Region:Middle East

Author(s):Shubham

Product Code:KRAD5559

Pages:90

Published On:December 2025

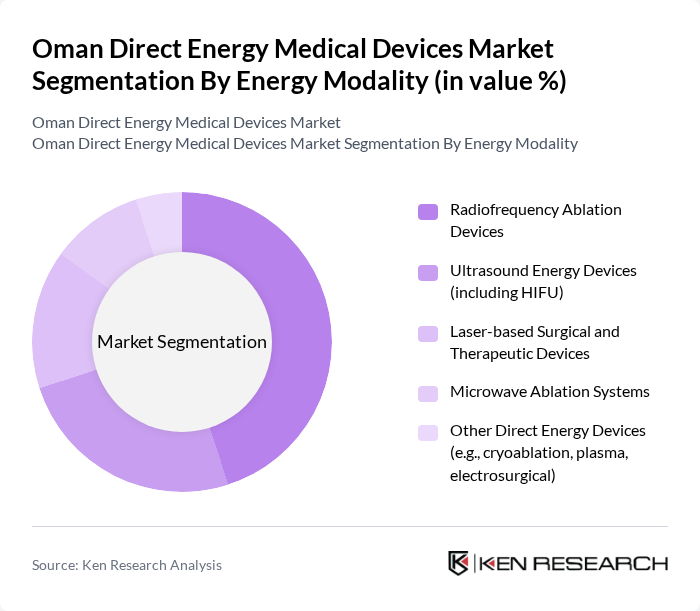

By Energy Modality:The market is segmented into various energy modalities, including Radiofrequency, Ultrasound, Laser, Microwave, and Others. Among these, Radiofrequency Ablation Devices are leading the market due to their effectiveness in treating various medical conditions, particularly in oncology and cardiology. The increasing adoption of these devices in hospitals and specialized clinics is driven by their minimally invasive nature and improved patient outcomes. Ultrasound Energy Devices, including High-Intensity Focused Ultrasound (HIFU), are also gaining traction due to their non-invasive approach and growing applications in aesthetic treatments.

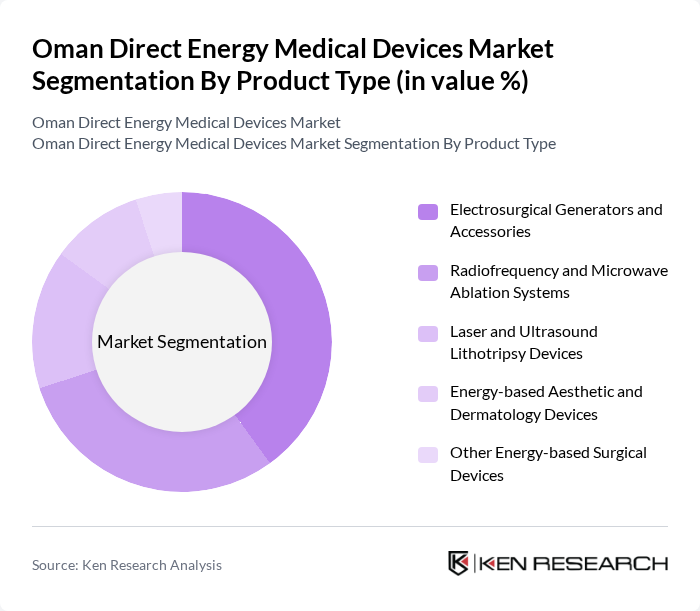

By Product Type:The product type segmentation includes Electrosurgical, Ablation, Lithotripsy, Aesthetic, and Others. Electrosurgical Generators and Accessories dominate this segment due to their widespread use in surgical procedures across various specialties. The increasing number of surgeries performed in Oman, coupled with advancements in electrosurgical technology, has led to a higher demand for these products. Additionally, Radiofrequency and Microwave Ablation Systems are gaining popularity for their effectiveness in treating tumors and other conditions, further driving market growth.

The Oman Direct Energy Medical Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic plc, Johnson & Johnson (Ethicon & Biosense Webster), Boston Scientific Corporation, Olympus Corporation, CONMED Corporation, Stryker Corporation, Abbott Laboratories, Smith & Nephew plc, B. Braun Melsungen AG, ERBE Elektromedizin GmbH, Hologic, Inc., AngioDynamics Inc., Karl Storz SE & Co. KG, Zimmer Biomet Holdings, Inc., Olympus Gulf FZE (Middle East Regional Entity) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman Direct Energy Medical Devices Market appears promising, driven by ongoing investments in healthcare infrastructure and technology. As the government continues to prioritize healthcare improvements, the demand for innovative medical devices is expected to rise. Additionally, the integration of telemedicine and AI technologies will likely enhance patient care and operational efficiency, creating a dynamic environment for market players. The focus on local manufacturing initiatives will further support sustainable growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Energy Modality (Radiofrequency, Ultrasound, Laser, Microwave, Others) | Radiofrequency Ablation Devices Ultrasound Energy Devices (including HIFU) Laser-based Surgical and Therapeutic Devices Microwave Ablation Systems Other Direct Energy Devices (e.g., cryoablation, plasma, electrosurgical) |

| By Product Type (Electrosurgical, Ablation, Lithotripsy, Aesthetic, Others) | Electrosurgical Generators and Accessories Radiofrequency and Microwave Ablation Systems Laser and Ultrasound Lithotripsy Devices Energy-based Aesthetic and Dermatology Devices Other Energy-based Surgical Devices |

| By Clinical Application (Oncology, Cardiology, Urology, Gastroenterology, Aesthetics & Others) | Oncology (tumor ablation) Cardiology (e.g., cardiac ablation) Urology (e.g., lithotripsy, BPH treatment) Gastroenterology and General Surgery Aesthetic & Dermatology Applications Other Therapeutic Applications |

| By End-User (Hospitals, Ambulatory Surgical Centers, Specialized Clinics) | Public Hospitals Private Hospitals Ambulatory Surgical Centers Specialized Clinics (Oncology, Cardiology, Urology, Aesthetics) Others |

| By Distribution Channel (Direct Tender, Local Distributors, OEM Partnerships) | Direct Tender Sales to Public Hospitals Sales via Local Medical Device Distributors OEM and Agency Partnerships Others |

| By Technology Integration (Standalone Systems, Integrated OR Platforms, Disposable Energy Devices) | Standalone Capital Equipment Integrated Operating Room and Imaging Platforms Single-use and Disposable Energy Devices Others |

| By Region (Muscat, Dhofar, Al Batinah, Others) | Muscat Governorate Dhofar Governorate Al Batinah Region Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 100 | Procurement Managers, Supply Chain Coordinators |

| Healthcare Professionals | 80 | Surgeons, Medical Technologists |

| Medical Device Distributors | 60 | Sales Representatives, Business Development Managers |

| Regulatory Bodies | 40 | Regulatory Affairs Specialists, Compliance Officers |

| Healthcare Facility Administrators | 70 | Facility Managers, Operations Directors |

The Oman Direct Energy Medical Devices Market is valued at approximately USD 12 million, reflecting growth driven by the rising prevalence of chronic diseases, advancements in medical technology, and increased demand for minimally invasive surgical procedures.