Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7273

Pages:85

Published On:December 2025

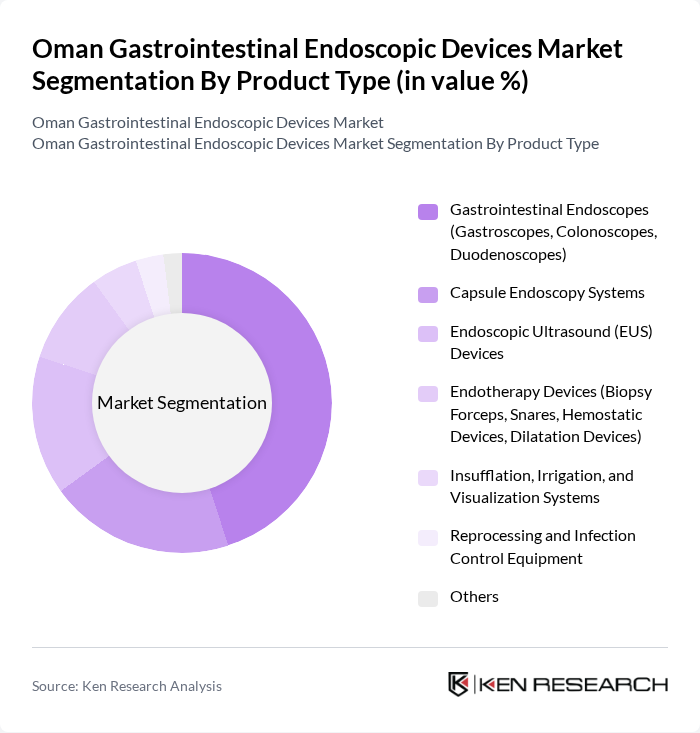

By Product Type:The product type segmentation includes various categories of devices used in gastrointestinal endoscopy. The subsegments are as follows: Gastrointestinal Endoscopes (Gastroscopes, Colonoscopes, Duodenoscopes), Capsule Endoscopy Systems, Endoscopic Ultrasound (EUS) Devices, Endotherapy Devices (Biopsy Forceps, Snares, Hemostatic Devices, Dilatation Devices), Insufflation, Irrigation, and Visualization Systems, Reprocessing and Infection Control Equipment, and Others. Among these, Gastrointestinal Endoscopes are the most widely used due to their essential role in diagnosing and treating gastrointestinal conditions.

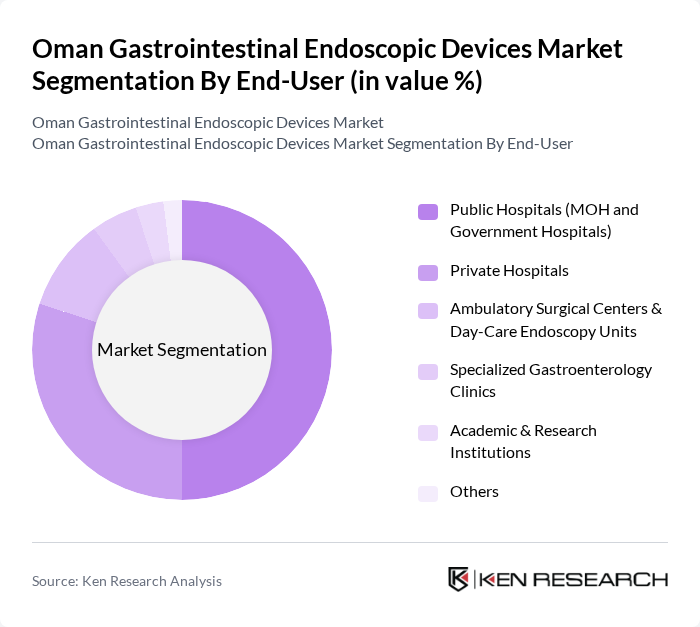

By End-User:The end-user segmentation includes various healthcare settings where gastrointestinal endoscopic devices are utilized. The subsegments are Public Hospitals (MOH and Government Hospitals), Private Hospitals, Ambulatory Surgical Centers & Day-Care Endoscopy Units, Specialized Gastroenterology Clinics, Academic & Research Institutions, and Others. Public hospitals dominate the market due to their extensive patient base and government support for advanced medical technologies.

The Oman Gastrointestinal Endoscopic Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Olympus Corporation, Boston Scientific Corporation, Medtronic plc, Cook Medical LLC, Pentax Medical (Hoya Group), Fujifilm Healthcare Corporation, STERIS plc, CONMED Corporation, Karl Storz SE & Co. KG, Richard Wolf GmbH, Ambu A/S, Merit Medical Systems, Inc., B. Braun Melsungen AG, Erbe Elektromedizin GmbH, Local & Regional Distributors (e.g., Al Nahda Industrial & Trading Co. LLC, Muscat Pharmacy & Stores LLC) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the gastrointestinal endoscopic devices market in Oman appears promising, driven by ongoing technological advancements and increased healthcare investments. As the government continues to prioritize healthcare infrastructure, the integration of digital health solutions and artificial intelligence in endoscopic procedures is expected to enhance diagnostic capabilities. Furthermore, the growing trend towards patient-centric care models will likely lead to increased demand for minimally invasive procedures, shaping the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Gastrointestinal Endoscopes (Gastroscopes, Colonoscopes, Duodenoscopes) Capsule Endoscopy Systems Endoscopic Ultrasound (EUS) Devices Endotherapy Devices (Biopsy Forceps, Snares, Hemostatic Devices, Dilatation Devices) Insufflation, Irrigation, and Visualization Systems Reprocessing and Infection Control Equipment Others |

| By End-User | Public Hospitals (MOH and Government Hospitals) Private Hospitals Ambulatory Surgical Centers & Day-Care Endoscopy Units Specialized Gastroenterology Clinics Academic & Research Institutions Others |

| By Procedure Type | Upper GI Endoscopy (EGD/Gastroscopy) Colonoscopy ERCP & EUS Procedures Capsule Endoscopy Procedures Therapeutic Endoscopic Procedures (Polypectomy, Hemostasis, Endoscopic Resection) Screening Procedures Others |

| By Geography (Oman) | Muscat Governorate Dhofar Governorate Al Batinah (North & South) Al Dakhiliyah Al Sharqiyah (North & South) Others |

| By Technology | High-Definition (HD) and 4K Video Endoscopy Systems Narrow Band / Image-Enhanced Endoscopy Systems Single-Use / Disposable Endoscopes Conventional Fiber-Optic Systems Others |

| By Distribution Channel | Direct Tendering to Public Hospitals Local Distributors & Importers Direct Sales to Private Hospitals & Clinics Group Purchasing Organizations & Buying Groups Others |

| By Price Tier | Entry-Level / Value Segment Mid-Range Systems Premium / High-End Systems Refurbished Systems |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Gastroenterology Clinics | 100 | Gastroenterologists, Clinic Managers |

| Hospitals with Endoscopy Units | 80 | Procurement Officers, Medical Directors |

| Medical Device Distributors | 60 | Sales Managers, Product Specialists |

| Healthcare Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Research Institutions | 40 | Clinical Researchers, Academic Professors |

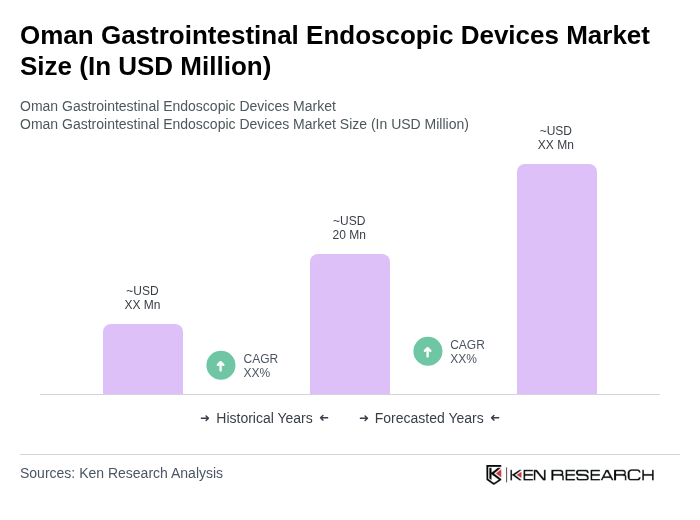

The Oman Gastrointestinal Endoscopic Devices Market is valued at approximately USD 20 million, reflecting a five-year historical analysis. This valuation is influenced by the rising prevalence of gastrointestinal disorders and advancements in endoscopic technologies.