Region:Middle East

Author(s):Rebecca

Product Code:KRAB7374

Pages:100

Published On:October 2025

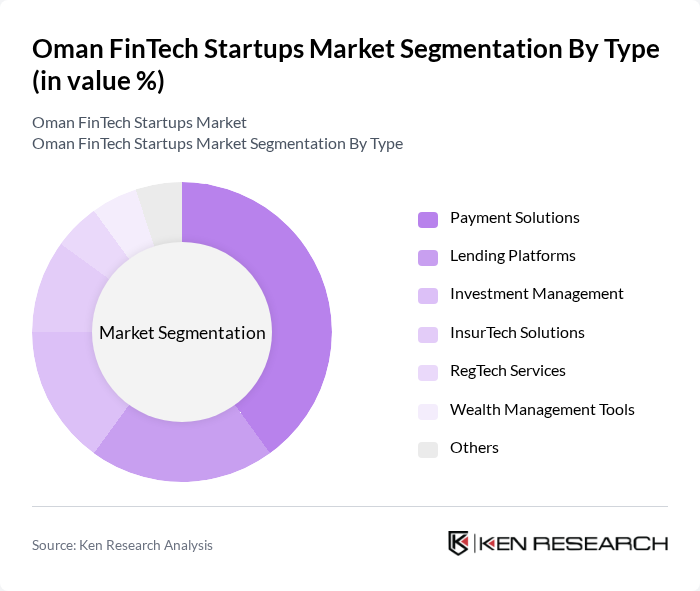

By Type:The market is segmented into various types, including Payment Solutions, Lending Platforms, Investment Management, InsurTech Solutions, RegTech Services, Wealth Management Tools, and Others. Payment Solutions dominate the market due to the increasing demand for seamless and secure digital transactions. The rise of e-commerce and mobile payments has significantly influenced consumer behavior, leading to a surge in the adoption of these solutions.

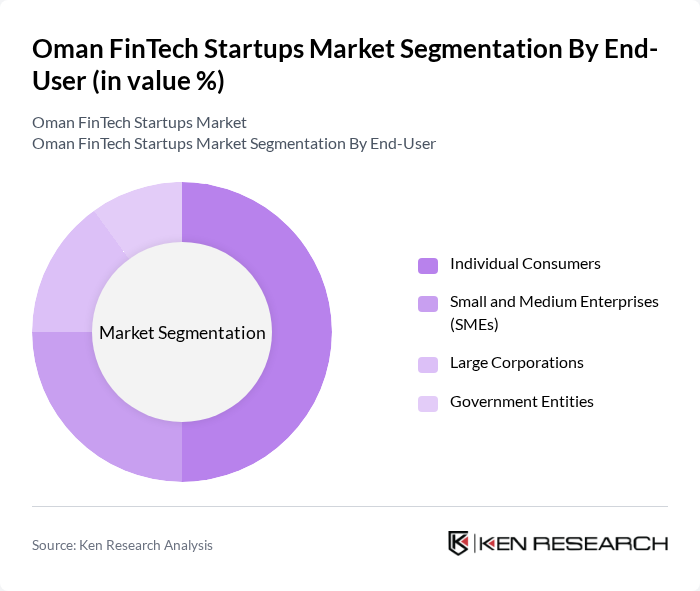

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Individual Consumers represent the largest segment, driven by the increasing use of mobile banking and digital wallets. The growing trend of online shopping and the need for convenient financial services have led to a significant rise in the adoption of FinTech solutions among individual users.

The Oman FinTech Startups Market is characterized by a dynamic mix of regional and international players. Leading participants such as OMAN FINTECH, FALCON GROUP, TAHSEEN FINANCIAL, ARAFAH FINTECH, AL RAJHI BANK, BAHRAIN FINTECH BAY, PAYFORT, RAKBANK, ZAIN CASH, STC PAY, NCB CAPITAL, ALINMA BANK, SABB, ARAB NATIONAL BANK, SAUDI ARABIAN MONETARY AUTHORITY contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman FinTech market appears promising, driven by increasing digital adoption and government initiatives aimed at fostering innovation. As the demand for financial inclusion rises, startups are likely to develop tailored solutions for underserved populations. Additionally, the integration of advanced technologies such as AI and blockchain will enhance service delivery and operational efficiency. The collaboration between FinTech firms and traditional banks is expected to create a more robust financial ecosystem, paving the way for sustainable growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Payment Solutions Lending Platforms Investment Management InsurTech Solutions RegTech Services Wealth Management Tools Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Application | Personal Finance Management Business Financing Payment Processing Fraud Detection |

| By Investment Source | Venture Capital Angel Investors Government Grants Crowdfunding |

| By Distribution Channel | Online Platforms Mobile Applications Direct Sales |

| By Customer Segment | Retail Customers Corporate Clients Institutional Investors |

| By Policy Support | Tax Incentives Regulatory Support Programs Subsidies for Startups |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Payments Solutions Providers | 100 | Product Managers, Business Development Executives |

| Digital Lending Platforms | 80 | Founders, Financial Analysts |

| InsurTech Startups | 70 | Operations Managers, Risk Assessment Officers |

| Blockchain and Cryptocurrency Firms | 60 | CTOs, Compliance Officers |

| RegTech Solutions | 50 | Regulatory Affairs Managers, Legal Advisors |

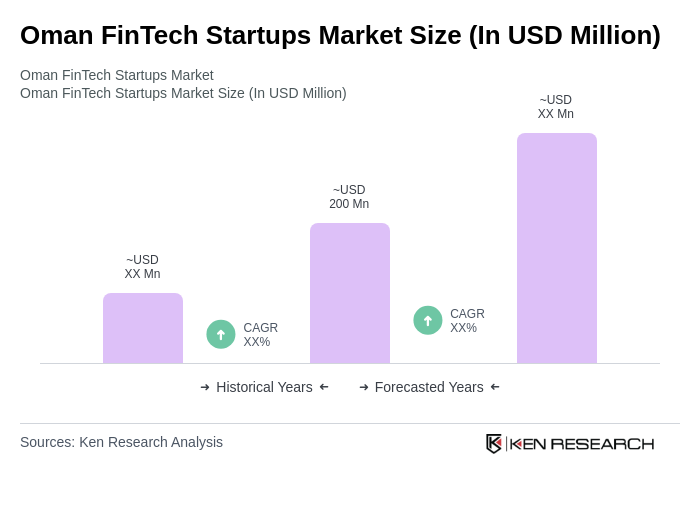

The Oman FinTech Startups Market is valued at approximately USD 200 million, reflecting a significant growth driven by the increasing adoption of digital payment solutions, mobile banking, and investment technologies among consumers.