Region:Middle East

Author(s):Rebecca

Product Code:KRAC2570

Pages:81

Published On:October 2025

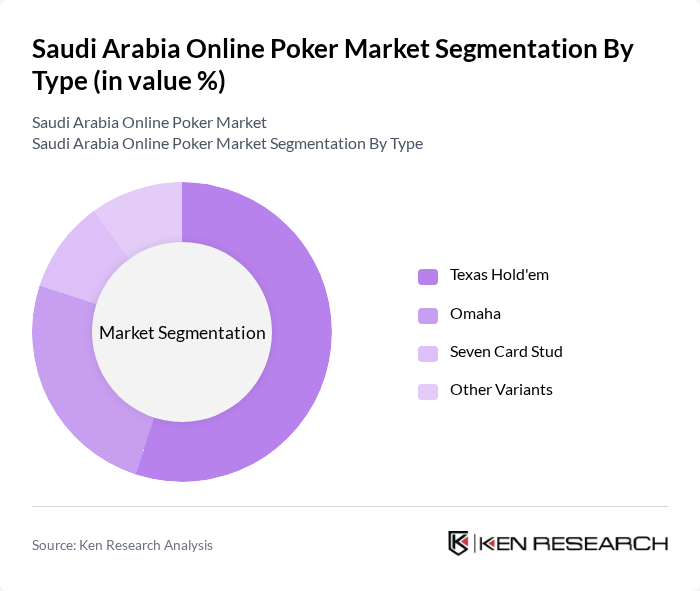

By Type:The online poker market can be segmented into various types, including Texas Hold'em, Omaha, Seven Card Stud, and other variants.Texas Hold'emis the most popular variant, attracting a significant number of players due to its strategic depth and widespread recognition. Omaha and Seven Card Stud also have dedicated player bases, while other variants cater to niche audiences. The dominance of Texas Hold'em aligns with global trends, as it is the preferred format on most major platforms.

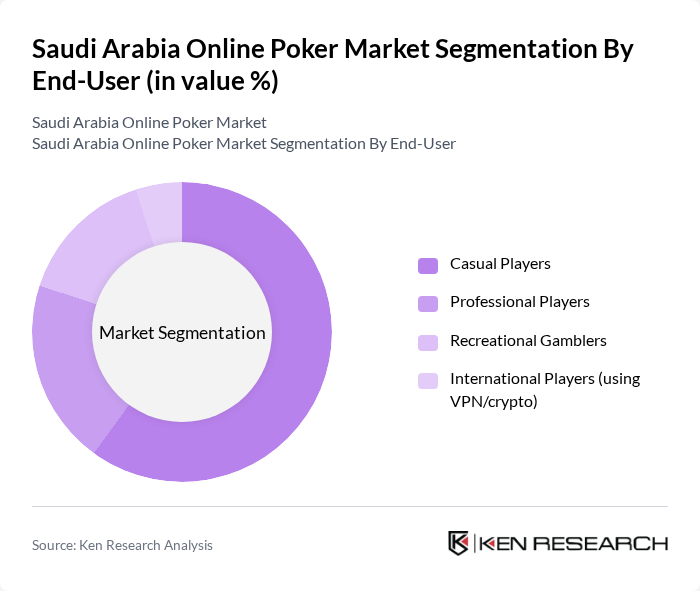

By End-User:The end-user segmentation includes casual players, professional players, recreational gamblers, and international players using VPN or cryptocurrency.Casual playersdominate the market, driven by the accessibility of online platforms, the social aspect of gaming, and the increasing use of mobile devices. Professional players contribute to the competitive scene, while recreational gamblers and international players—often accessing platforms via VPN or crypto—add diversity to the user base. The prevalence of VPN and cryptocurrency usage is notable due to local restrictions.

The Saudi Arabia Online Poker Market is characterized by a dynamic mix of regional and international players. Leading participants such as PokerStars, 888poker, PartyPoker, Betfair Poker, GGPoker, Unibet Poker, William Hill Poker, Betway Poker, Red Star Poker, iPoker Network, Americas Cardroom, Black Chip Poker, ACR Poker, BetOnline Poker, Intertops Poker, Natural8, TigerGaming Poker, Bodog Poker, Bwin Poker, PokerKing contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia online poker market appears cautiously optimistic, driven by technological advancements and changing consumer behaviors. As mobile gaming continues to expand, operators may explore innovative platforms that enhance user engagement. Additionally, the potential for regulatory reforms could pave the way for a more structured online gaming environment, allowing for safer and more accessible gaming experiences. These developments may attract both local and international players, fostering a more vibrant online poker ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Texas Hold'em Omaha Seven Card Stud Other Variants |

| By End-User | Casual Players Professional Players Recreational Gamblers International Players (using VPN/crypto) |

| By Payment Method | Credit/Debit Cards E-Wallets Bank Transfers Cryptocurrency Prepaid Cards |

| By Device Type | Desktop Mobile Tablet Smart TV |

| By Game Format | Cash Games Tournaments Sit & Go |

| By User Demographics | Age Group (18-24, 25-34, 35-44, 45+) Gender (Male, Female, Other) |

| By Market Maturity | Emerging Market Established Market Offshore/Black Market Segment |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Potential Online Poker Players | 100 | Individuals aged 18-45, interested in gaming |

| Legal Experts on Gambling Regulations | 40 | Lawyers and consultants specializing in gaming law |

| Gaming Enthusiasts | 80 | Members of online gaming communities and forums |

| Payment Solution Providers | 40 | Executives from digital payment companies |

| Market Analysts and Researchers | 40 | Industry analysts with a focus on online gaming trends |

The Saudi Arabia Online Poker Market is valued at approximately USD 800 million, driven by factors such as high internet penetration, mobile gaming growth, and increasing interest in online gambling among the youth population.