Region:Middle East

Author(s):Shubham

Product Code:KRAA8764

Pages:86

Published On:November 2025

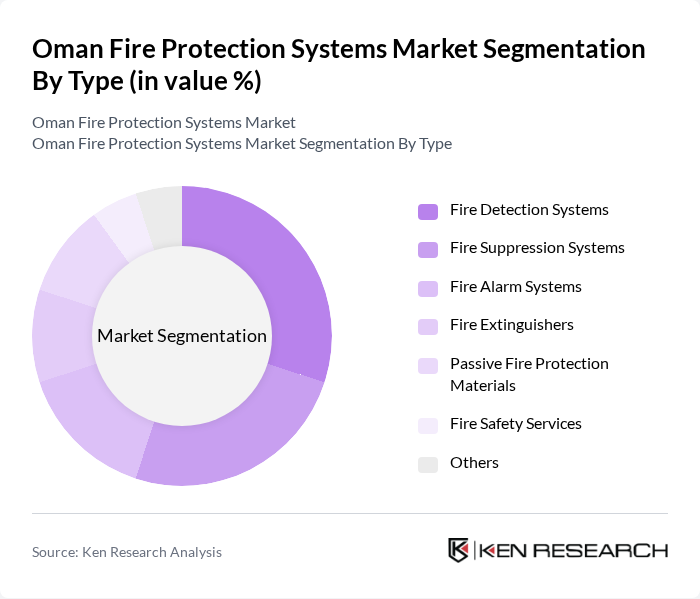

By Type:The market is segmented into fire detection systems, fire suppression systems, fire alarm systems, fire extinguishers, passive fire protection materials, fire safety services, and others. Fire detection systems and fire suppression systems are particularly significant due to their critical role in early warning and active response, ensuring safety in both residential and commercial settings. The adoption of integrated fire protection solutions is rising, supported by technological advancements such as IoT-enabled devices and smart monitoring platforms.

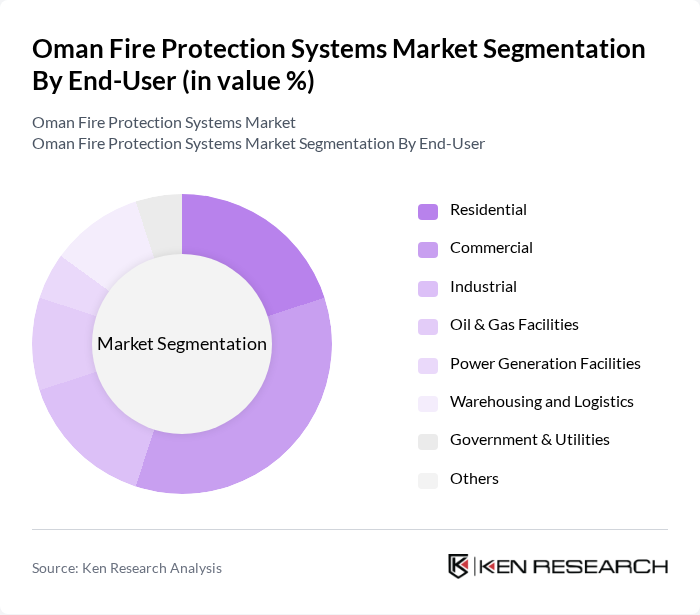

By End-User:The end-user segmentation includes residential, commercial, industrial, oil & gas facilities, power generation facilities, warehousing and logistics, government & utilities, and others. The commercial sector remains the largest end-user, driven by the expansion of business premises and mandatory compliance with fire safety regulations. The oil & gas sector is also a major contributor, given the high-risk nature of operations and the need for robust fire protection measures. Industrial and warehousing segments are experiencing increased adoption of advanced fire safety solutions due to operational safety requirements and regulatory compliance.

The Oman Fire Protection Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Muscat Fire & Safety Engineering Company LLC (MFSE), National Fire Fighting Manufacturing FZCO (NAFFCO), Firex Oman LLC, Tyco Fire & Security (Johnson Controls), Honeywell International Inc., Siemens AG, United Fire & Safety LLC, Bosch Security Systems, Kidde (Carrier Global Corporation), Apollo Fire Detectors (Halma plc), Hochiki Corporation, Minimax Viking, FirePro Systems, SFFECO Global, Advanced Fire & Safety Solutions LLC contribute to innovation, geographic expansion, and service delivery in this space.

The Oman fire protection systems market is poised for significant growth as industrialization and urbanization continue to accelerate. With government initiatives focusing on infrastructure development and stringent safety regulations, the demand for advanced fire protection solutions is expected to rise. Additionally, the integration of smart technologies and eco-friendly solutions will shape the future landscape, enhancing safety and efficiency in fire management. The market is likely to witness increased investments in training programs to address workforce shortages, ensuring a robust safety culture.

| Segment | Sub-Segments |

|---|---|

| By Type | Fire Detection Systems Fire Suppression Systems Fire Alarm Systems Fire Extinguishers Passive Fire Protection Materials (e.g., fire-resistant coatings, fireproof sealants, fire-rated doors) Fire Safety Services Others |

| By End-User | Residential Commercial Industrial Oil & Gas Facilities Power Generation Facilities Warehousing and Logistics Government & Utilities Others |

| By Application | Fire Safety Audits Installation Services Maintenance Services Consulting Services Retrofitting & Upgrades Others |

| By Technology | Conventional Systems Addressable Systems Wireless Systems Smart/IoT-Enabled Systems Others |

| By Region | Muscat Salalah Sohar Nizwa Duqm Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes Others |

| By Policy Support | Subsidies Tax Exemptions Regulatory Compliance Support Training and Certification Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Building Fire Safety | 100 | Facility Managers, Safety Officers |

| Industrial Fire Protection Systems | 80 | Plant Managers, Safety Compliance Officers |

| Residential Fire Safety Solutions | 70 | Homeowners, Property Managers |

| Oil & Gas Sector Fire Safety | 100 | Safety Managers, Operations Directors |

| Fire Safety Equipment Suppliers | 90 | Sales Managers, Product Development Heads |

The Oman Fire Protection Systems Market is valued at approximately USD 145 million, driven by increasing urbanization, stricter safety regulations, and heightened awareness of fire safety among businesses and homeowners.