Oman Online Bingo Games Market Overview

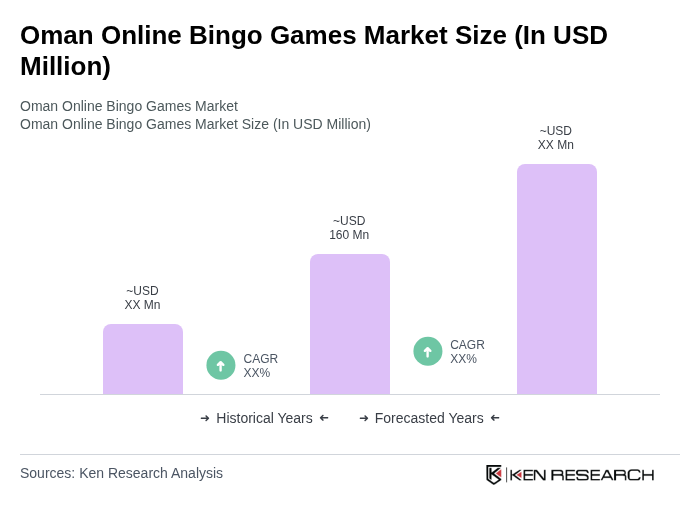

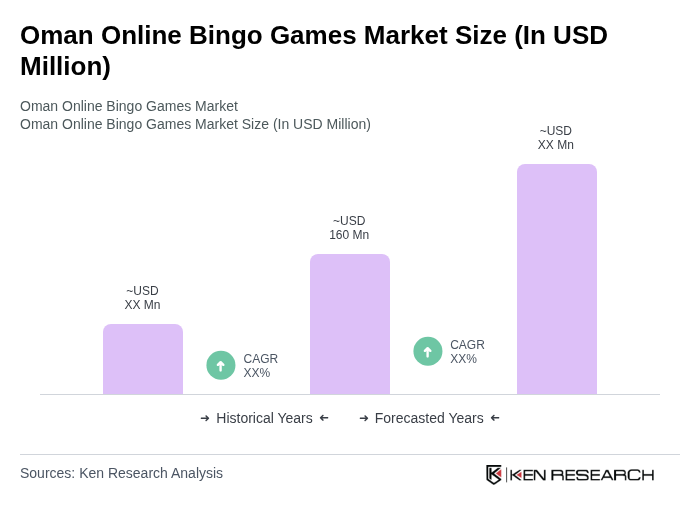

- The Oman Online Bingo Games Market is valued at USD 160 million, based on a five-year historical analysis and benchmarking against the growth of the global online bingo games market and the broader Middle East and Africa online gambling landscape. This growth is primarily driven by the increasing penetration of the internet, the rise of mobile gaming, and the expansion of digital payment solutions in Oman. The market has seen a surge in participation due to the convenience and accessibility offered by online platforms, particularly via smartphones and app-based interfaces.

- Muscat is the dominant city in the Oman Online Bingo Games Market, primarily due to its higher population density, urbanization, and concentration of the country’s digital infrastructure. The city has a vibrant entertainment and leisure culture, with residents showing increasing engagement in online gaming and digital entertainment services. Additionally, higher broadband penetration, greater smartphone ownership, and the focus of regional and international operators on major urban centers have further solidified Muscat's position as a market leader.

- In 2023, the Omani government continued to apply a structured framework to oversee gaming and gambling-related digital activities under broader communications and e-commerce oversight, with a focus on responsible use of online services. This framework operates through instruments such as the Electronic Transactions Law issued by Royal Decree No. 69/2008 under the Ministry of Commerce, Industry and Investment Promotion, and the Telecommunications Regulatory Law issued by Royal Decree No. 30/2002 under the Telecommunications Regulatory Authority, which together set out licensing, consumer protection, age-related safeguards, and compliance requirements for online service providers, including identity verification and content controls. These measures aim to protect consumers, ensure data and payment security, and promote a safer online environment for interactive digital entertainment.

Oman Online Bingo Games Market Segmentation

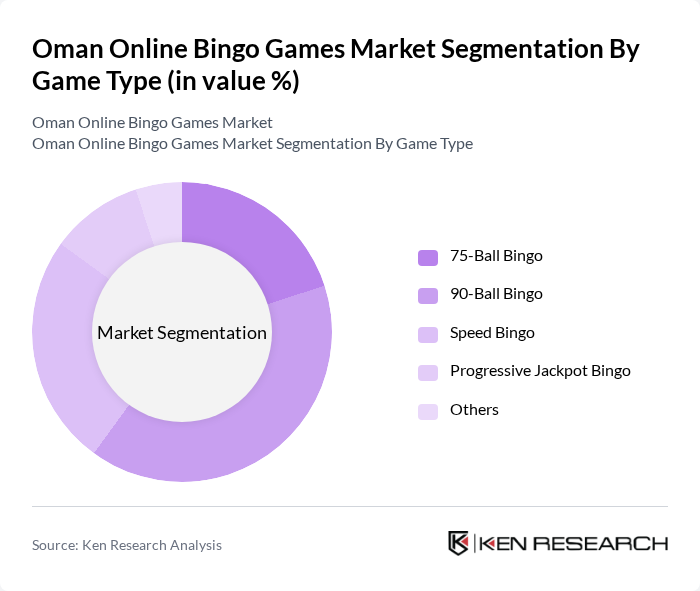

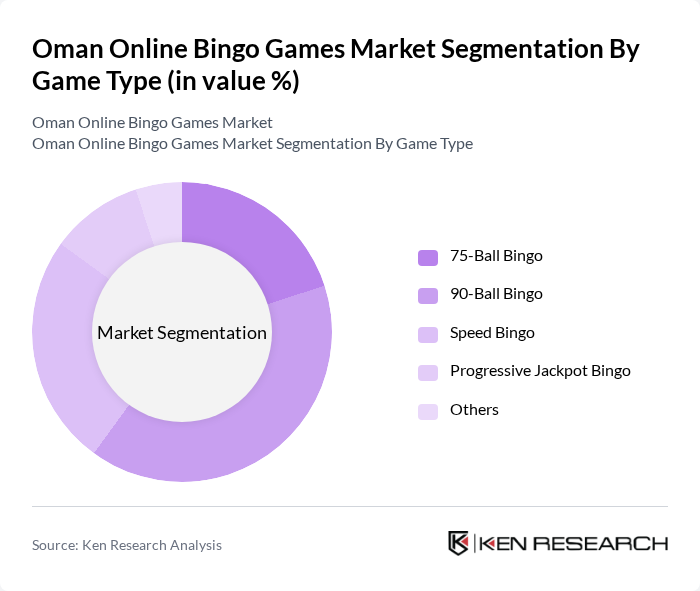

By Game Type:The market is segmented into various game types, including 75-Ball Bingo, 90-Ball Bingo, Speed Bingo, Progressive Jackpot Bingo, and others, in line with global online bingo offerings. Among these, 90-Ball Bingo has emerged as one of the most popular formats globally and is widely adopted on international platforms accessible to Omani players, due to its traditional roots and widespread appeal in Europe and other regions. Players are drawn to its simplicity and the social aspect of playing in larger groups, which enhances the gaming experience. Speed Bingo and other fast-paced variants are also gaining traction, particularly among younger, mobile-first players who prefer shorter, more frequent gaming sessions, reflecting broader online gambling trends.

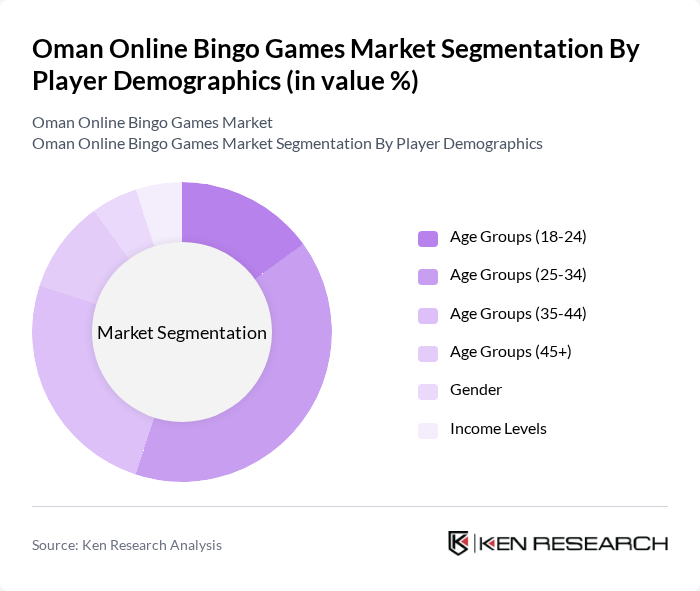

By Player Demographics:The player demographics segment includes age groups (18-24, 25-34, 35-44, 45+), gender, income levels, and others. Consistent with global online bingo and online gambling usage patterns, the 25-34 age group is the most significant demographic, as this cohort is more inclined to engage in online gaming due to their high familiarity with smartphones, apps, and digital payment platforms. Additionally, the gender distribution is relatively balanced, with both males and females participating actively; however, males tend to dominate in higher-frequency or more competitive gaming segments, reflecting wider online gambling participation trends in the Middle East and Africa.

Oman Online Bingo Games Market Competitive Landscape

The Oman Online Bingo Games Market is characterized by a dynamic mix of regional and international players, aligned with broader online gambling and iGaming participation in the Middle East and Africa. Leading participants such as Bet365, 888 Holdings (888casino), LeoVegas, Casumo, Betway, William Hill, Unibet, BGO Entertainment, Lottoland, Gamesys Group (part of Entain plc), Red Tiger Gaming (part of Evolution Gaming), Playtech, Microgaming, Yggdrasil Gaming, International Game Technology (IGT) contribute to innovation, geographic expansion, and service delivery in this space through enhancements in mobile platforms, localized content, live-host formats, and gamified loyalty programs.

Oman Online Bingo Games Market Industry Analysis

Growth Drivers

- Increasing Internet Penetration:As of future, Oman boasts an internet penetration rate of approximately 98%, with around 4.5 million active internet users. This widespread access facilitates online gaming, including bingo, as more individuals can participate from the comfort of their homes. The government’s investment in digital infrastructure has significantly contributed to this growth, making online platforms more accessible and appealing to a broader audience, particularly among younger demographics.

- Rising Popularity of Online Gaming:The online gaming sector in Oman has seen a substantial increase, with the number of online gamers reaching 1.2 million in future. This surge is driven by the growing acceptance of digital entertainment, particularly among the youth. The global trend towards online gaming, coupled with local cultural shifts, has made bingo an attractive option for leisure, further enhancing its market presence in Oman.

- Enhanced Mobile Accessibility:With mobile phone penetration in Oman exceeding 150% in future, the accessibility of online bingo games via smartphones has significantly improved. Approximately 3.5 million Omanis use mobile devices for internet access, allowing for seamless gaming experiences. This trend is bolstered by the availability of user-friendly apps and mobile-optimized websites, making it easier for players to engage with bingo games anytime and anywhere.

Market Challenges

- Regulatory Restrictions:The online gaming industry in Oman faces stringent regulatory challenges, with the government imposing strict licensing requirements on operators. As of future, only three licensed online gaming platforms are operational, limiting market competition. These regulations are designed to control gambling activities, but they also hinder the growth potential of the online bingo market, as many international operators remain hesitant to enter the market due to compliance issues.

- Cultural Resistance to Gambling:Despite the increasing popularity of online gaming, cultural attitudes towards gambling in Oman remain conservative. Approximately 60% of the population expresses disapproval of gambling activities, which poses a significant barrier to market expansion. This cultural resistance can limit the player base for online bingo games, as many potential users may avoid participation due to societal pressures and personal beliefs against gambling.

Oman Online Bingo Games Market Future Outlook

The future of the Oman online bingo games market appears promising, driven by technological advancements and changing consumer preferences. As mobile gaming continues to expand, operators are likely to invest in innovative game formats and enhanced user experiences. Additionally, the integration of social features and gamification elements will attract a younger audience, fostering community engagement. However, addressing regulatory challenges and cultural perceptions will be crucial for sustainable growth in this evolving landscape.

Market Opportunities

- Expansion of Mobile Gaming Platforms:The increasing reliance on mobile devices presents a significant opportunity for online bingo operators. By developing dedicated mobile applications and optimizing existing platforms, companies can tap into the growing number of mobile users, potentially increasing player engagement and retention rates.

- Partnerships with Local Businesses:Collaborating with local businesses can enhance market penetration for online bingo games. By forming strategic partnerships, operators can leverage local networks to promote their platforms, attract new players, and create tailored marketing campaigns that resonate with the cultural context of Oman.