Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7224

Pages:89

Published On:December 2025

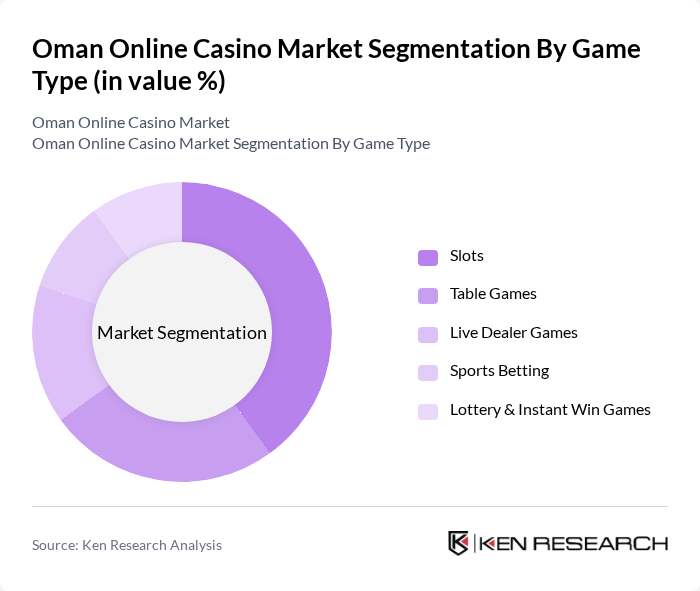

By Game Type:The online casino market in Oman is segmented into various game types, including slots, table games, live dealer games, sports betting, and lottery & instant win games, broadly mirroring the product mix seen in the wider MEA online gambling market. Each of these segments caters to different player preferences and demographics, contributing to the overall market dynamics. Slots and virtual casino games benefit from their ease of access on mobile devices and high content variety, while live dealer games and sports betting attract players seeking real-time interaction and event-based wagering, particularly around international football and cricket events.

By Player Demographics:The player demographics in the Oman online casino market are categorized by age groups, gender, income levels, and nationality (Omani vs. expatriate). Understanding these demographics is crucial for operators to tailor their offerings and marketing strategies effectively. The market is characterized by a relatively young and digitally engaged player base, reflecting Oman’s median age in the mid?20s and high smartphone penetration, with expatriates generally showing higher engagement in offshore iGaming and casino platforms compared to local Omanis.

The Oman Online Casino Market is characterized by a dynamic mix of regional and international players, with offshore brands capturing the majority of local iGaming traffic. Leading participants such as Stake.com, Betfinal, 1xBet, 22Bet, Parimatch, Melbet, Betway, Bet365, LeoVegas, Casumo, Unibet, 888casino (888 Holdings), Bwin, PokerStars Casino, Mr Green contribute to innovation, geographic expansion, localized Arabic/English interfaces, and diversified payment options in this space.

The future of the Oman online casino market appears promising, driven by technological advancements and changing consumer preferences. As internet and smartphone penetration continue to rise, more players are expected to engage with online gaming platforms in future. Additionally, the integration of innovative features such as live dealer games and virtual reality experiences will likely enhance user engagement. However, addressing regulatory challenges and promoting responsible gaming will be essential for sustainable growth in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Game Type | Slots Table Games Live Dealer Games Sports Betting Lottery & Instant Win Games |

| By Player Demographics | Age Groups Gender Income Levels Nationality (Omani vs. Expatriate) |

| By Payment Method | Credit/Debit Cards (Visa, Mastercard) E-Wallets (Skrill, Neteller, PayPal) Bank Transfers Prepaid Cards & Vouchers Cryptocurrency (Bitcoin, USDT, Others) |

| By Device Type | Desktop Mobile Web Mobile Apps Tablet |

| By Geographic Distribution | Muscat Governorate Dhofar & Southern Governorates Interior Governorates (Al Dakhiliyah, Al Batinah, Others) |

| By Marketing Channel | Social Media & Influencer Marketing Affiliate & SEO Marketing Direct & Referral Marketing Offline & Cross-Border Advertising |

| By Customer Loyalty Programs | VIP & High Roller Programs Tiered Reward Points & Cashback Welcome, Reload & Referral Bonuses Tournaments & Seasonal Promotions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Casino Players | 120 | Regular Players, Casual Gamblers |

| Regulatory Experts | 40 | Legal Advisors, Compliance Officers |

| Online Casino Operators | 60 | Business Development Managers, Marketing Directors |

| Potential Players | 120 | Young Adults, Expatriates |

| Industry Analysts | 40 | Market Researchers, Financial Analysts |

The Oman Online Casino Market is valued at approximately USD 110 million, reflecting a five-year historical analysis of online gambling activities in the region, driven by increased internet and smartphone penetration.