Region:Middle East

Author(s):Shubham

Product Code:KRAA8472

Pages:88

Published On:November 2025

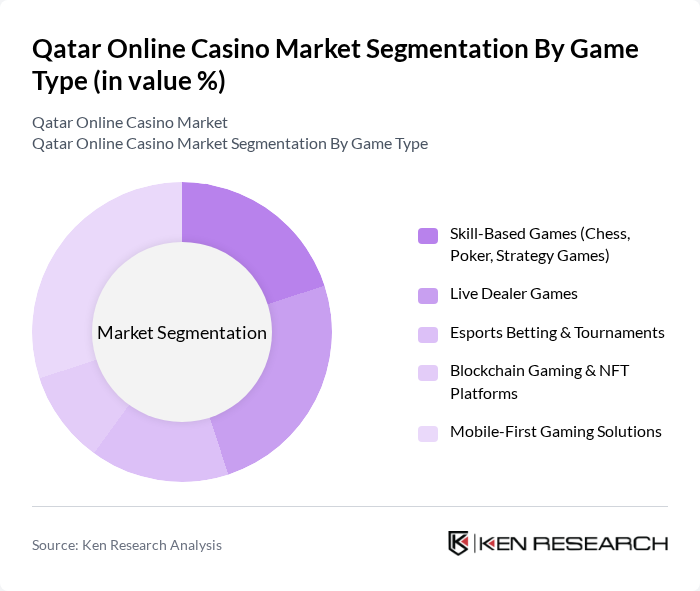

By Game Type:The online casino market is segmented into various game types, including skill-based games, live dealer games, esports betting, blockchain gaming, and mobile-first solutions. Among these, mobile-first gaming solutions are currently dominating the market due to the increasing use of smartphones and the demand for on-the-go gaming experiences. Players prefer the convenience and accessibility that mobile platforms offer, leading to a significant shift in consumer behavior towards mobile gaming. This trend is further supported by advancements in mobile technology and internet connectivity.

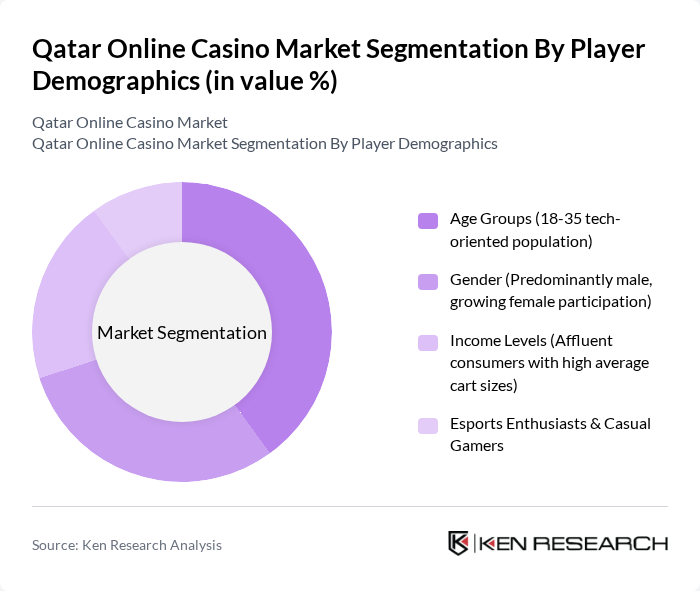

By Player Demographics:The player demographics segment includes age groups, gender, income levels, and gaming preferences. The age group of 18-35 is particularly significant, as this tech-oriented population is driving the demand for online gaming. This demographic is characterized by a preference for interactive and engaging gaming experiences, which has led to a rise in esports enthusiasts and casual gamers. The growing female participation in gaming is also noteworthy, as it reflects a shift in societal norms and increased marketing efforts targeting women.

The Qatar Online Casino Market is characterized by a dynamic mix of regional and international players. Leading participants such as Jackpot City Casino (Microgaming-powered, 600+ games), 22Bet Casino (3,600+ games, Malta-licensed), Microgaming (Software provider, founded 1994), Evolution Gaming (Live dealer specialist, founded 2006), ZEBEDEE (Blockchain gaming & NFT platform), Local Esports Startups (Qatar Esports Forum participants), Government-Backed Gaming Arenas (Skill-based venues), Qatari Technology Partners (Local compliance facilitators), Regional GCC Operators (Expanding into Qatar market), B2B Software Licensing Providers (85% of online casino games), Mobile-First Platform Developers, Cryptocurrency Casino Operators, Esports Tournament Organizers, Payment Gateway Providers (Crypto-enabled), Content Localization & Compliance Consultants contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar online casino market appears promising, driven by technological advancements and evolving consumer preferences. As internet penetration continues to rise, more players are expected to engage in online gaming. Additionally, the integration of blockchain technology and cryptocurrency is likely to enhance transaction security and attract tech-savvy users. However, operators must remain vigilant in navigating regulatory challenges while exploring innovative gaming solutions that align with local cultural values and legal frameworks.

| Segment | Sub-Segments |

|---|---|

| By Game Type | Skill-Based Games (Chess, Poker, Strategy Games) Live Dealer Games Esports Betting & Tournaments Blockchain Gaming & NFT Platforms Mobile-First Gaming Solutions |

| By Player Demographics | Age Groups (18-35 tech-oriented population) Gender (Predominantly male, growing female participation) Income Levels (Affluent consumers with high average cart sizes) Esports Enthusiasts & Casual Gamers |

| By Payment Method | E-Wallets & Digital Payment Systems Cryptocurrency & Blockchain Payments Bank Transfers & Local Payment Rails Instant-Pay Solutions Biometric Payment Authentication |

| By Device Type | Mobile (70% of market revenue) Desktop Tablet Data-Light Mobile Experiences |

| By Geographic Reach | Domestic Startups (25% market share) International Operators (70% offshore activity) GCC Regional Players |

| By Marketing Channel | Social Media & Live-Stream Shopping Affiliate Marketing & Partnerships Esports Events & Sponsorships Vertical Video Ads & Influencer Marketing |

| By Customer Loyalty Programs | VIP Programs & Tiered Rewards Reward Points & In-Game Asset Trading Referral Bonuses & Community Incentives Esports Tournament Prize Pools |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Casino Players | 120 | Regular Players, Casual Gamblers |

| Online Casino Operators | 60 | Business Development Managers, Marketing Directors |

| Regulatory Authorities | 40 | Policy Makers, Compliance Officers |

| Gaming Industry Experts | 40 | Market Analysts, Consultants |

| Potential Players (Non-Users) | 100 | Young Adults, Tech-Savvy Individuals |

The Qatar Online Casino Market is valued at approximately USD 130 million, reflecting significant growth driven by digital payment adoption, mobile gaming, and the popularity of esports and skill-based betting among younger demographics.