Region:Middle East

Author(s):Shubham

Product Code:KRAD2621

Pages:85

Published On:January 2026

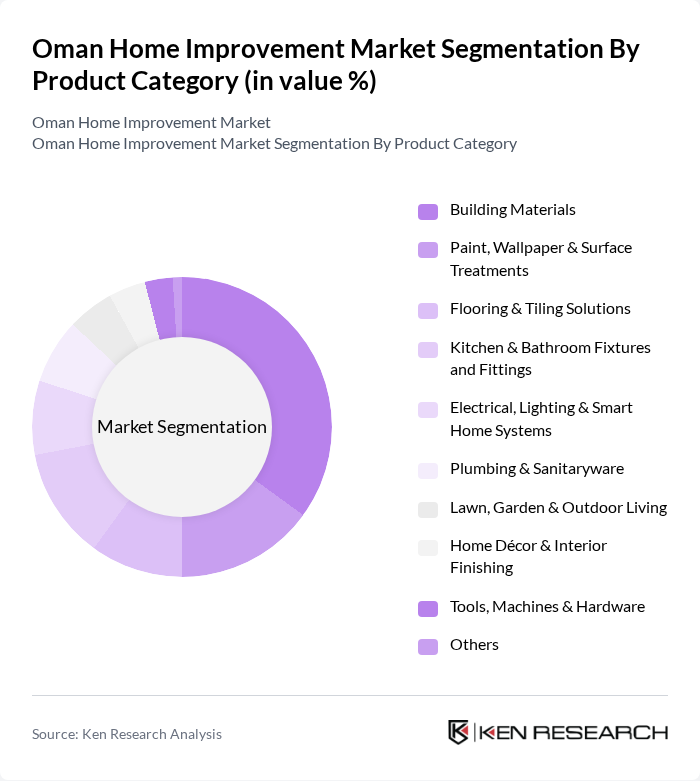

By Product Category:The product category segmentation of the Oman Home Improvement Market includes various subsegments such as Building Materials, Paint, Wallpaper & Surface Treatments, Flooring & Tiling Solutions, Kitchen & Bathroom Fixtures and Fittings, Electrical, Lighting & Smart Home Systems, Plumbing & Sanitaryware, Lawn, Garden & Outdoor Living, Home Décor & Interior Finishing, Tools, Machines & Hardware, and Others. Building Materials represents the leading subsegment, supported by the expansion of the construction industry and the growing hardware and building materials trade in the country. Demand for quality building materials is fueled by both residential and commercial projects, including villas, apartments, and mixed-use developments, with increasing emphasis on durable, compliant, and aesthetically appealing products. The broader shift towards modern and sustainable construction practices, such as better insulation, improved façades, and higher-grade finishes, continues to influence purchasing patterns in this segment.

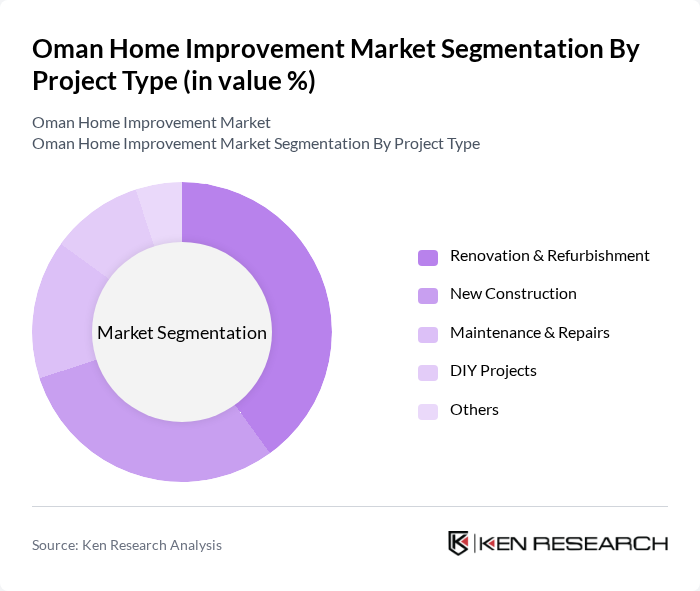

By Project Type:The project type segmentation includes Renovation & Refurbishment, New Construction, Maintenance & Repairs, DIY Projects, and Others. Renovation & Refurbishment is the dominant segment, underpinned by a rising stock of existing villas and apartments requiring upgrades, energy-efficiency improvements, and modernized finishes to meet evolving consumer preferences. This trend is supported by growing middle-income households, lifestyle-driven upgrades, and the need to refresh older housing built during earlier waves of development. The DIY Projects segment is also gaining traction, supported by the expansion of DIY and hardware store formats and online channels, as consumers increasingly undertake smaller-scale painting, décor, and repair tasks themselves for cost savings and personalization.

The Oman Home Improvement Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Trading Establishment (Home Mart, etc.), Khimji Ramdas, Al-Futtaim Group (IKEA, ACE, etc.), Landmark Group (Home Centre, Home Box), Al Seeb Technical Establishment (SARCO), Al Maha Ceramics SAOG, Hadid International Services (Building Materials Division), Assarain Group of Companies (Assarain Concrete, Tiles & Sanitaryware), Towell Group (Retail & Building Materials), Bahwan Engineering Group (Civil & Interiors Division), Al Anwar Ceramic Tiles Company, Muscat Home Centre, Oman Cement Company, Raysut Cement Company, and other emerging local home improvement retailers contribute to innovation, geographic expansion, and service delivery in this space. These companies benefit from Oman’s ongoing construction and housing development, with building materials, ceramics, sanitaryware, and home furnishings forming key product categories supplied to both trade and retail channels.

The Oman home improvement market is poised for significant growth, driven by increasing disposable incomes and urbanization trends. As more consumers seek to enhance their living spaces, the demand for innovative and sustainable home solutions will rise. Additionally, government initiatives aimed at housing development will further stimulate the market. However, challenges such as high raw material costs and limited financing options may temper growth. Overall, the market is expected to adapt and evolve, presenting new opportunities for stakeholders.

| Segment | Sub-Segments |

|---|---|

| By Product Category | Building Materials (cement, bricks, doors, windows, roofing, insulation) Paint, Wallpaper & Surface Treatments Flooring & Tiling Solutions Kitchen & Bathroom Fixtures and Fittings Electrical, Lighting & Smart Home Systems Plumbing & Sanitaryware Lawn, Garden & Outdoor Living Home Décor & Interior Finishing Tools, Machines & Hardware Others |

| By Project Type | Renovation & Refurbishment New Construction Maintenance & Repairs DIY Projects Others |

| By End-User | Residential Commercial (Retail, Offices, Hospitality) Industrial (Manufacturing, Warehousing) Government & Infrastructure Projects Others |

| By Distribution Channel | Organized Retail (DIY Chains, Hypermarkets) Independent Hardware & Specialty Stores Building Material Yards & Wholesale Distributors Online Retail / E-commerce Platforms Direct Sales (B2B) Others |

| By Technology & Solution Type | Smart Home & Home Automation Energy-Efficient Lighting & Appliances Sustainable & Green Building Materials Modular Kitchens & Storage Solutions Others |

| By Region | Muscat Dhofar Al Batinah Al Dakhiliyah Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Homeowners' Spending Patterns | 120 | Homeowners, Property Managers |

| Retailer Insights on Product Demand | 80 | Store Managers, Sales Representatives |

| Contractor Perspectives on Market Trends | 60 | General Contractors, Subcontractors |

| Supplier Feedback on Distribution Challenges | 50 | Supply Chain Managers, Product Distributors |

| Consumer Preferences in Home Improvement | 100 | Homeowners, DIY Enthusiasts |

The Oman Home Improvement Market is valued at approximately USD 2.1 billion, driven by the growth in construction, residential real estate, and hardware segments, alongside increasing urbanization and demand for home renovation projects.