in the near future, representing 15% of the total population. Older adults are more susceptible to digestive issues, leading to increased demand for health supplements tailored to their needs. The government’s focus on elder care and wellness programs has further fueled this trend, resulting in a 25% increase in sales of digestive health products specifically designed for seniors in the last year.

Market Challenges

- High Competition Among Local and International Brands:The Oman digestive health supplements market is characterized by intense competition, with over 50 local and international brands vying for market share. This saturation has led to aggressive pricing strategies, making it challenging for new entrants to establish themselves. Recently, the top five brands accounted for 60% of the market, highlighting the dominance of established players and the difficulty for newcomers to gain traction.

- Regulatory Hurdles and Compliance Issues:Navigating the regulatory landscape in Oman poses significant challenges for health supplement manufacturers. The Ministry of Health has implemented stringent guidelines for product registration and labeling, which can take up to six months to complete. Non-compliance can result in hefty fines or product recalls. Recently, 20% of new product applications faced delays due to regulatory issues, hindering market entry and innovation.

Oman Digestive Health Supplements Market Future Outlook

The Oman digestive health supplements market is poised for significant evolution, driven by increasing consumer demand for personalized nutrition and innovative product formulations. As the population becomes more health-conscious, the integration of technology in supplement development, such as AI-driven personalized health assessments, is expected to gain traction. Additionally, the rise of e-commerce platforms will facilitate broader access to diverse product offerings, enhancing consumer choice and convenience in the coming years.

Market Opportunities

- Introduction of Innovative Product Formulations:There is a growing opportunity for companies to develop unique formulations that cater to specific digestive health needs, such as gluten-free or vegan options. This trend is supported by a 30% increase in consumer interest in specialized supplements, indicating a lucrative market for innovation and differentiation.

- Collaborations with Healthcare Professionals:Partnering with healthcare providers can enhance credibility and consumer trust in digestive health supplements. Research shows that 40% of consumers prefer recommendations from healthcare professionals, presenting a significant opportunity for brands to establish partnerships that can drive sales and improve product visibility in the market.