Region:Middle East

Author(s):Shubham

Product Code:KRAD2622

Pages:90

Published On:January 2026

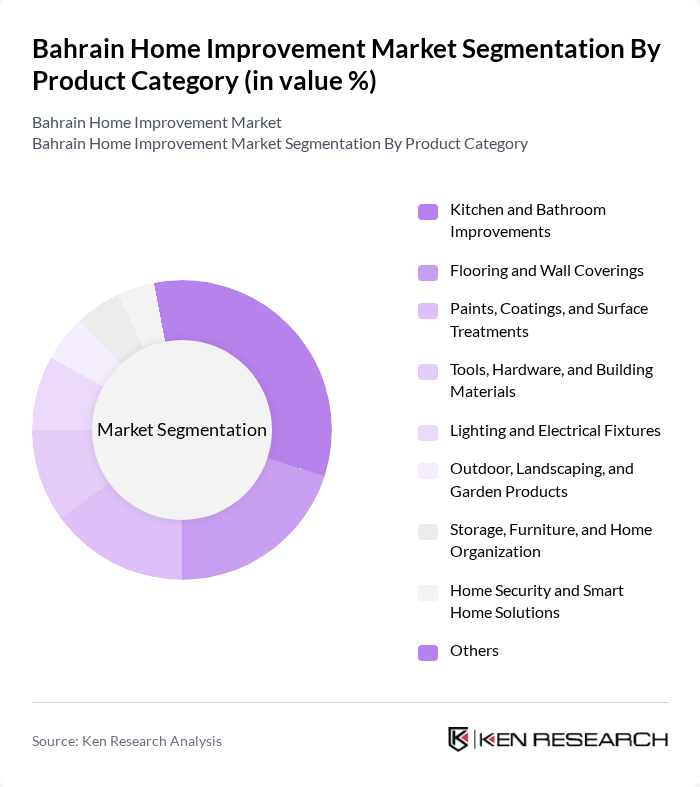

By Product Category:The product category segmentation includes various subsegments such as Kitchen and Bathroom Improvements, Flooring and Wall Coverings, Paints, Coatings, and Surface Treatments, Tools, Hardware, and Building Materials, Lighting and Electrical Fixtures, Outdoor, Landscaping, and Garden Products, Storage, Furniture, and Home Organization, Home Security and Smart Home Solutions, and Others. Among these, Kitchen and Bathroom Improvements are leading the market due to the increasing focus on modernizing these essential spaces in homes through premium fittings, water-efficient fixtures, and contemporary designs. Consumers are investing in high-quality fixtures, integrated storage, and innovative designs, driving significant growth in this subsegment and aligning with global trends where kitchen and bathroom upgrades account for a substantial share of home improvement spending.

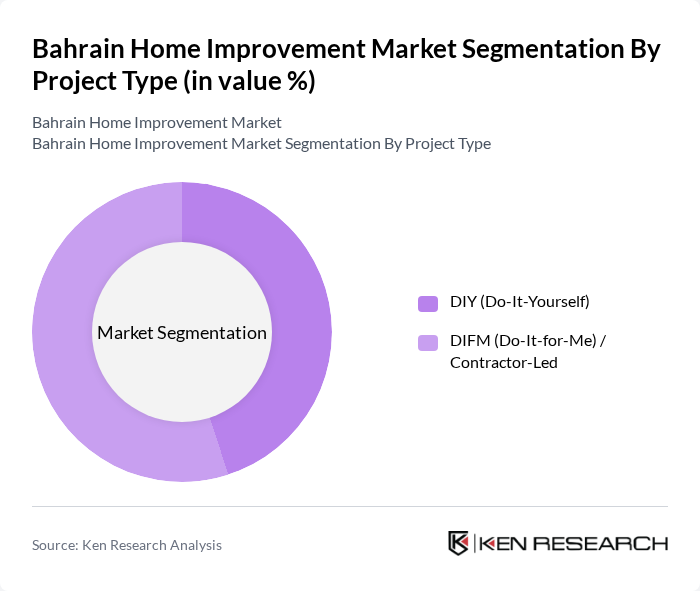

By Project Type:The project type segmentation includes DIY (Do-It-Yourself) and DIFM (Do-It-for-Me) / Contractor-Led. The DIY segment is gaining traction as more consumers are inclined to undertake home improvement projects themselves, supported by the availability of online tutorials, e-commerce platforms, and user-friendly products that mirror global DIY trends in home improvement. However, the DIFM segment remains significant as many homeowners prefer to hire professionals for complex renovations, electrical and plumbing works, and structural changes, ensuring quality, regulatory compliance, and efficiency in their projects.

The Bahrain Home Improvement Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA Bahrain, Home Centre Bahrain, Ace Hardware (Al-Futtaim ACE), Manazel Bahrain, Haji Hassan Group, Khamis Al Ansari Trading Co., Bahrain Hardware Company, Mohammed Fakhroo & Bros., Bahrain Building Materials Company, Al Zayani Investments (Home & Building Materials), RG Architects & Interiors, Mohammed Jalal & Sons, Awal Building Materials, AlMuftah Home & Garden, Other Notable Local Retailers and Contractors contribute to innovation, geographic expansion, and service delivery in this space, with offerings spanning furniture, décor, hardware, building materials, and turnkey renovation services.

The Bahrain home improvement market is poised for significant transformation in the coming years, driven by technological advancements and changing consumer preferences. The integration of smart home technologies is expected to reshape product offerings, while a growing emphasis on sustainability will influence purchasing decisions. Additionally, the rise of e-commerce platforms will facilitate easier access to home improvement products, enhancing market reach and consumer engagement. Overall, these trends indicate a dynamic and evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Product Category | Kitchen and Bathroom Improvements Flooring and Wall Coverings Paints, Coatings, and Surface Treatments Tools, Hardware, and Building Materials Lighting and Electrical Fixtures Outdoor, Landscaping, and Garden Products Storage, Furniture, and Home Organization Home Security and Smart Home Solutions Others |

| By Project Type | DIY (Do-It-Yourself) DIFM (Do-It-for-Me) / Contractor-Led |

| By End-User | Residential – Apartments/Flats Residential – Villas/Townhouses Commercial (Retail, Offices, Hospitality) Public and Institutional Buildings Others |

| By Application | Renovation and Remodeling New Home Fit-Out and Interior Completion Repair and Maintenance Energy-Efficiency and Sustainability Upgrades Others |

| By Distribution Channel | Home Improvement and Hardware Retailers Furniture and Home Décor Stores Building Material Suppliers and Trade Counters E-commerce and Online Marketplaces Others |

| By Technology Adoption | Smart Home and Automation Systems Energy-Efficient and Green Building Solutions Modular and Prefabricated Improvement Solutions AR/VR and Digital Design Tools Others |

| By Region | Capital Governorate Muharraq Governorate Northern Governorate Southern Governorate Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Home Renovation Projects | 120 | Homeowners, Property Managers |

| DIY Product Purchases | 100 | DIY Enthusiasts, Retail Customers |

| Professional Contractor Insights | 80 | General Contractors, Subcontractors |

| Interior Design Trends | 70 | Interior Designers, Architects |

| Home Improvement Retail Experience | 90 | Store Managers, Sales Associates |

The Bahrain Home Improvement Market is valued at approximately USD 1.0 billion, driven by increasing disposable incomes, a growing population, and a rising trend in home renovations and improvements as households upgrade their living spaces.