Global General Anesthesia Drugs Market Overview

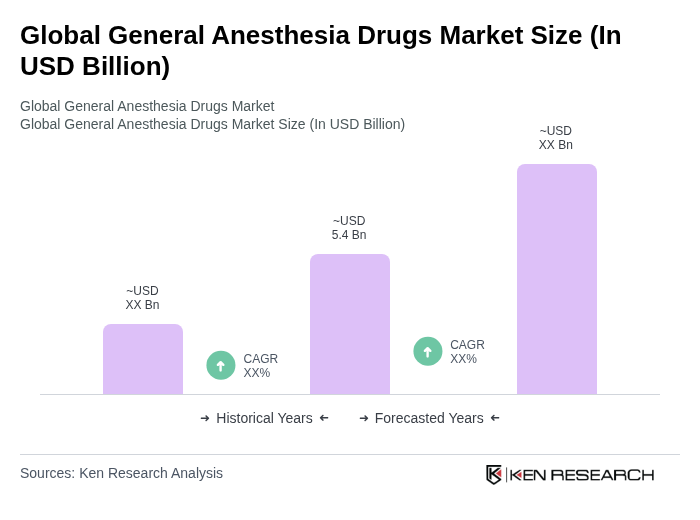

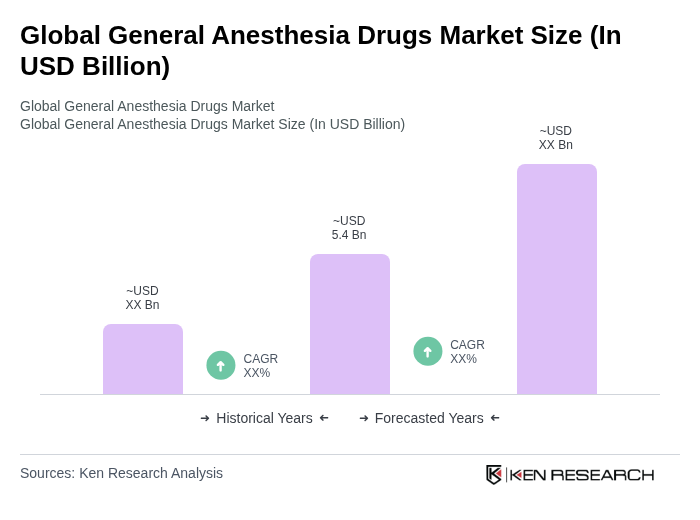

- The Global General Anesthesia Drugs Market is valued at USD 5.4 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing number of surgical procedures, advancements in anesthesia technology, the rising prevalence of chronic diseases, and a growing geriatric population requiring surgical interventions. The demand for effective and safe anesthesia solutions continues to rise, reflecting the market's robust expansion.

- Key players in this market include the United States, Germany, and Japan, which dominate due to their advanced healthcare infrastructure, high surgical volumes, and significant investments in medical research and development. North America, led by the United States, holds the largest market share, while Germany and Japan are recognized for their innovation and high standards in surgical care. These countries are at the forefront of innovation in anesthesia drugs, contributing to their leadership in the global market.

- In 2023, the U.S. Food and Drug Administration (FDA) implemented the “Anesthetics and Analgesics Drug Products Advisory Committee Guidance Update, 2023,” issued by the U.S. Food and Drug Administration. This regulation introduced enhanced requirements for clinical trial design, post-market surveillance, and risk mitigation strategies for general anesthesia drugs, mandating comprehensive safety and efficacy data prior to approval and ongoing monitoring for adverse events in clinical practice.

Global General Anesthesia Drugs Market Segmentation

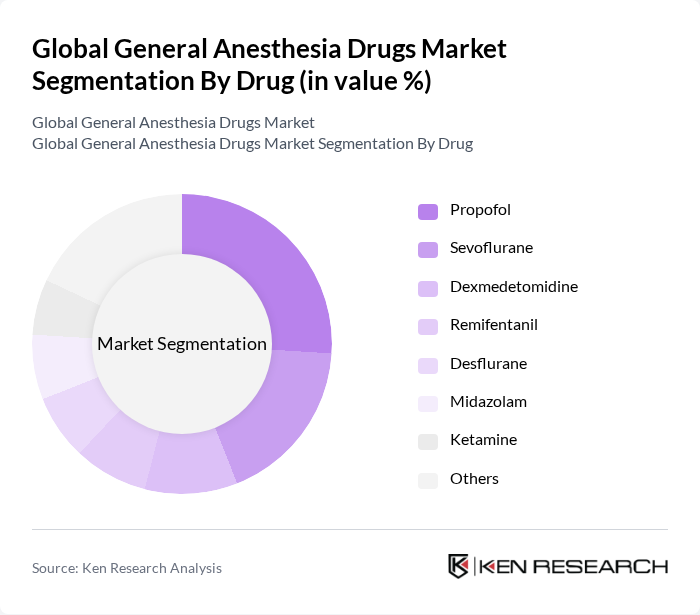

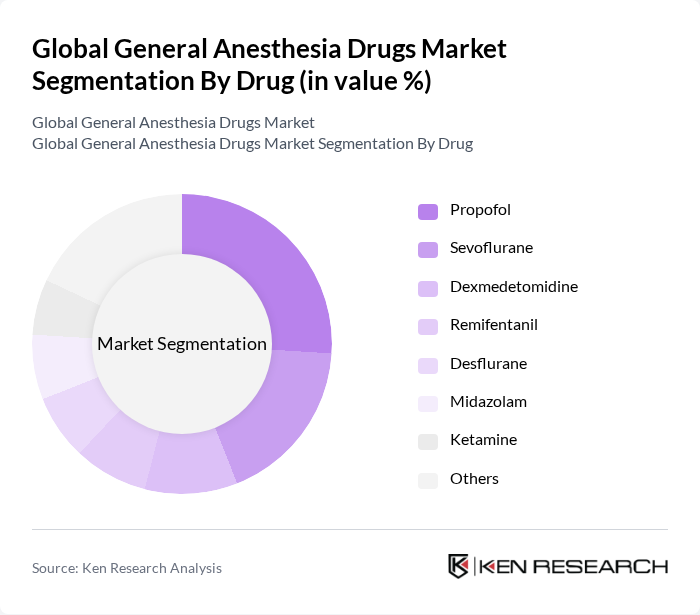

By Drug:The market is segmented into various drugs, including Propofol, Sevoflurane, Dexmedetomidine, Remifentanil, Desflurane, Midazolam, Ketamine, and Others. Among these, Propofol is the leading drug due to its rapid onset and recovery profile, making it a preferred choice for outpatient and ambulatory surgeries. Sevoflurane follows closely, favored for its low blood solubility, minimal side effects, and suitability for pediatric and adult anesthesia. The increasing preference for these drugs in surgical settings is driven by their safety, efficacy, and favorable pharmacokinetic properties.

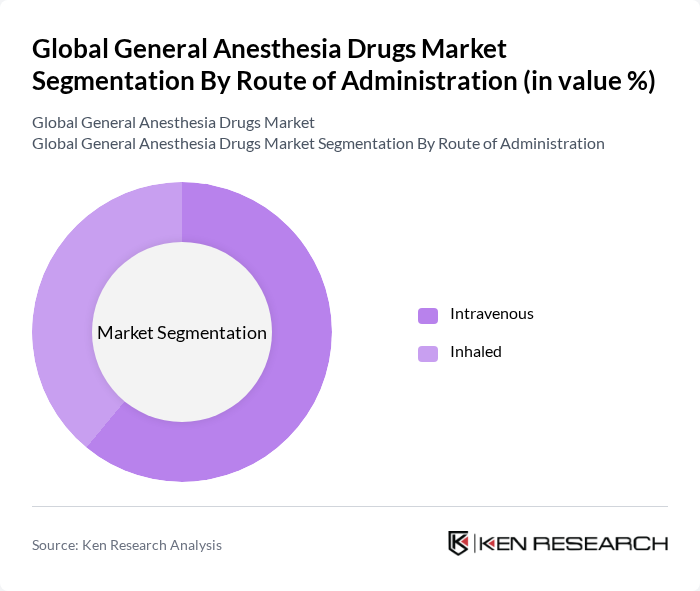

By Route of Administration:The market is divided into Intravenous and Inhaled routes. The Intravenous route is the most widely used due to its rapid action, ease of titration, and suitability for both induction and maintenance of anesthesia, particularly in emergency and ambulatory settings. Inhaled anesthetics, while also widely utilized, are preferred in controlled environments such as operating rooms for maintenance of anesthesia. The preference for intravenous administration is driven by its effectiveness in achieving quick sedation and anesthesia, as well as the increasing adoption of short-stay and day-care surgeries.

Global General Anesthesia Drugs Market Competitive Landscape

The Global General Anesthesia Drugs Market is characterized by a dynamic mix of regional and international players. Leading participants such as AbbVie Inc., Baxter International Inc., Fresenius Kabi AG, Hikma Pharmaceuticals PLC, Viatris Inc. (formerly Mylan N.V.), Pfizer Inc., Roche Holding AG, Aspen Pharmacare Holdings Limited, B. Braun Melsungen AG, Merck & Co., Inc., Johnson & Johnson, AstraZeneca PLC, GlaxoSmithKline plc (GSK), Novartis AG, Teva Pharmaceutical Industries Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

Global General Anesthesia Drugs Market Industry Analysis

Growth Drivers

- Increasing Surgical Procedures Globally:The global surgical procedures are projected to reach approximately 234 million annually, driven by an aging population and advancements in surgical techniques. The World Health Organization estimates that around 11% of the global population undergoes surgery each year, significantly boosting the demand for general anesthesia drugs. This surge in surgical interventions necessitates effective anesthesia management, thereby propelling market growth in the None region.

- Rising Prevalence of Chronic Diseases:Chronic diseases, such as cardiovascular disorders and diabetes, are on the rise, affecting over 1.5 billion people globally. The increasing incidence of these conditions often requires surgical interventions, which in turn drives the demand for general anesthesia. The Centers for Disease Control and Prevention (CDC) reports that chronic diseases account for approximately 70% of all deaths in the United States, highlighting the urgent need for effective anesthesia solutions in surgical settings.

- Advancements in Anesthesia Technology:Technological innovations in anesthesia delivery systems and monitoring equipment are enhancing patient safety and efficacy. The global market for anesthesia devices is expected to exceed $10 billion, reflecting a compound annual growth rate of 6.5%. These advancements facilitate more precise dosing and monitoring, which are critical in improving patient outcomes during surgeries, thus driving the demand for general anesthesia drugs in the None region.

Market Challenges

- Stringent Regulatory Requirements:The regulatory landscape for anesthesia drugs is complex, with agencies like the FDA enforcing rigorous approval processes. In future, the FDA is expected to review over 1,000 new drug applications, with a significant portion related to anesthesia. These stringent regulations can delay the introduction of new products, hindering market growth and innovation in the None region, as companies navigate compliance challenges.

- High Cost of Anesthesia Drugs:The cost of general anesthesia drugs can be prohibitively high, with some formulations exceeding $500 per dose. This financial burden can limit access, particularly in developing regions where healthcare budgets are constrained. The World Bank indicates that healthcare spending in low-income countries averages only $50 per capita, making it challenging to procure advanced anesthesia drugs, thus posing a significant market challenge.

Global General Anesthesia Drugs Market Future Outlook

The future of the general anesthesia drugs market appears promising, driven by ongoing technological advancements and an increasing focus on patient safety. As healthcare systems evolve, the integration of digital health technologies is expected to enhance monitoring and management of anesthesia, improving outcomes. Additionally, the growing trend towards personalized medicine will likely lead to tailored anesthesia solutions, addressing individual patient needs and preferences, thereby fostering market growth in the None region.

Market Opportunities

- Expansion in Emerging Markets:Emerging markets present significant growth opportunities for general anesthesia drugs, with healthcare expenditure projected to increase by 10% annually. Countries like India and Brazil are investing heavily in healthcare infrastructure, which will enhance access to surgical procedures and anesthesia, creating a robust demand for these drugs in the None region.

- Development of Innovative Drug Formulations:The market is witnessing a shift towards innovative drug formulations that enhance efficacy and reduce side effects. Research and development investments are expected to exceed $5 billion, focusing on creating safer and more effective anesthesia options. This innovation will cater to the growing demand for improved patient outcomes, presenting a lucrative opportunity in the None region.