Region:Middle East

Author(s):Geetanshi

Product Code:KRAC9381

Pages:84

Published On:November 2025

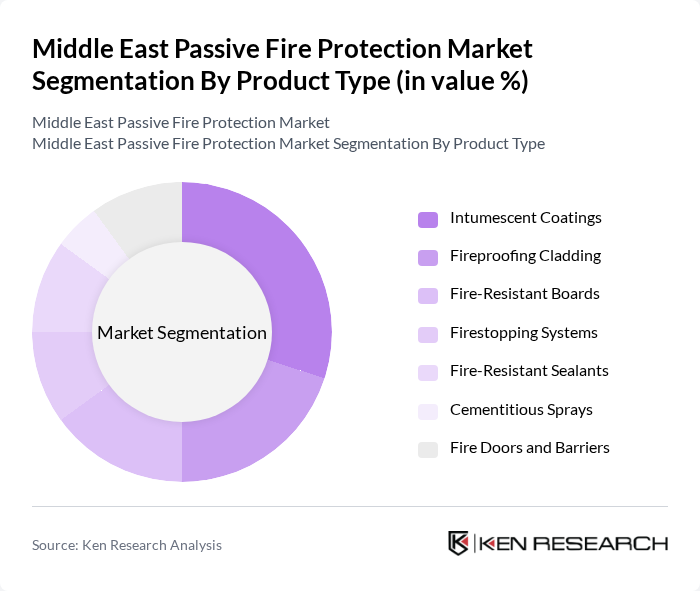

By Product Type:The product type segmentation includes various solutions designed to prevent the spread of fire and smoke. The subsegments are Intumescent Coatings, Fireproofing Cladding, Fire-Resistant Boards, Firestopping Systems, Fire-Resistant Sealants, Cementitious Sprays, and Fire Doors and Barriers. Among these,Intumescent Coatingsare gaining traction due to their effectiveness in protecting structural steel and their aesthetic appeal, making them a preferred choice in modern construction. Cementitious materials remain the largest revenue-generating segment, but intumescent coatings are the fastest-growing due to their lightweight application and compatibility with architectural designs .

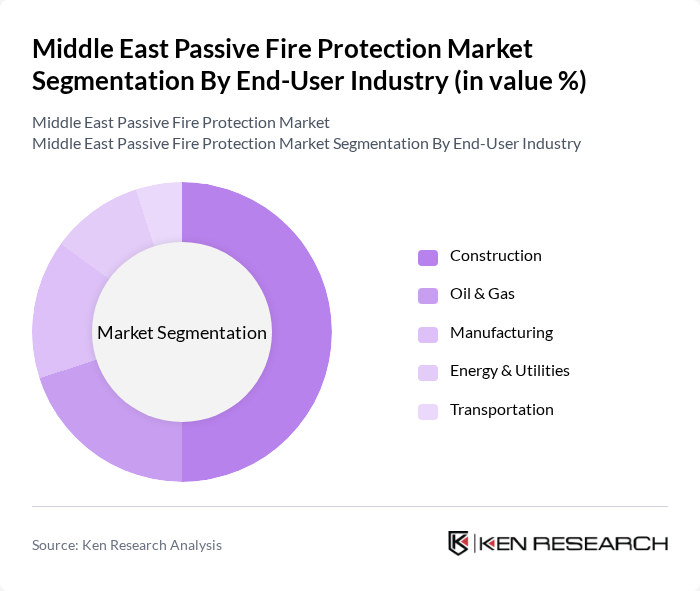

By End-User Industry:The end-user industry segmentation encompasses various sectors utilizing passive fire protection solutions, including Construction, Oil & Gas, Manufacturing, Energy & Utilities, and Transportation. TheConstruction sectoris the largest consumer, driven by the increasing number of high-rise buildings and commercial complexes that require robust fire safety measures to comply with regulations and ensure occupant safety. The Oil & Gas sector also represents a significant share due to the high-risk nature of operations and mandatory safety compliance in the region .

The Middle East Passive Fire Protection Market is characterized by a dynamic mix of regional and international players. Leading participants such as 3M Company, Hilti Group, PPG Industries, BASF SE, AkzoNobel N.V., RPM International Inc., Etex Group, The Sherwin-Williams Company, Promat International, Rockwool International A/S, Sika AG, Hempel A/S, Morgan Advanced Materials, Contego International Inc., Rudolf Hensel GmbH contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Middle East passive fire protection market appears promising, driven by ongoing construction projects and regulatory advancements. As governments continue to enforce stricter fire safety regulations, the demand for innovative fire protection solutions is expected to rise. Additionally, the integration of smart technologies into building management systems will enhance fire safety measures, creating a more proactive approach to fire risk management. This evolving landscape will likely foster collaboration between manufacturers and construction firms to develop advanced fire protection strategies.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Intumescent Coatings Fireproofing Cladding Fire-Resistant Boards Firestopping Systems Fire-Resistant Sealants Cementitious Sprays Fire Doors and Barriers |

| By End-User Industry | Construction Oil & Gas Manufacturing Energy & Utilities Transportation |

| By Application | Commercial Buildings Residential Buildings Industrial Plants Warehousing Oil & Gas Facilities Transportation Infrastructure |

| By Technology | Conventional Materials Advanced Intumescent Technologies Ceramic-Based Coatings Non-Combustible Insulation |

| By Project Type | New Construction Renovation Maintenance & Retrofitting |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Geography | GCC Countries (Saudi Arabia, UAE, Kuwait, Qatar, Bahrain, Oman) Levant Region (Jordan, Lebanon, Syria, Palestine) North Africa (Egypt, Morocco, Algeria, Tunisia) Other Middle East Countries |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Building Projects | 75 | Project Managers, Safety Compliance Officers |

| Industrial Facilities | 65 | Facility Managers, Fire Safety Engineers |

| Residential Developments | 55 | Architects, Construction Supervisors |

| Government Infrastructure Projects | 45 | Regulatory Officials, Urban Planners |

| Fire Safety Equipment Suppliers | 60 | Sales Managers, Product Development Leads |

The Middle East Passive Fire Protection Market is valued at approximately USD 110 million, driven by increasing construction activities, stricter fire safety regulations, and heightened awareness of fire safety standards across various industries in the region.