Region:Middle East

Author(s):Shubham

Product Code:KRAB7281

Pages:90

Published On:October 2025

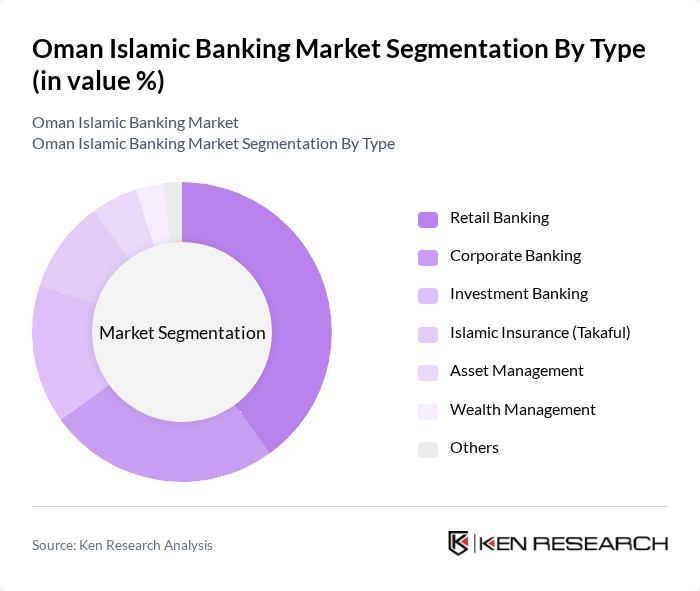

By Type:

The market is segmented into various types, including Retail Banking, Corporate Banking, Investment Banking, Islamic Insurance (Takaful), Asset Management, Wealth Management, and Others. Among these, Retail Banking is the leading sub-segment, driven by the increasing number of individual customers seeking Sharia-compliant personal finance solutions. The demand for home financing and personal loans has surged, reflecting a shift in consumer preferences towards Islamic banking products. Corporate Banking also plays a significant role, catering to businesses looking for ethical financing options.

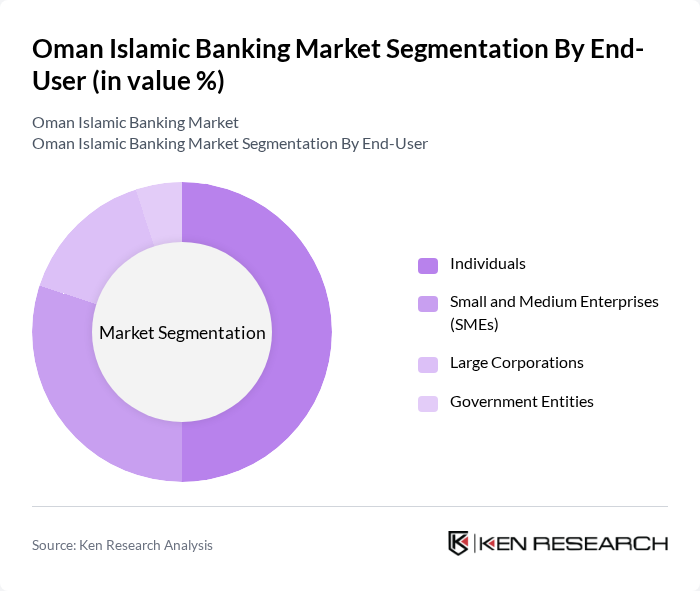

By End-User:

The end-user segmentation includes Individuals, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. The Individuals segment dominates the market, as personal banking services are increasingly tailored to meet the needs of retail customers. The rise in disposable income and financial literacy among the population has led to a greater demand for personal loans, savings accounts, and investment products. SMEs are also significant contributors, seeking Islamic financing options to support their growth and operational needs.

The Oman Islamic Banking Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bank Muscat, Oman Arab Bank, Alizz Islamic Bank, Bank Dhofar, National Bank of Oman, Oman International Bank, HSBC Bank Oman, Qatar Islamic Bank (Oman), Abu Dhabi Islamic Bank, Muscat Finance, Oman Investment and Finance Company, Dhofar International Development and Investment Holding Company, Al Izz Islamic Bank, Oman Housing Bank, Oman National Investment Corporation Holding contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Islamic banking sector in Oman appears promising, driven by increasing consumer demand for ethical financial solutions and the ongoing digital transformation. As the government continues to support Islamic finance initiatives, the sector is likely to see enhanced regulatory frameworks that promote growth. Additionally, the collaboration with fintech companies is expected to innovate service delivery, making Islamic banking more appealing to a diverse customer base, including non-Muslims, thereby expanding market reach and enhancing financial inclusion.

| Segment | Sub-Segments |

|---|---|

| By Type | Retail Banking Corporate Banking Investment Banking Islamic Insurance (Takaful) Asset Management Wealth Management Others |

| By End-User | Individuals Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Product Offering | Murabaha Ijarah Sukuk Mudarabah |

| By Distribution Channel | Branch Banking Online Banking Mobile Banking Direct Sales |

| By Customer Segment | Retail Customers Corporate Clients Institutional Investors |

| By Geographical Presence | Urban Areas Rural Areas |

| By Regulatory Compliance Level | Fully Compliant Partially Compliant Non-Compliant |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Banking Customers | 150 | Individual Account Holders, Retail Banking Managers |

| Corporate Banking Clients | 100 | Corporate Account Managers, CFOs of SMEs |

| Islamic Financing Product Users | 80 | Product Managers, Marketing Executives |

| Regulatory Stakeholders | 50 | Regulatory Officials, Compliance Officers |

| Islamic Banking Analysts | 70 | Financial Analysts, Economic Researchers |

The Oman Islamic Banking Market is valued at approximately USD 7 billion, reflecting significant growth driven by the increasing demand for Sharia-compliant financial products and a supportive regulatory environment from the government.