Region:Asia

Author(s):Dev

Product Code:KRAD5133

Pages:88

Published On:December 2025

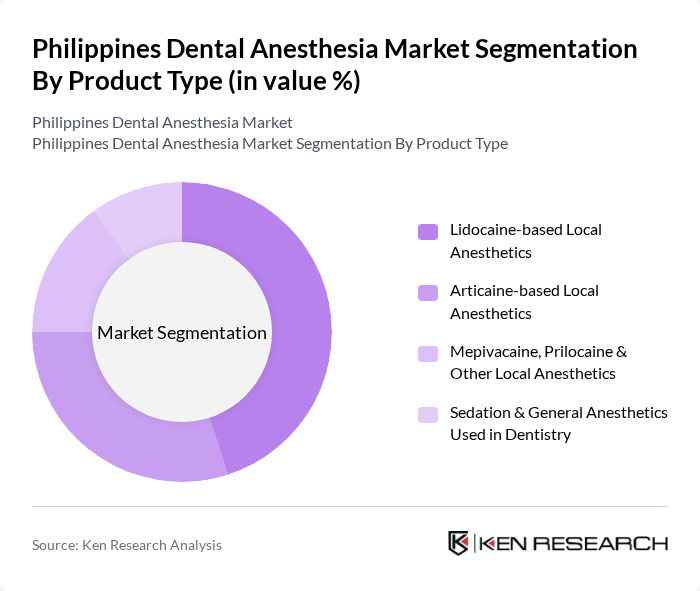

By Product Type:The product type segmentation includes various anesthetic agents used in dental procedures. The subsegments are Lidocaine-based Local Anesthetics, Articaine-based Local Anesthetics, Mepivacaine, Prilocaine & Other Local Anesthetics, and Sedation & General Anesthetics Used in Dentistry. Among these, Lidocaine-based local anesthetics dominate the market due to their widespread use and effectiveness in providing pain relief during dental procedures. Articaine is also gaining traction due to its rapid onset and effectiveness in various dental applications.

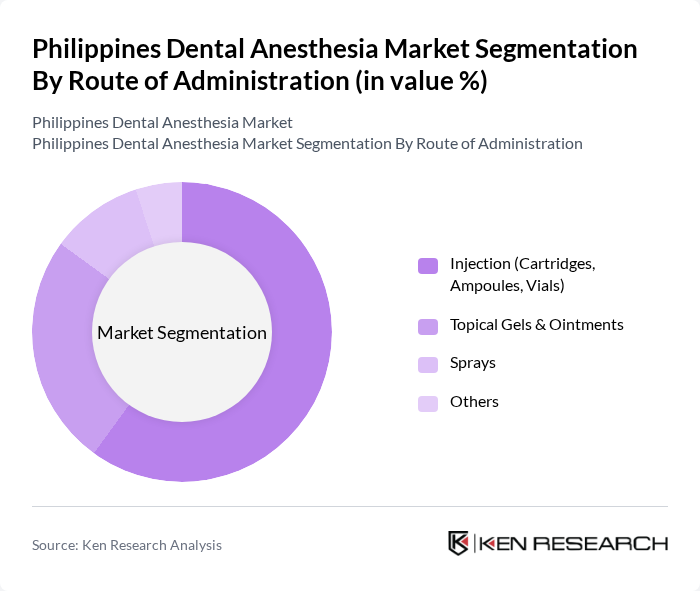

By Route of Administration:This segmentation includes the various methods through which dental anesthetics are administered. The subsegments are Injection (Cartridges, Ampoules, Vials), Topical Gels & Ointments, Sprays, and Others. The injection route dominates the market due to its effectiveness and rapid onset of action, making it the preferred choice among dental practitioners. Topical gels are also popular for minor procedures, while sprays are used less frequently.

The Philippines Dental Anesthesia Market is characterized by a dynamic mix of regional and international players. Leading participants such as Septodont, Dentsply Sirona, 3M Company, Primex Pharmaceuticals AG, Hikma Pharmaceuticals PLC, Pfizer Inc., Aspen Pharmacare Holdings Limited, Fresenius Kabi AG, Henry Schein, Inc., Unilab (United Laboratories, Inc.), Lloyd Laboratories, Inc., Metro Drug, Inc., Zuellig Pharma Philippines, Patterson Companies, Inc., GC Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the dental anesthesia market in the Philippines appears promising, driven by ongoing advancements in technology and increasing public awareness of dental health. As the population continues to grow and urbanize, the demand for dental services, including anesthesia, is expected to rise. Additionally, the government’s focus on improving healthcare infrastructure will likely facilitate better access to dental care, further propelling market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Lidocaine-based Local Anesthetics Articaine-based Local Anesthetics Mepivacaine, Prilocaine & Other Local Anesthetics Sedation & General Anesthetics Used in Dentistry |

| By Route of Administration | Injection (Cartridges, Ampoules, Vials) Topical Gels & Ointments Sprays Others |

| By End-User | Private Dental Clinics Hospital-based Dental Departments Dental Schools & Training Institutions Public Health Dental Centers |

| By Application | Restorative & Preventive Procedures Oral & Maxillofacial Surgery Implantology & Periodontal Surgery Pediatric & Special Care Dentistry |

| By Distribution Channel | Direct Sales to Large Accounts Dental & Medical Distributors Hospital & Retail Pharmacies Online / E-commerce Pharmacies |

| By Patient Demographics | Adults (19–64 Years) Children & Adolescents (0–18 Years) Geriatric Patients (65+ Years) Medically Compromised & Special Needs Patients |

| By Payer & Insurance Coverage | PhilHealth-covered Procedures Private Health Insurance Corporate & HMO Dental Plans Out-of-Pocket Payments |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General Dental Practices | 120 | Dentists, Clinic Managers |

| Specialized Dental Clinics | 90 | Oral Surgeons, Anesthesiologists |

| Public Health Institutions | 70 | Healthcare Administrators, Policy Makers |

| Dental Equipment Suppliers | 60 | Sales Managers, Product Specialists |

| Dental Education Institutions | 50 | Faculty Members, Curriculum Developers |

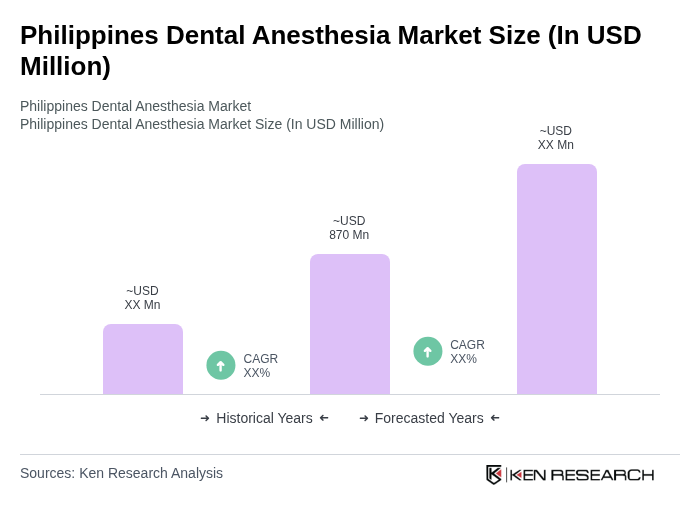

The Philippines Dental Anesthesia Market is valued at approximately USD 870 million, reflecting a significant growth driven by increasing dental procedures, advancements in anesthesia technologies, and rising awareness of oral health among the population.