Region:Middle East

Author(s):Rebecca

Product Code:KRAC9820

Pages:85

Published On:November 2025

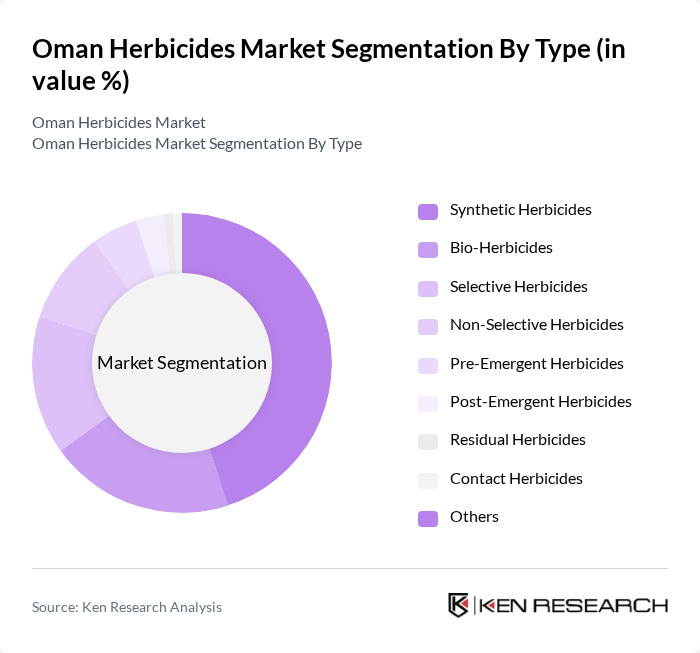

By Type:The herbicides market in Oman is segmented into synthetic herbicides, bio-herbicides, selective herbicides, non-selective herbicides, pre-emergent herbicides, post-emergent herbicides, residual herbicides, contact herbicides, and others.Synthetic herbicidescontinue to dominate due to their proven effectiveness and broad-spectrum weed control. Farmers favor these for their reliability and rapid action. However, there is a noticeable shift towardbio-herbicidesand integrated pest management approaches, driven by regulatory incentives and increased awareness of sustainability in agriculture.

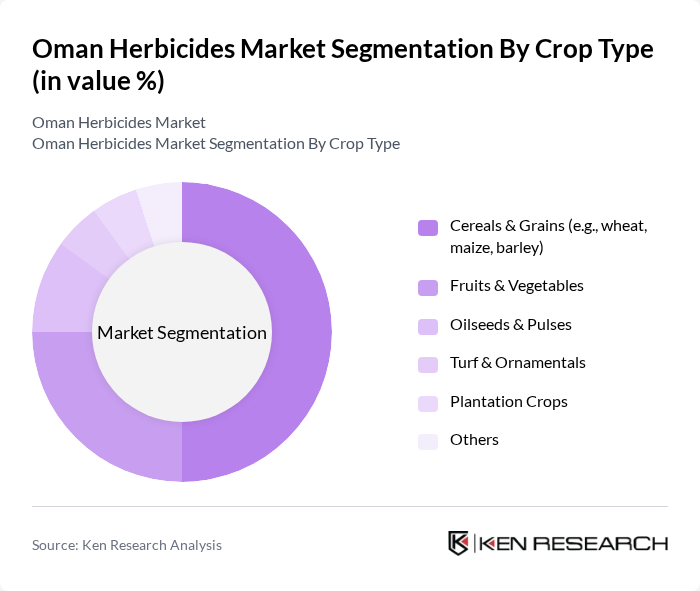

By Crop Type:The herbicides market is further segmented by crop type, including cereals & grains, fruits & vegetables, oilseeds & pulses, turf & ornamentals, plantation crops, and others.Cereals and grains(such as wheat, maize, and barley) represent the largest segment, reflecting their central role in Oman's food security and agricultural output. The expansion of fruit and vegetable cultivation is also increasing demand for specialized herbicide solutions to maximize yield and quality.

The Oman Herbicides Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Syngenta AG, Bayer CropScience AG, Corteva Agriscience, FMC Corporation, UPL Limited, ADAMA Agricultural Solutions Ltd., Nufarm Limited, Sumitomo Chemical Co., Ltd., Marrone Bio Innovations, Inc., Albaugh LLC, Belchim Crop Protection NV/SA, Cheminova A/S (now part of FMC Corporation), Isagro S.p.A. (now part of Gowan Company), Arysta LifeScience Corporation (now part of UPL Limited) contribute to innovation, geographic expansion, and service delivery in this space.

The Oman herbicides market is poised for significant transformation as it adapts to evolving agricultural practices and consumer preferences. The increasing emphasis on sustainable agriculture and the integration of precision farming technologies are expected to drive innovation in herbicide formulations. Additionally, the collaboration between agricultural research institutions and private companies will likely enhance the development of eco-friendly herbicides, aligning with global trends towards sustainability. This dynamic environment presents both challenges and opportunities for stakeholders in the herbicide sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Synthetic Herbicides Bio-Herbicides Selective Herbicides Non-Selective Herbicides Pre-Emergent Herbicides Post-Emergent Herbicides Residual Herbicides Contact Herbicides Others |

| By Crop Type | Cereals & Grains (e.g., wheat, maize, barley) Fruits & Vegetables Oilseeds & Pulses Turf & Ornamentals Plantation Crops Others |

| By Application | Crop Protection Non-Crop Protection Soil Management Others |

| By Formulation | Liquid Formulations Granular Formulations Soluble Concentrates Others |

| By Distribution Channel | Direct Sales Retail Stores Online Sales Distributors Others |

| By Geography | Muscat Salalah Sohar Nizwa Others |

| By Policy Support | Subsidies Tax Exemptions Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cereal Crop Herbicide Usage | 100 | Farmers, Agronomists |

| Vegetable Crop Herbicide Preferences | 70 | Horticulturists, Agricultural Retailers |

| Herbicide Distribution Channels | 50 | Distributors, Supply Chain Managers |

| Impact of Regulations on Herbicide Use | 40 | Policy Makers, Environmental Consultants |

| Trends in Organic Herbicide Alternatives | 60 | Organic Farmers, Agricultural Researchers |

The Oman Herbicides Market is valued at approximately USD 70 million, reflecting a five-year historical analysis. This growth is driven by increasing agricultural productivity and the need for effective weed management solutions in high-value crop cultivation.