Region:Middle East

Author(s):Dev

Product Code:KRAC4084

Pages:85

Published On:October 2025

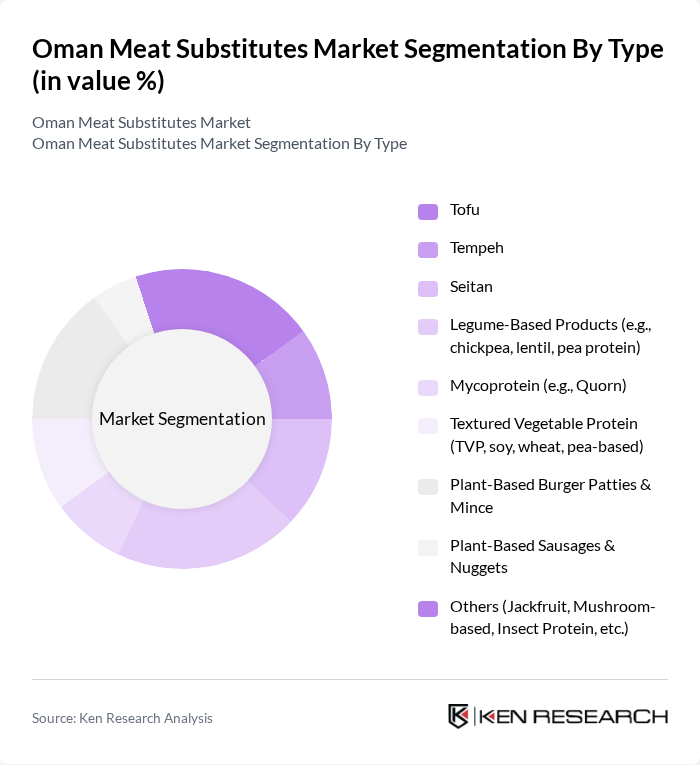

By Type:The market is segmented into various types of meat substitutes, including Tofu, Tempeh, Seitan, Legume-Based Products (e.g., chickpea, lentil, pea protein), Mycoprotein (e.g., Quorn), Textured Vegetable Protein (TVP, soy, wheat, pea-based), Plant-Based Burger Patties & Mince, Plant-Based Sausages & Nuggets, and Others (Jackfruit, Mushroom-based, Insect Protein, etc.). Each of these subsegments caters to different consumer preferences and dietary needs.Recent trends indicate thatlegume-based products and TVPare gaining traction due to their affordability and protein content, while tofu remains popular among traditional consumers. Mycoprotein and innovative plant-based patties are increasingly present in premium retail and foodservice outlets .

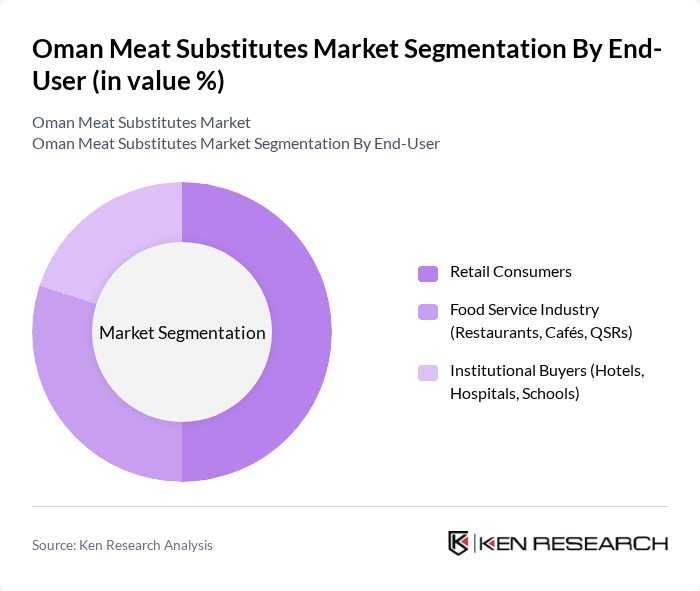

By End-User:The market is segmented by end-users into Retail Consumers, Food Service Industry (Restaurants, Cafés, QSRs), and Institutional Buyers (Hotels, Hospitals, Schools). Each segment has distinct purchasing behaviors and preferences, influencing the types of meat substitutes that are in demand.Retail consumersdrive the majority of sales, especially through supermarkets and specialty stores, while thefood service industryis rapidly adopting plant-based menu options to cater to evolving consumer preferences.Institutional buyersare increasingly incorporating meat substitutes in menus, particularly in health-focused and educational settings .

The Oman Meat Substitutes Market is characterized by a dynamic mix of regional and international players. Leading participants such as Beyond Meat, Impossible Foods, Quorn Foods, Tofurky, MorningStar Farms (Kellogg Company), Gardein (Conagra Brands), Field Roast (Greenleaf Foods), Lightlife Foods (Greenleaf Foods), Amy's Kitchen, Daiya Foods, Oumph! (LIVEKINDLY Collective), The Meatless Farm, Good Catch Foods, VBites Foods, Fazenda Futuro, Eat Just, Al Islami Foods, Al Ain Farms, Al Rawdah (Emirates Modern Poultry Co.), Greenest Foods contribute to innovation, geographic expansion, and service delivery in this space.

The future of the meat substitutes market in Oman appears promising, driven by increasing health consciousness and environmental sustainability trends. As consumer preferences shift towards plant-based diets, manufacturers are likely to invest in innovative product development and marketing strategies. Additionally, the government’s support for sustainable food initiatives will further enhance market growth. Collaborations with local food service providers will also play a crucial role in expanding the availability of meat substitutes, making them more accessible to the general population.

| Segment | Sub-Segments |

|---|---|

| By Type | Tofu Tempeh Seitan Legume-Based Products (e.g., chickpea, lentil, pea protein) Mycoprotein (e.g., Quorn) Textured Vegetable Protein (TVP, soy, wheat, pea-based) Plant-Based Burger Patties & Mince Plant-Based Sausages & Nuggets Others (Jackfruit, Mushroom-based, Insect Protein, etc.) |

| By End-User | Retail Consumers Food Service Industry (Restaurants, Cafés, QSRs) Institutional Buyers (Hotels, Hospitals, Schools) |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Specialty Health Food Stores Direct Sales (B2B, Foodservice Distributors) |

| By Price Range | Economy Mid-Range Premium |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-Friendly Packaging |

| By Flavor Profile | Savory Spicy Sweet |

| By Nutritional Content | High Protein Low Carb Gluten-Free Fortified (e.g., B12, Iron, Omega-3) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market Insights | 120 | Store Managers, Category Buyers |

| Consumer Preferences Survey | 150 | Health-conscious Consumers, Vegetarians, Flexitarians |

| Food Service Sector Analysis | 90 | Restaurant Owners, Menu Planners |

| Nutrition Expert Interviews | 40 | Dietitians, Nutritionists, Health Coaches |

| Manufacturing Insights | 60 | Production Managers, Quality Control Officers |

The Oman Meat Substitutes Market is valued at approximately USD 5 million, reflecting a growing trend towards plant-based diets driven by health consciousness and environmental concerns among consumers.