Region:Middle East

Author(s):Shubham

Product Code:KRAD6807

Pages:100

Published On:December 2025

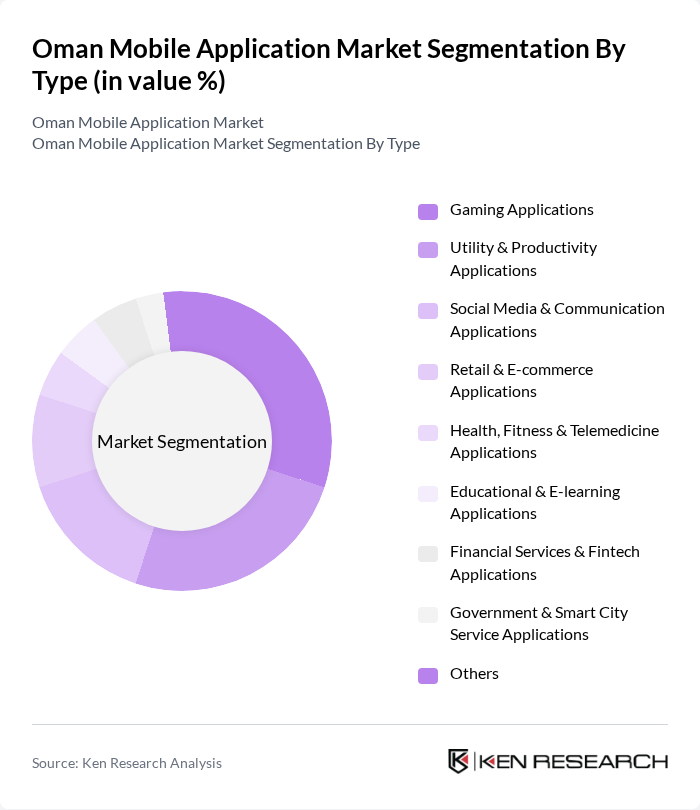

By Type:The mobile application market in Oman is segmented into various types, including gaming applications, utility & productivity applications, social media & communication applications, retail & e-commerce applications, health, fitness & telemedicine applications, educational & e-learning applications, financial services & fintech applications, government & smart city service applications, and others. Among these, gaming applications have shown significant growth due to the increasing popularity of mobile gaming among the youth, while utility and productivity applications are gaining traction as more users seek to enhance their daily efficiency through technology.

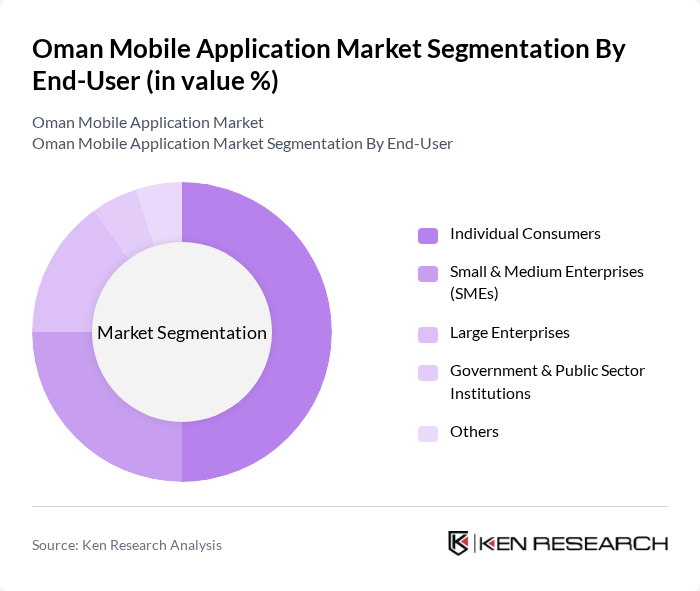

By End-User:The end-user segmentation of the mobile application market includes individual consumers, small & medium enterprises (SMEs), large enterprises, government & public sector institutions, and others. Individual consumers represent the largest segment, driven by the increasing adoption of smartphones and the demand for diverse applications for entertainment, communication, and daily tasks. SMEs are also increasingly leveraging mobile applications to enhance their operational efficiency and customer engagement.

The Oman Mobile Application Market is characterized by a dynamic mix of regional and international players. Leading participants such as Omantel (Oman Telecommunications Company), Ooredoo Oman, Awasr, Oman Data Park, Oman Technology Fund (Oriental Group – OTF), Innovation Development Oman Holding (IDO Investments), eMushrif, Thawani Technologies, Talabat Oman, Marhaba Taxi, Sarwa Technologies, eSpace, Infoline LLC, National Bank of Oman (NBO) – Mobile App, Bank Muscat – Mobile Banking & mBanking App contribute to innovation, geographic expansion, and service delivery in this space.

The Oman mobile application market is poised for significant growth, driven by technological advancements and evolving consumer behaviors. As smartphone penetration and internet connectivity continue to rise, the demand for innovative mobile solutions will increase. Additionally, the integration of AI and machine learning technologies is expected to enhance user experiences, making applications more intuitive and personalized. The government's supportive initiatives will further foster a conducive environment for app development, paving the way for a vibrant digital ecosystem in Oman.

| Segment | Sub-Segments |

|---|---|

| By Type | Gaming Applications Utility & Productivity Applications Social Media & Communication Applications Retail & E-commerce Applications Health, Fitness & Telemedicine Applications Educational & E-learning Applications Financial Services & Fintech Applications Government & Smart City Service Applications Others |

| By End-User | Individual Consumers Small & Medium Enterprises (SMEs) Large Enterprises Government & Public Sector Institutions Others |

| By Region | Muscat Dhofar (incl. Salalah) Al Batinah Al Dakhiliyah (incl. Nizwa) Others |

| By Application Category | Mobile Banking & Digital Payments Travel, Navigation & Ride-hailing Food Delivery & Quick Commerce Media, OTT Streaming & Entertainment On-demand Services (home, logistics, etc.) Enterprise & Collaboration Applications Others |

| By Monetization / Payment Model | Free (Ad-supported) Applications One-time Paid Applications Subscription-based Applications Freemium Applications In-app Purchase-based Applications Others |

| By User Demographics | Age Groups Gender Income Levels Education Levels Nationality (Omani vs Expatriate) Others |

| By Device Type | Smartphones Tablets Wearable Devices Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Application Developers | 80 | Founders, CTOs, Product Managers |

| End-Users of Mobile Applications | 120 | Smartphone Users, Tech Enthusiasts |

| Telecommunications Service Providers | 60 | Marketing Managers, Business Development Executives |

| Regulatory Bodies and Government Officials | 40 | Policy Makers, Regulatory Analysts |

| Industry Experts and Analysts | 50 | Market Researchers, Technology Consultants |

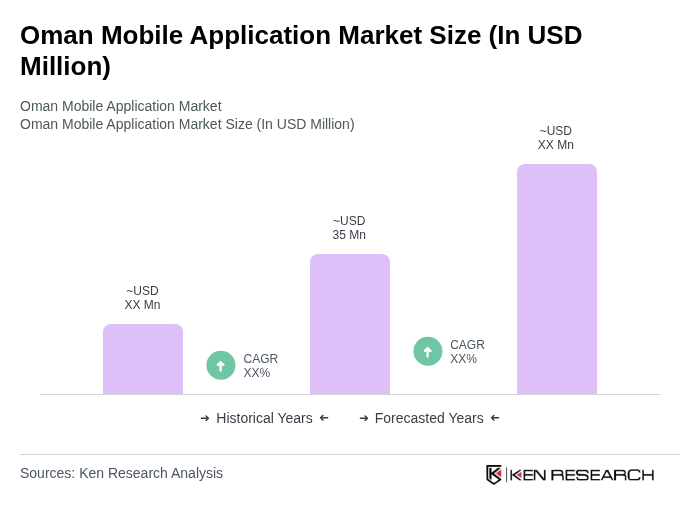

The Oman Mobile Application Market is valued at approximately USD 35 million, driven by factors such as high smartphone penetration exceeding 90% and increasing demand for mobile services across various sectors like e-commerce, healthcare, and education.