Region:Middle East

Author(s):Dev

Product Code:KRAA8199

Pages:85

Published On:November 2025

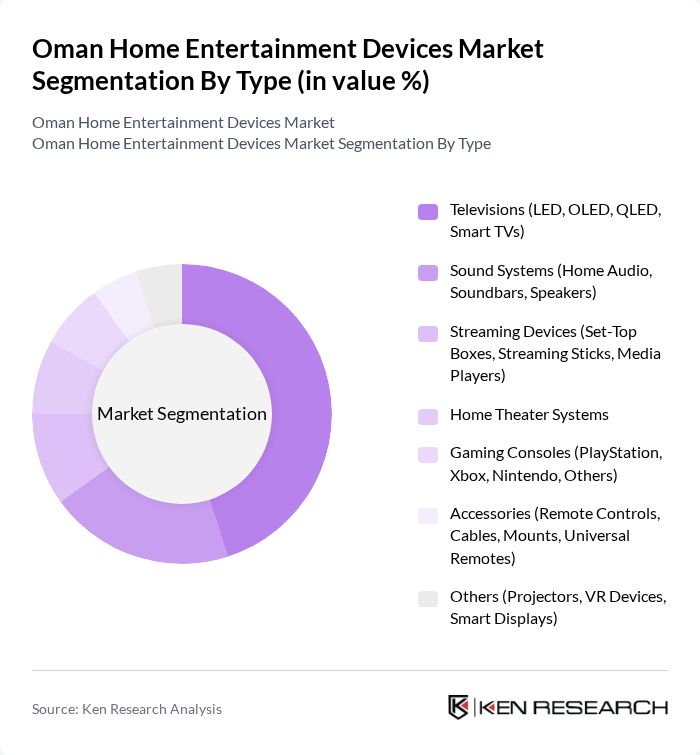

By Type:The market is segmented into various types of home entertainment devices, including televisions, sound systems, streaming devices, home theater systems, gaming consoles, accessories, and others. Among these, televisions—especially smart TVs—dominate the market due to their advanced features, integration with streaming services, and increasing consumer preference for larger screen sizes and enhanced picture quality. This segment remains the largest contributor to market revenue, reflecting the shift towards premium models and immersive viewing experiences .

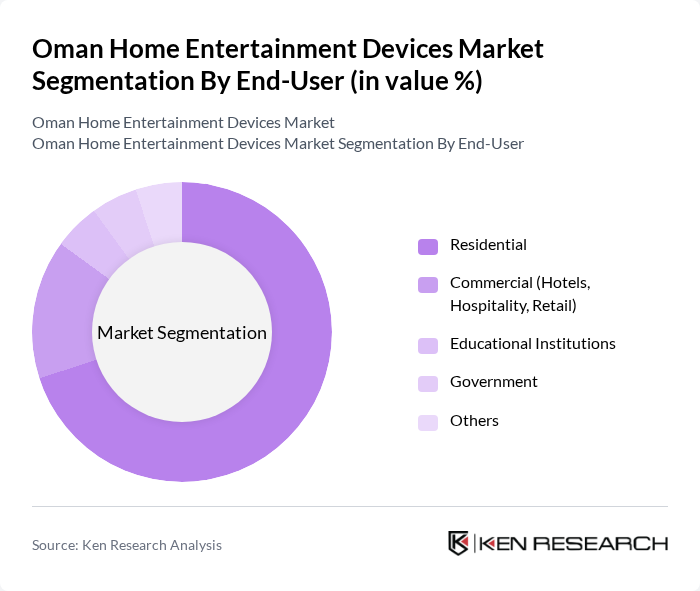

By End-User:The end-user segmentation includes residential, commercial, educational institutions, government, and others. The residential segment is the largest, driven by the increasing trend of home entertainment consumption, especially during and after the pandemic. Consumers are investing in high-quality devices to enhance their at-home viewing experiences, leading to a surge in demand for televisions and sound systems. The commercial segment, including hotels and retail, also shows steady growth as businesses upgrade their entertainment offerings to attract customers .

The Oman Home Entertainment Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Electronics, LG Electronics, Sony Corporation, Panasonic Corporation, Philips Electronics, Bose Corporation, JBL (Harman International), Amazon (Fire TV), Google (Chromecast), Xiaomi Corporation, Hisense, TCL Technology, Vizio, Denon, Sharp Corporation, Super General Company, Geepas (Western International Group), Krypton, Cyber, Bosch, Braun, Hitachi, Garmin contribute to innovation, geographic expansion, and service delivery in this space .

The Oman home entertainment devices market is poised for significant transformation as consumer preferences shift towards advanced technologies and integrated systems. With the increasing adoption of streaming services and smart home devices, manufacturers are likely to focus on innovation and product differentiation. Additionally, the expansion of e-commerce platforms will facilitate easier access to a wider range of products, enhancing consumer choice. As the market evolves, companies that adapt to these trends will be better positioned to capture emerging opportunities and drive growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Televisions (LED, OLED, QLED, Smart TVs) Sound Systems (Home Audio, Soundbars, Speakers) Streaming Devices (Set-Top Boxes, Streaming Sticks, Media Players) Home Theater Systems Gaming Consoles (PlayStation, Xbox, Nintendo, Others) Accessories (Remote Controls, Cables, Mounts, Universal Remotes) Others (Projectors, VR Devices, Smart Displays) |

| By End-User | Residential Commercial (Hotels, Hospitality, Retail) Educational Institutions Government Others |

| By Distribution Channel | Online Retail (E-commerce Platforms, Brand Websites) Offline Retail (Electronics Stores, Hypermarkets, Supermarkets) Direct Sales (Brand Showrooms, Corporate Sales) Others (Distributors, Value-Added Resellers) |

| By Brand | Premium Brands (Samsung, LG, Sony, Bose) Mid-Range Brands (Panasonic, Philips, Hisense, TCL) Budget Brands (Geepas, Super General, Krypton, Cyber) Others |

| By Technology | LED OLED QLED LCD Others (Plasma, DLP, Laser) |

| By Consumer Demographics | Age Group Income Level Urban vs Rural Others |

| By Price Range | Low-End Mid-Range High-End Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Retailers | 100 | Store Managers, Sales Representatives |

| Home Entertainment Device Manufacturers | 60 | Product Managers, Marketing Directors |

| Online Retail Platforms | 50 | eCommerce Managers, Data Analysts |

| Consumer Focus Groups | 40 | Tech Enthusiasts, Early Adopters |

| Industry Experts and Analysts | 30 | Market Analysts, Industry Consultants |

The Oman Home Entertainment Devices Market is valued at approximately USD 500 million, reflecting a significant growth trend driven by rising disposable incomes, urbanization, and a demand for advanced technology in home entertainment systems.