Region:Middle East

Author(s):Geetanshi

Product Code:KRAC3089

Pages:96

Published On:October 2025

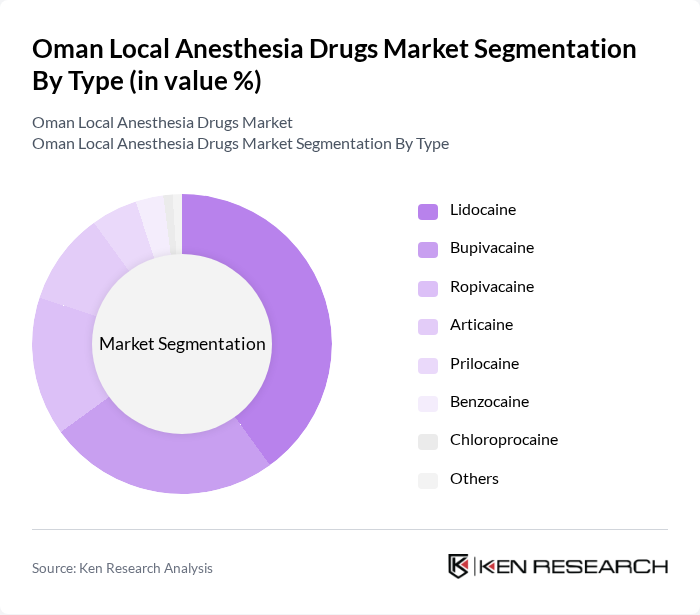

By Type:The local anesthesia drugs market in Oman is segmented into Lidocaine, Bupivacaine, Ropivacaine, Articaine, Prilocaine, Benzocaine, Chloroprocaine, and Others. Lidocaine remains the most widely used due to its rapid onset and effectiveness in a broad range of medical procedures, particularly dental and minor surgical interventions. Bupivacaine and Ropivacaine are increasingly preferred in surgical settings for their long-lasting effects and favorable safety profiles. Articaine is commonly used in dental applications due to its superior tissue penetration. Prilocaine, Benzocaine, and Chloroprocaine serve niche roles in specific procedures or patient populations.

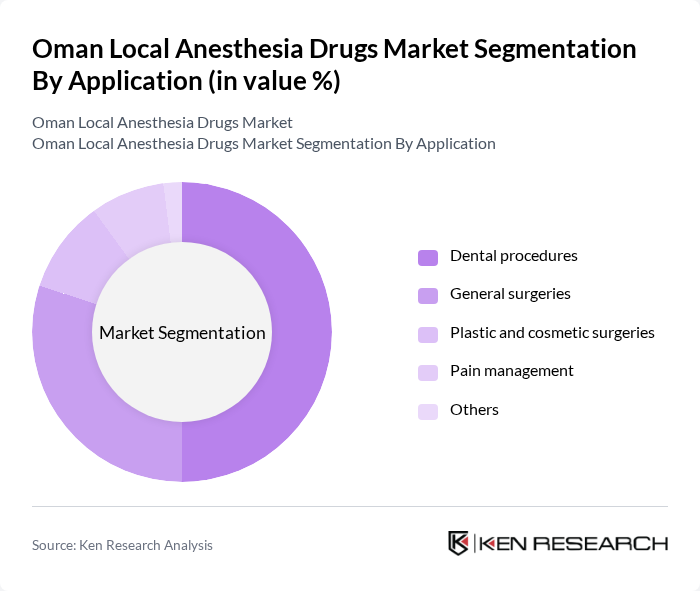

By Application:Applications of local anesthesia drugs in Oman include dental procedures, general surgeries, plastic and cosmetic surgeries, pain management, and other medical interventions. Dental procedures account for the largest share due to the high frequency of dental surgeries and the critical need for effective pain management in this field. General surgeries also represent a substantial segment, reflecting the essential role of local anesthetics in a wide range of surgical interventions. The use of local anesthetics in plastic and cosmetic surgeries is growing, driven by increased demand for minimally invasive procedures. Pain management applications are expanding as healthcare providers focus on improving patient comfort and outcomes.

The Oman Local Anesthesia Drugs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aspen Pharmacare Holdings Limited, Pfizer Inc., Novartis AG (Sandoz division), Sanofi S.A., Johnson & Johnson (Janssen Pharmaceuticals), B. Braun Melsungen AG, AbbVie Inc. (Allergan), Hikma Pharmaceuticals PLC, Teva Pharmaceutical Industries Ltd., Viatris Inc. (formerly Mylan N.V.), Sandoz (a Novartis division), Mallinckrodt Pharmaceuticals, Endo International plc, AcelRx Pharmaceuticals, Inc., Pacira BioSciences, Inc., Aspen Pharma Middle East FZ-LLC, Oman Pharmaceutical Products Co. LLC, and Julphar (Gulf Pharmaceutical Industries) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the local anesthesia drugs market in Oman appears promising, driven by the increasing adoption of minimally invasive surgical techniques and a growing emphasis on patient comfort. As healthcare providers continue to prioritize effective pain management, the integration of advanced drug delivery systems is likely to enhance the efficacy of local anesthesia. Additionally, collaborations between pharmaceutical companies and healthcare institutions will foster innovation, ensuring that the market remains responsive to evolving patient needs and technological advancements.

| Segment | Sub-Segments |

|---|---|

| By Type | Lidocaine Bupivacaine Ropivacaine Articaine Prilocaine Benzocaine Chloroprocaine Others |

| By Application | Dental procedures General surgeries Plastic and cosmetic surgeries Pain management Others |

| By End-User | Hospitals Clinics Ambulatory surgical centers Dental clinics Others |

| By Distribution Channel | Direct sales Wholesalers Online pharmacies Hospital pharmacies Others |

| By Formulation | Injectable Topical Gel Patch Spray Others |

| By Packaging Type | Vials Pre-filled syringes Ampoules Single-dose ampoules Others |

| By Price Range | Low Medium High Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Anesthesiology Practices | 60 | Anesthesiologists, Nurse Anesthetists |

| Dental Clinics | 50 | Dentists, Oral Surgeons |

| Pharmaceutical Distributors | 40 | Sales Managers, Product Managers |

| Hospital Procurement Departments | 45 | Procurement Officers, Supply Chain Managers |

| Regulatory Bodies | 40 | Health Policy Analysts, Regulatory Affairs Specialists |

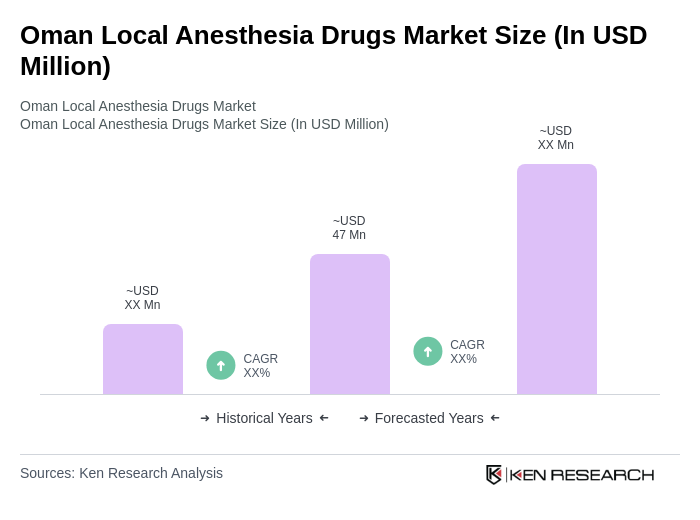

The Oman Local Anesthesia Drugs Market is valued at approximately USD 47 million, reflecting a five-year historical analysis. This valuation is influenced by the increasing prevalence of dental and surgical procedures and advancements in drug formulations.